Edit Your Comment

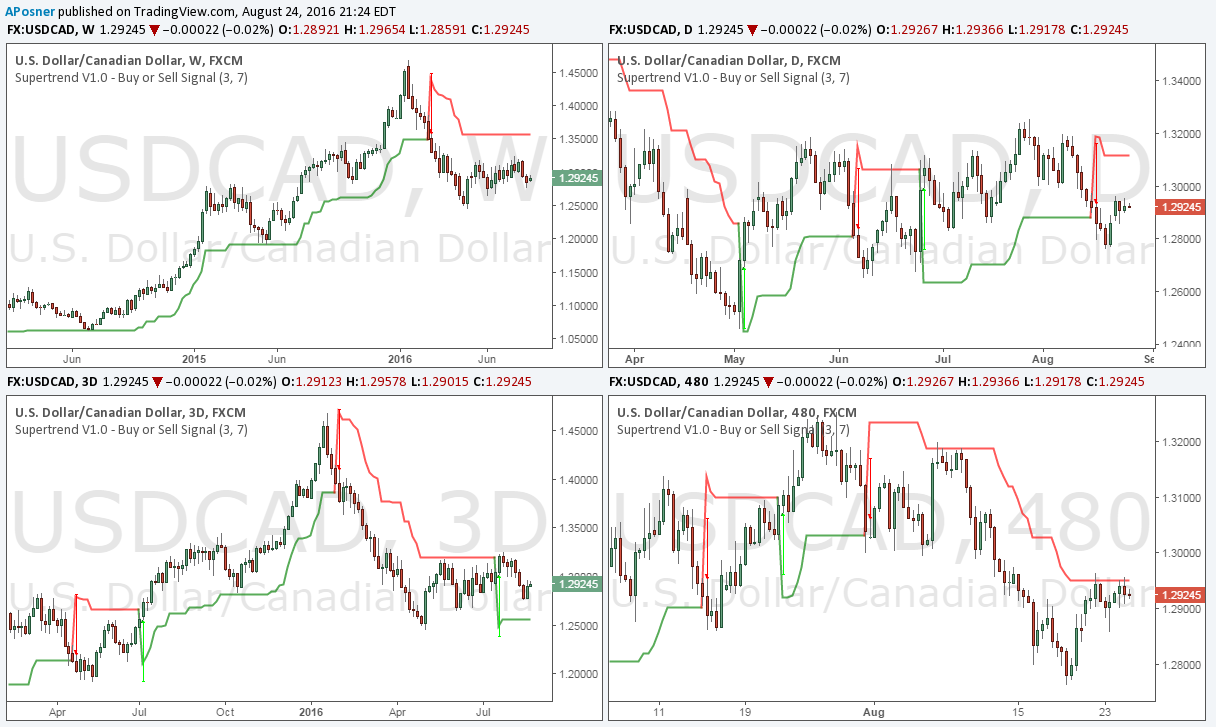

USDCAD

Dec 09, 2012 부터 멤버

게시물1

Aug 25, 2016 at 01:39

Dec 09, 2012 부터 멤버

게시물1

USD/CAD rally was short lived

With the fall in oil comes a decline in the USD/CAD pair. The pair was already in a medium-term downtrend but recently had been rallying with oil. Crude oil prices made their way to nearly $50 this month which provided a catalyst for USD/CAD to rally. With the build in oil, today the momentum behind the crude rally is over, and this will weigh on the Loonie.

From a technical perspective, the pair has been consolidating sideways all week near the 1.2950 area which is a support/resistance line tracing back to October 2105 with multiple touch point since then. On an 8 hour chart, the price has run to the median line and has been moving sideways. With each bullish push into the declining pitchfork, the median line has rejected price setting up the reversal.

Current situation:

- The pair has found resistance at the median line of the pitchfork on the 8-hour chart.

- US economic data dominates the calendar Thursday and Friday this week. Next week more US data and Canadian m/m GDP.

Looking ahead:

- Lower oil prices will result in a weaker Loonie. The market currently lacks a catalyst to push oil up over $50. There is another inventory report next Wednesday.

Notes:

- The overnight lending rates of the two currencies are now the same negating any carry benefit for the Loonie.

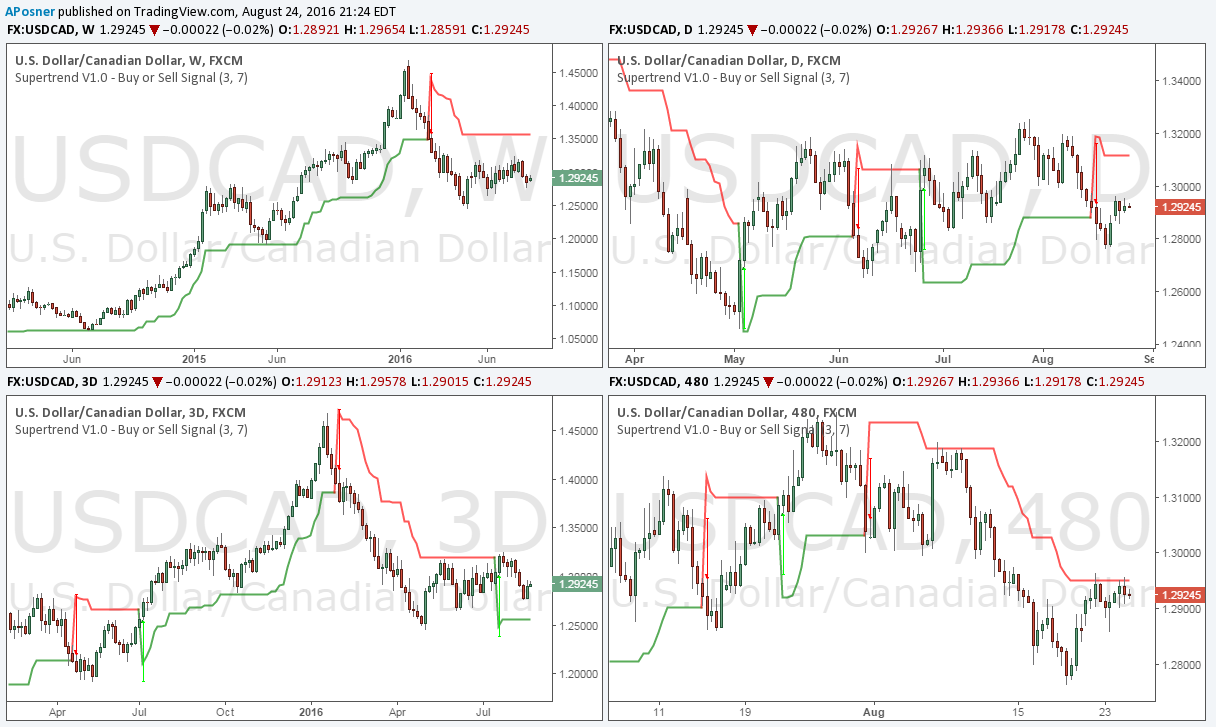

With the fall in oil comes a decline in the USD/CAD pair. The pair was already in a medium-term downtrend but recently had been rallying with oil. Crude oil prices made their way to nearly $50 this month which provided a catalyst for USD/CAD to rally. With the build in oil, today the momentum behind the crude rally is over, and this will weigh on the Loonie.

From a technical perspective, the pair has been consolidating sideways all week near the 1.2950 area which is a support/resistance line tracing back to October 2105 with multiple touch point since then. On an 8 hour chart, the price has run to the median line and has been moving sideways. With each bullish push into the declining pitchfork, the median line has rejected price setting up the reversal.

Current situation:

- The pair has found resistance at the median line of the pitchfork on the 8-hour chart.

- US economic data dominates the calendar Thursday and Friday this week. Next week more US data and Canadian m/m GDP.

Looking ahead:

- Lower oil prices will result in a weaker Loonie. The market currently lacks a catalyst to push oil up over $50. There is another inventory report next Wednesday.

Notes:

- The overnight lending rates of the two currencies are now the same negating any carry benefit for the Loonie.

Uncommon Wisdom for All

Oct 02, 2014 부터 멤버

게시물905

Sep 07, 2016 at 12:33

Nov 14, 2015 부터 멤버

게시물315

jayrness posted:

@dianajs , do you think that the interest rate decision, if it will remain at 0.50%, will give the cad a bullish trend, or will remain its bearish bias?

There is virtually no chance that they'll change the rate. Its all about the statement.

Nov 09, 2015 부터 멤버

게시물20

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.