The Fed Will Set the Mood for EUR/USD

By RoboForex Analytical Department

EUR/USD starts a new week of March by consolidating around 1.0670.

This week, investors will be anxious. The key event is the meeting of the US Federal Reserve System, where monetary politicians will have to make difficult decisions, specifically the ones concerning the interest rate. As soon as problematic spots emerged in the US banking sector, the market started discussing the necessity to make a pause in lifting the interest rate to stop the crisis from expanding.

On the other hand, there are appearing more and more arguments supporting the growth of the interest rate. Among them there are the increase in base inflation and the Core PCE inflation index, tracked by the Fed.

Earlier the ECB lifted its rate by 50 base points, dismissing banking problems, and continued tightening the monetary policy. Its main goal is still beating high prices.

By the end of the week, volatility of EUR/USD will have increased noticeably.

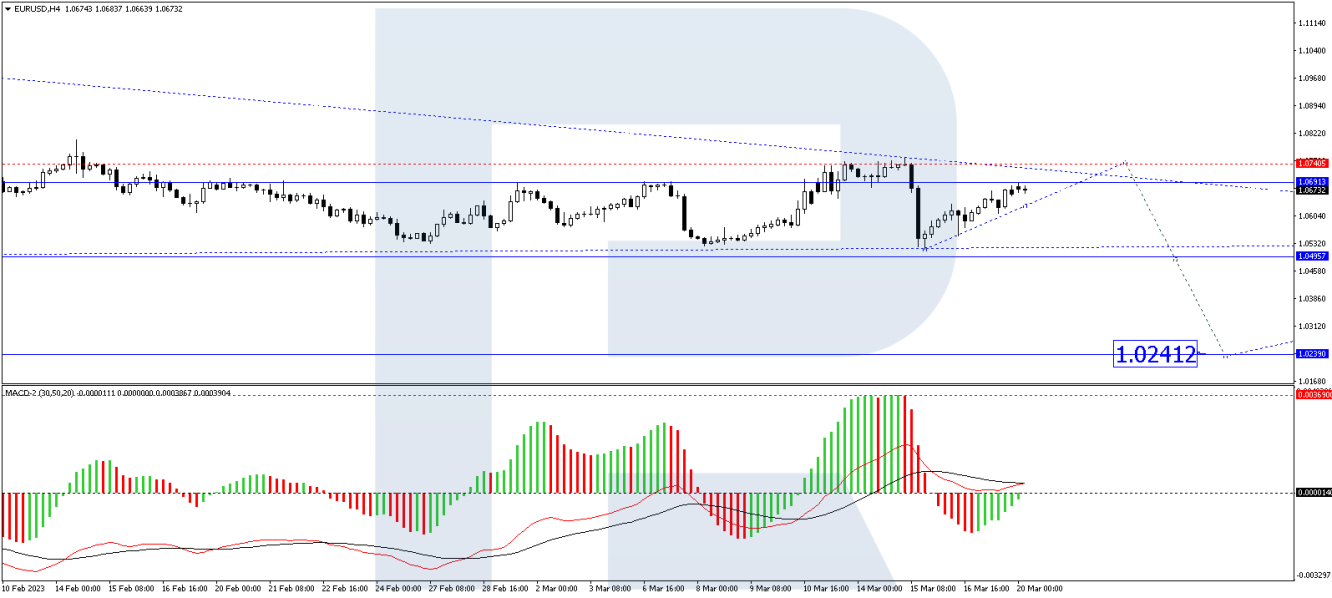

On H4, EUR/USD has formed a correctional structure to 1.0630. At the moment, the market is consolidating around it and with an escape from the range upwards might extend the structure to 1.0708. Then a decline to 1.0630 might follow. And then a link of growth to 1.0742 is not excluded. There the wave of growth will exhaust its potential. Next, the pair should go down by the trend to 1.0505. Technically, this scenario is confirmed by the MACD. Its signal line is above zero and is preparing to renew the highs.

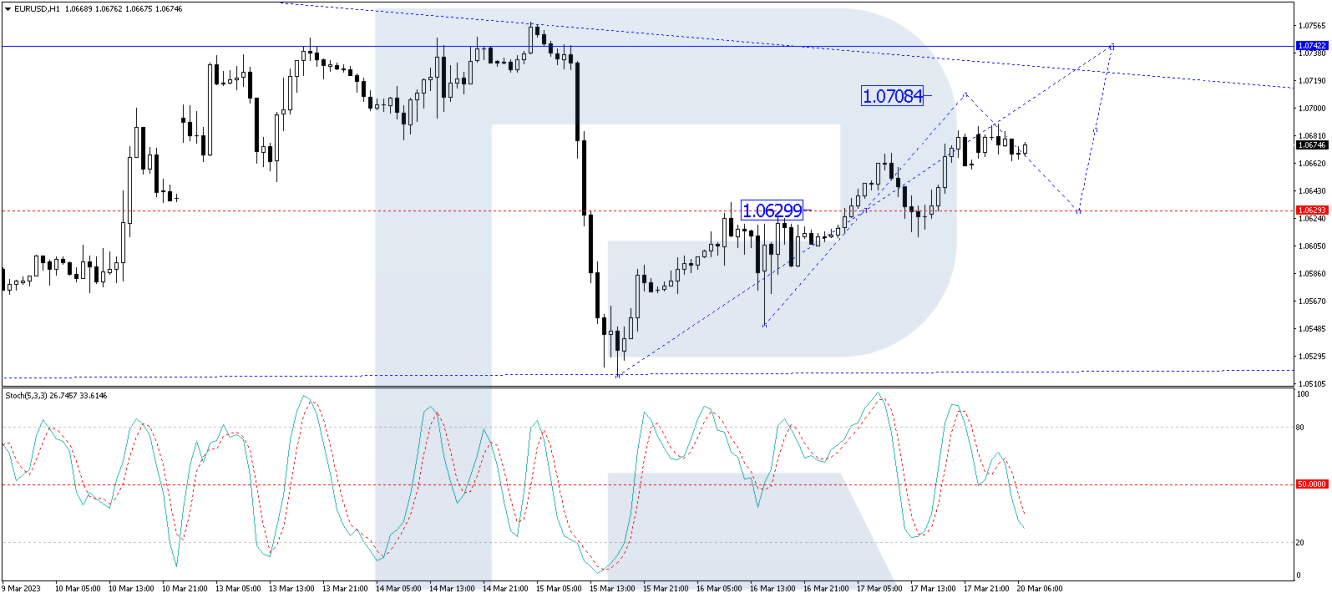

On the H1 chart, EUR/USD has completed a wave of growth to 1.0650. Today the market has already formed a link of decline to 1.0620 and a link of growth to 1.0687. At the moment, a consolidation range is forming under this level. The price might escape it upwards, opening a pathway to 1.0708. Then a decline to 1.0620 and growth to 1.0742 are expected. Upon reaching this level, the price might fall to 1.0600, and if this level breaks, the quotes might drop to 1.0540. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is near 50, and later it should fall to 20.

DisclaimerAny forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.