Edit Your Comment

DAX Resilience: False Breakout Signals Potential Upswing

May 02, 2024からメンバー

3 投稿

Jun 13, 2024 at 05:46

May 02, 2024からメンバー

3 投稿

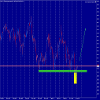

Yesterday, we observed fascinating moves on the indices. Initially, prices collapsed sharply in the first half of the day. However, as American traders returned to the market, prices surged significantly higher. On the German DAX, a crucial horizontal support level at 18,390 points, which had been held in May and early June, was breached. This support break seemed significant, but by the end of the session, prices had reversed sharply, closing above this support again. This reversal marks a false breakout, indicated by an orange color on the chart, and suggests a positive sentiment. As long as the DAX remains above this green support level, the outlook is bullish, and further rises are anticipated.

This recovery and false breakout pattern highlight the dynamic nature of the market, emphasizing the importance of monitoring key support and resistance levels. The ability of the DAX to recover from such a sharp decline within the same day demonstrates the resilience of the market and the potential for continued upward movement. Traders should stay vigilant, as this pattern could lead to further gains if the bullish sentiment holds. If prices fall below the orange-marked support again, it would nullify the false breakout pattern and signal a return to a bearish trend.

In summary, the DAX's performance underscores the market's volatility and the crucial role of support levels. The false breakout pattern observed yesterday could signal the beginning of a new upward trend if the green support level holds. However, a drop below this level could reignite bearish sentiment, making it essential for traders to closely watch these levels for further market direction.

This recovery and false breakout pattern highlight the dynamic nature of the market, emphasizing the importance of monitoring key support and resistance levels. The ability of the DAX to recover from such a sharp decline within the same day demonstrates the resilience of the market and the potential for continued upward movement. Traders should stay vigilant, as this pattern could lead to further gains if the bullish sentiment holds. If prices fall below the orange-marked support again, it would nullify the false breakout pattern and signal a return to a bearish trend.

In summary, the DAX's performance underscores the market's volatility and the crucial role of support levels. The false breakout pattern observed yesterday could signal the beginning of a new upward trend if the green support level holds. However, a drop below this level could reignite bearish sentiment, making it essential for traders to closely watch these levels for further market direction.

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。