Edit Your Comment

DAX Resilience: False Breakout Signals Potential Upswing

May 02, 2024 부터 멤버

게시물3

Jun 13, 2024 at 05:46

May 02, 2024 부터 멤버

게시물3

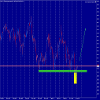

Yesterday, we observed fascinating moves on the indices. Initially, prices collapsed sharply in the first half of the day. However, as American traders returned to the market, prices surged significantly higher. On the German DAX, a crucial horizontal support level at 18,390 points, which had been held in May and early June, was breached. This support break seemed significant, but by the end of the session, prices had reversed sharply, closing above this support again. This reversal marks a false breakout, indicated by an orange color on the chart, and suggests a positive sentiment. As long as the DAX remains above this green support level, the outlook is bullish, and further rises are anticipated.

This recovery and false breakout pattern highlight the dynamic nature of the market, emphasizing the importance of monitoring key support and resistance levels. The ability of the DAX to recover from such a sharp decline within the same day demonstrates the resilience of the market and the potential for continued upward movement. Traders should stay vigilant, as this pattern could lead to further gains if the bullish sentiment holds. If prices fall below the orange-marked support again, it would nullify the false breakout pattern and signal a return to a bearish trend.

In summary, the DAX's performance underscores the market's volatility and the crucial role of support levels. The false breakout pattern observed yesterday could signal the beginning of a new upward trend if the green support level holds. However, a drop below this level could reignite bearish sentiment, making it essential for traders to closely watch these levels for further market direction.

This recovery and false breakout pattern highlight the dynamic nature of the market, emphasizing the importance of monitoring key support and resistance levels. The ability of the DAX to recover from such a sharp decline within the same day demonstrates the resilience of the market and the potential for continued upward movement. Traders should stay vigilant, as this pattern could lead to further gains if the bullish sentiment holds. If prices fall below the orange-marked support again, it would nullify the false breakout pattern and signal a return to a bearish trend.

In summary, the DAX's performance underscores the market's volatility and the crucial role of support levels. The false breakout pattern observed yesterday could signal the beginning of a new upward trend if the green support level holds. However, a drop below this level could reignite bearish sentiment, making it essential for traders to closely watch these levels for further market direction.

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.