Crypto market let off steam over the weekend and is ready to move upwards

Crypto market let off steam over the weekend and is ready to move upwards

Market Picture

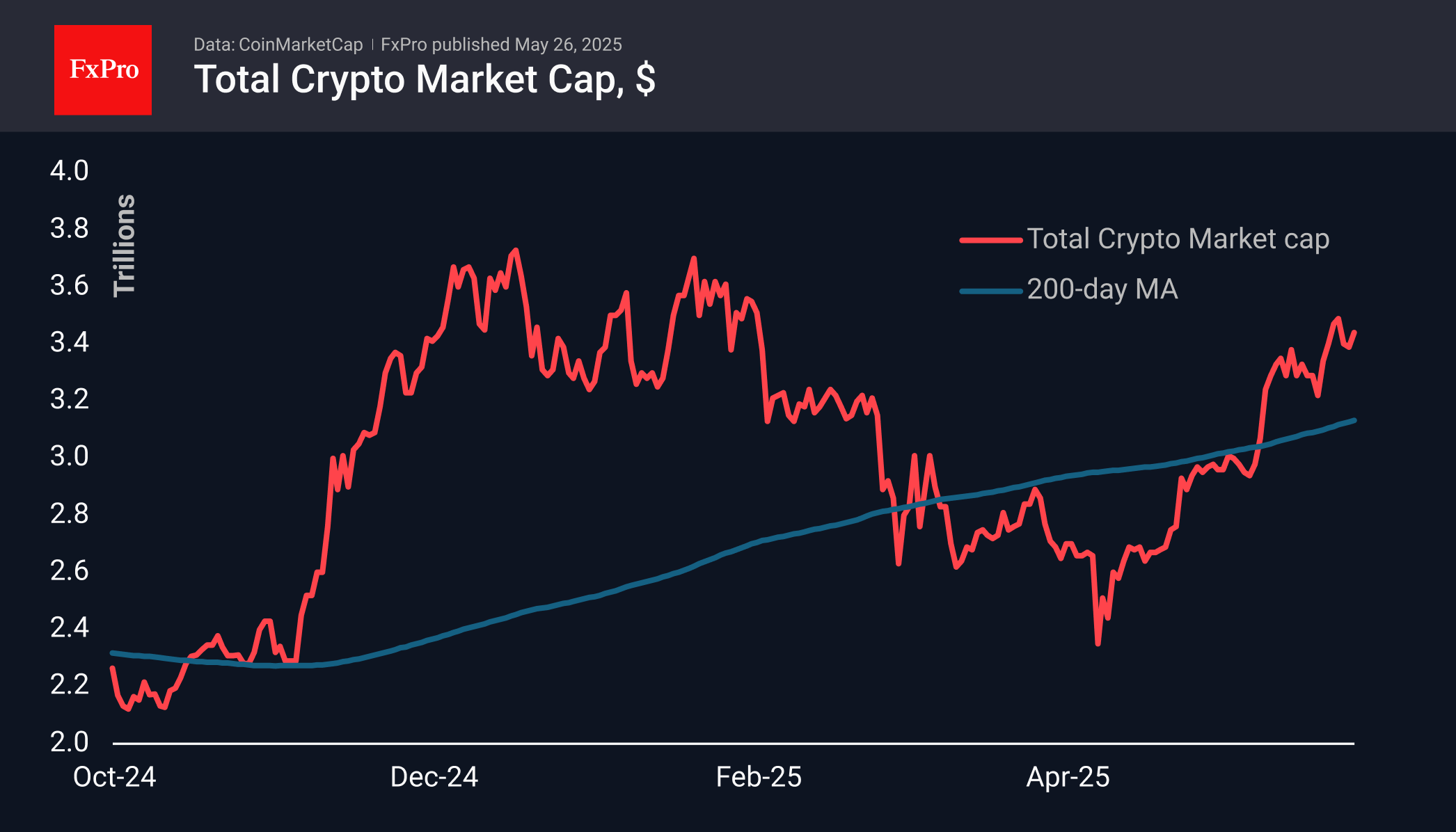

The Crypto Market cap rose by 6.5% from last week's level to $3.43 trillion. However, since Friday, the market has taken a pause and moved further sideways, falling to $3.35—the upper boundary of the previous resistance. Market capitalisation has been building up in small steps upwards, which looks like the formation of a solid base typical of the early stages of bullish momentum.

The sentiment index is at 73, having pulled back from extreme greed territory. The market is balancing around the current mark, letting off steam after strong bounces, which is also helping to extend the rally, albeit at a slower pace.

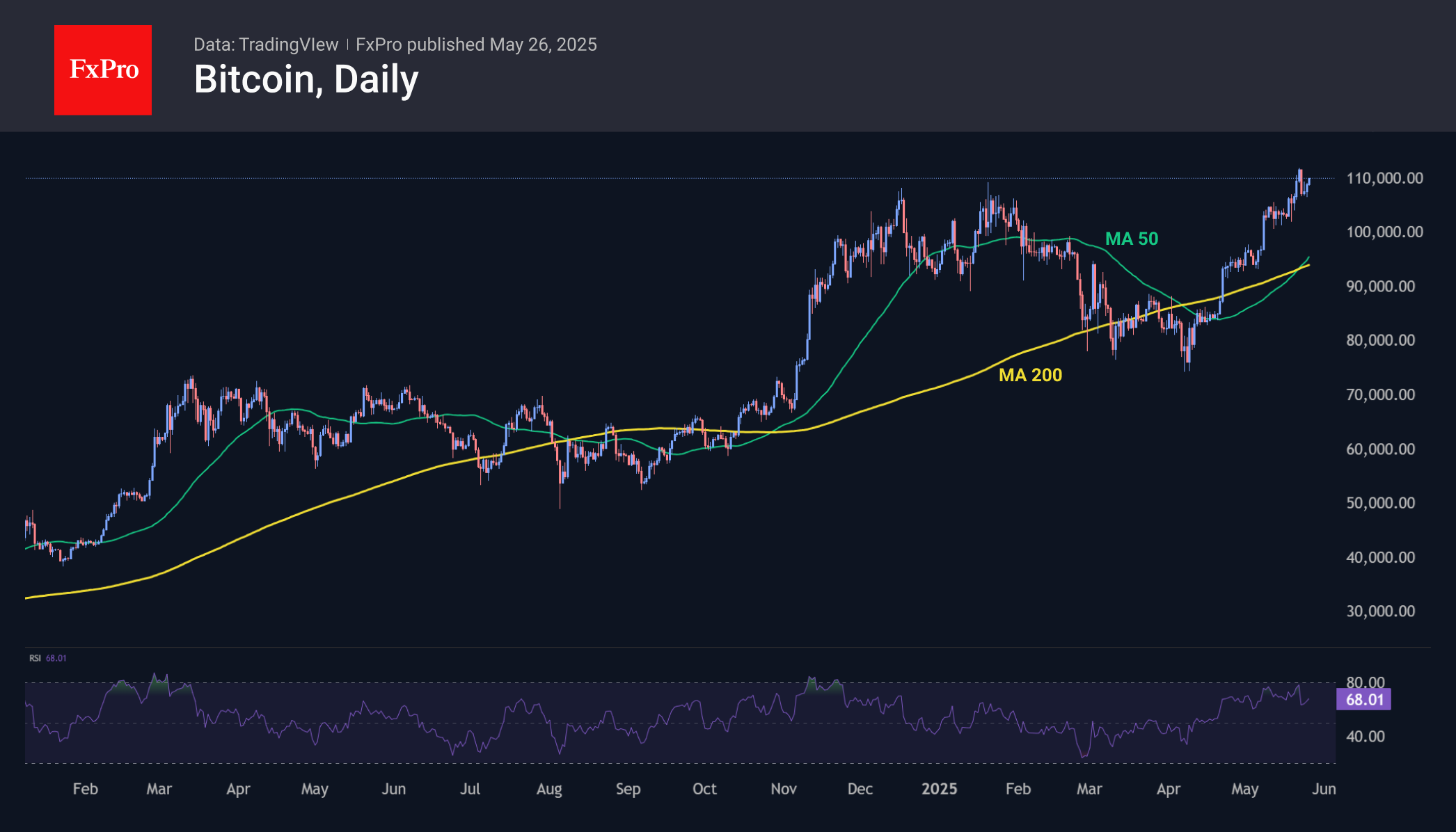

Bitcoin recharged over the weekend, retreating to $106.5K. As of Monday morning, it is trying again to break above $110.0K. At the end of last week, the Relative Strength Index touched the 80 level on the daily timeframes, indicating overbought conditions, but the subsequent retreat cleared the way for a rally. However, whether the coin goes there will depend on the dynamics of global markets, where the focus remains on the US and Japanese bond markets.

News Background

Significant inflows into US spot bitcoin ETFs have continued for five consecutive weeks. According to SoSoValue, net inflows into spot BTC-ETFs totalled $2.75bn last week, bringing the total amount invested since January 2024 to $44.53bn.

Inflows into spot Ethereum-ETFs in the US have continued for 4 out of the last 5 weeks, totalling $248.3 million last week, bringing the total since the ETF's launch in July 2024 to $2.76 billion.

Strategy announced the launch of a new $2.1bn Class A preferred share offering programme. The funds are expected to go predominantly towards additional bitcoin investments.

According to the WSJ, major US banks are in talks to jointly issue a stablecoin. The initiative aims to counter the growing influence of the crypto industry.

Former IMF chief economist Kenneth Rogoff said cryptocurrency is increasingly being used in the global shadow economy, undermining the US dollar's dominance. He noted that the dollar is gradually surrendering its position to the yuan and euro.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)