Investors cheer potential end to US government shutdown

Dollar slides the most against risk-linked currencies

The US dollar traded lower on Friday against most of its major counterparts, extending Thursday’s retreat, triggered by a report saying that firms in the US cut more than 150k jobs in October, marking the biggest reduction for the month in more than 20 years, as industries adopt AI-driven changes and aim at cutting costs.

The biggest gainer was the Canadian dollar as Canada’s better-than-expected jobs data for October convinced more market participants that the Bank of Canda is done cutting interest rates. According to Canada’s Overnight Index Swaps (OIS) market, there is only a 40% chance of another 25bps cut by June.

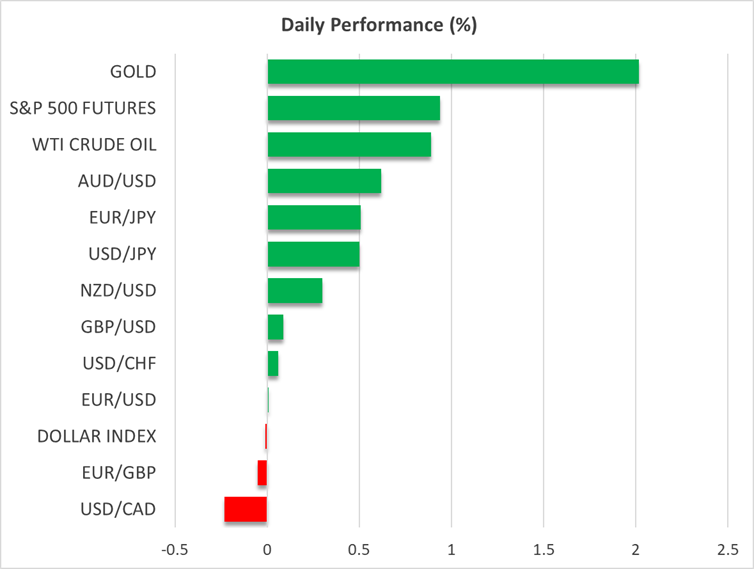

The greenback remained soft at the start of this week as well, losing the most ground against the risk-linked currencies aussie, kiwi and loonie, and gaining only against the yen. This suggests a risk-on trading environment and indeed this may be the case as signs became prominent that the federal government could soon reopen.

Will the US government shutdown end soon?

On Sunday, the US Senate advanced a House-passed bill that would be amended to fund the government until January 30. If the bill passes through the Senate, it will return to the House for approval. Then, it will be sent to President Trump for signing it into law. This could take several days, but according to Polymarket, the implied probability that the government will reopen before November 15 skyrocketed to 92%.

Should this be the case, this means that a barrage of government data will start flowing, including the nonfarm payrolls for both September and October, as well as the CPI inflation numbers for October. Despite the Fed appearing hawkish at its latest meeting and investors gaining insight into how the economy is faring through private and Fed-compiled data, the release of official reports could well impact market expectations about the Fed’s future course of action.

According to Fed funds futures, investors are penciling in a 65% chance of a quarter-point cut in December, while they are expecting another 60bps worth of cuts by the end of 2026. Prior to the Fed decision, a December cut was fully priced in, and another three 25bps reductions were expected for next year.

Stock futures advance, but safe-haven gold rebounds

On Wall Street, both the Dow Jones and the S&P 500 closed fractionally up on Friday, but the Nasdaq slid. Nonetheless, stock futures are well into green territory, reflecting the positive atmosphere after the Senate’s decision to advance the aforementioned funding bill and get the government running again until January 30.

Having said all that, while a final accord could further boost confidence and drive Wall Street even higher, it cannot undo the damage caused by the longest shutdown in US history. Therefore, there is still the risk for Q4 data to come in on the weak side and thereby prompt investors to reduce their risk exposure, especially with valuations at extremely high levels. Specifically, the forward price-to-earnings ratio of the S&P 500 surpassed the 2020 highs.

Strangely, the ultimate safe haven gold is rebounding strongly today, instead of selling off amidst the optimism surrounding the likelihood of a US government reopening. Perhaps gold enthusiasts considered the 4000 zone as a good buying opportunity after the steep correction the metal experienced in late October, or it could be a catch-up response to the dollar slide on Thursday after Challenger, Gray and Christmas reported that US-based companies scaled back more than 150k jobs last month.

.jpg)