Risk markets struggle on lack of bullish catalysts

Risk assets are under pressure

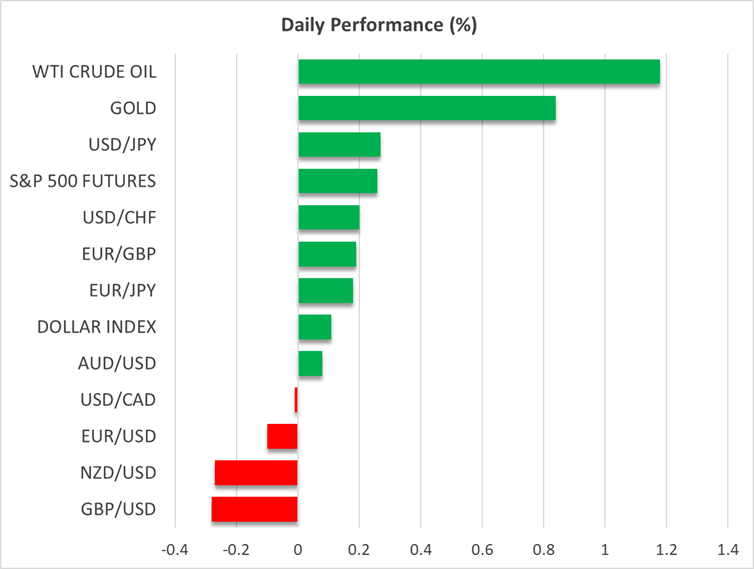

Despite the relatively upbeat end of October and seasonality analysis identifying November as the best month for the Nasdaq 100 index, weakness in US equities persists. The tech-heavy Nasdaq is on course for its worst week since April, fully erasing last week’s solid gains.

The crypto market also continues to feel pressure, with major cryptocurrencies recording double-digit weekly losses for the first time since the early March 2025 correction. In terms of year-to-date performance, bitcoin is up just 9%, while ether is almost flat. Both are severely lacking against gold’s 52% gain, despite the recent correction to $4,000.

With the liquidity troubles in the US banking system fading, the inability of risk assets to rally potentially reflects graver issues. There seems to be genuine concern about AI investment and, as New York Fed President Williams noted, its impact on global demand for capital, potentially damaging other sectors.

Risk markets in search of bullish catalysts

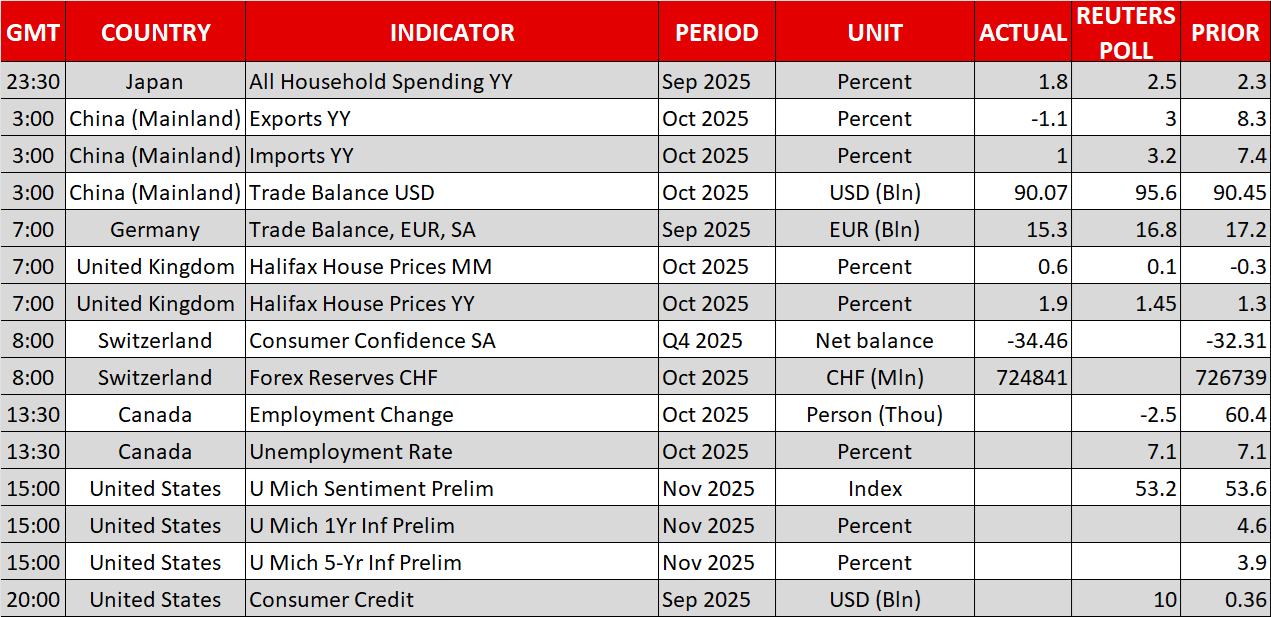

Under normal conditions, the day would have been monopolized by the nonfarm payrolls figure and other key jobs data. Instead, investors will scrutinize the preliminary University of Michigan Consumer Sentiment survey.

Stocks are also looking at Fedspeak, the US government shutdown negotiations and trade developments for positive news in order to build their case for the next rally. However, Fedspeak remains mostly hawkish, with regional Fed Presidents Goolsbee, Hammack and Musalem, and Governor Barr highlighting their concerns about the inflation outlook, with Goolsbee emphasizing their nervousness about making rate decisions without fresh inflation data.

With Chair Powell telling investors that a December rate cut would be very difficult to justify without official data, the focus is firmly on the US shutdown. During Thursday’s session, a small group of Republican Senators expressed their optimism about a weekend deal, but US House Speaker Johnson quickly shut down these expectations.

There is an increasing possibility of the shutdown continuing into year-end, damaging both the US economy and the Fed’s ability to perform its duties. Notably, with Trump blaming the shutdown for this week’s bad electoral results for the Republican party, he might be ready to make the necessary concessions to reopen the federal government.

Meanwhile, there are reports about some inconsistencies in the US-China agreement about rare earth metals. Investors are eager to see if these inconsistencies can be quickly ironed out, particularly as the US is apparently restricting the sale of Nvidia’s scaled-down AI chips.

BoE confirms split over the rates outlook

After great speculation about whether the BoE will cut rates on November 6 or postpone any decisions for December, the 5-4 vote to hold rates steady confirmed the prevailing split in the MPC. The debate centered around the inflation outlook, with the hawks highlighting the need for prolonged monetary policy restriction to tackle the risk of persistent inflation, and the doves attaching greater weight to downside risks.

The decisive vote was cast by Governor Bailey. In defiance of his dovish pedigree, he acknowledged that there is value in waiting for further evidence before making the next move. That said, there is speculation that his decision was not entirely economically driven. He is said to have sided with the hawks as a goodwill gesture after the August vote fiasco, when a second round of voting was held to get the rate cut approved.

Interestingly, the BoE’s decision to stand pat could backfire, as Chancellor Reeves is preparing to announce personal tax hikes. Therefore, investors are already manning their battle stations for the December meeting, with a 60% probability currently assigned to a 25bps rate cut.

Despite the dovish meeting, the pound managed to post gains versus both the dollar and the euro, a rather small reprieve considering its continued underperformance. Notably, November is the sixth consecutive month of euro/pound rising, currently up 4.2% since end-May, while euro/dollar has risen by only 1.6% in the same period.

.jpg)