USDCAD holds on recovery action as NFP report awaited

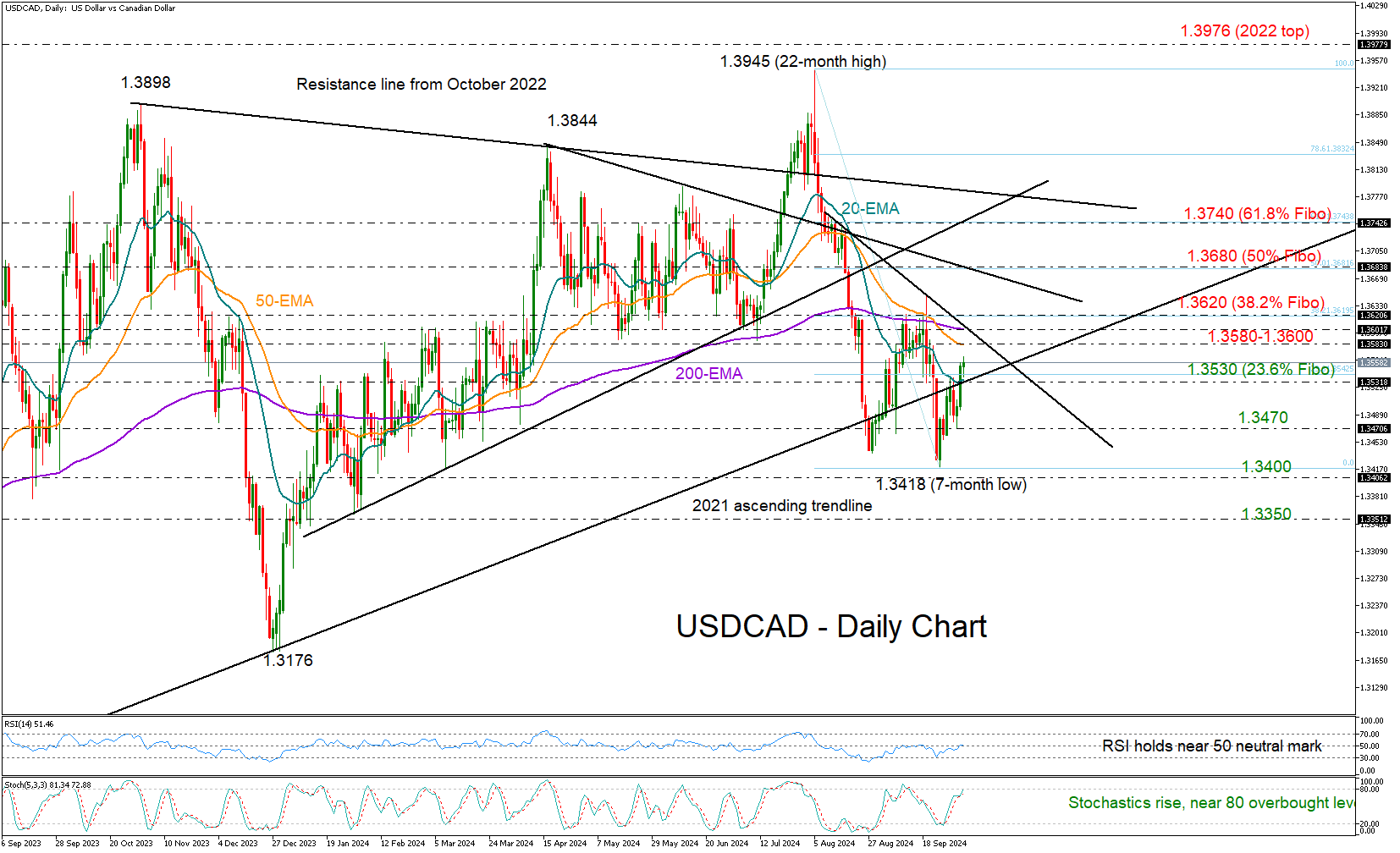

USDCAD continued its upward movement from a seven-month low of 1.3418, surpassing its 20-day exponential moving average (EMA) and the constraining ascending line from the 2021 low.

The range of 1.3580-1.3620, which encapsulates the 50- and 200-day EMAs as well as the 38.2% Fibonacci retracement of the latest downleg is the next target on the upside. A successful penetration higher could see an acceleration towards the 50% Fibonacci of 1.3680. Further up, the bulls may head for the 61.8% Fibonacci of 1.3740.

However, caution may be necessary based on the technical picture. There is no improvement in trend signals as the EMAs continue to point downwards. Moreover, the RSI has yet to step clearly above its 50 neutral mark and the stochastic oscillator is already very close to its 80 overbought level.

Nevertheless, sellers may stay on the sidelines until the price slips below the 20-day EMA at 1.3530. If this situation occurs, there could be immediate support around 1.3470, and then the bears may push for a close below 1.3400 with scope to reach the 1.3350 barrier from January 2024.

Briefly, there may be constraints on how much USDCAD can rise in the near future. For a decisive rally the pair may need to pierce through 1.3620, whilst a drop below 13530 might be enough to resume selling interest.

.jpg)