Bitcoin Adjusting First Quarter Gains

Market picture

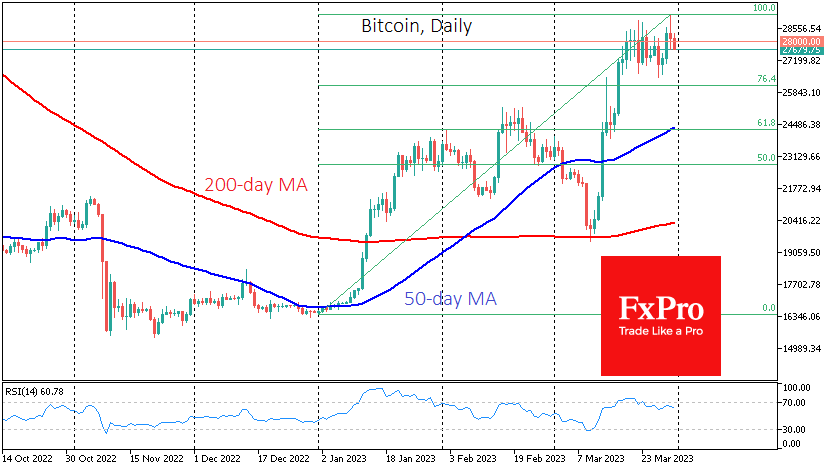

The crypto market's capitalisation fell by 1.1% over the past day to 1.17 trillion, which resembles profit-taking after 50% of market growth in the first quarter of this year.

Bitcoin underwent an even more active sell-off the night before, losing about 2% in 24 hours, but holding near $ 28K, bringing the result of the first quarter to 70%. A full correction from these levels involves a pullback to $ 26K or even $ 25K.

The fact that the stock market has maintained a positive bias over the past day, and the dollar has been declining, additionally supports the idea of a local shake-up of crypto portfolios, but not the return of pessimism. If this happens, anxiety will kick in when the decline is under $ 25K.

News feed

The US Securities and Exchange Commission (SEC) has charged the cryptocurrency platform Beaxy with brokerage and clearing activities without proper registration.

Gensler called on the government to allocate $2.4 billion to the SEC to prosecute unregistered crypto companies more effectively. He says, "the cryptocurrency market is the Wild West, where people put hard-earned money at risk by investing it in high-risk assets."

Senator from the US Democratic Party, Elizabeth Warren, called for an "anti-crypto army". In her future election campaign, she plans to pay special attention to the problems of cryptocurrency companies and the formation of a broad coalition of opponents of crypto assets.

Part of the digital division of the Stuttgart Stock Exchange (Boerse Stuttgart), Blocknox has received a cryptocurrency custodian license from the German Federal Financial Supervisory Authority (BaFin).

By the FxPro analyst team

-11122024742.png)

-11122024742.png)