Crypto market takes a chance on recovery

Market Picture

The cryptocurrency market rallied 3.4% overnight to $2.4 trillion, taking advantage of the mixed performance of US indices, with the Russell2000 and Dow Jones up and the Nasdaq100 and S&P500 down. It's not a full recovery, but it's the second bounce in a week from just under $2.31 trillion.

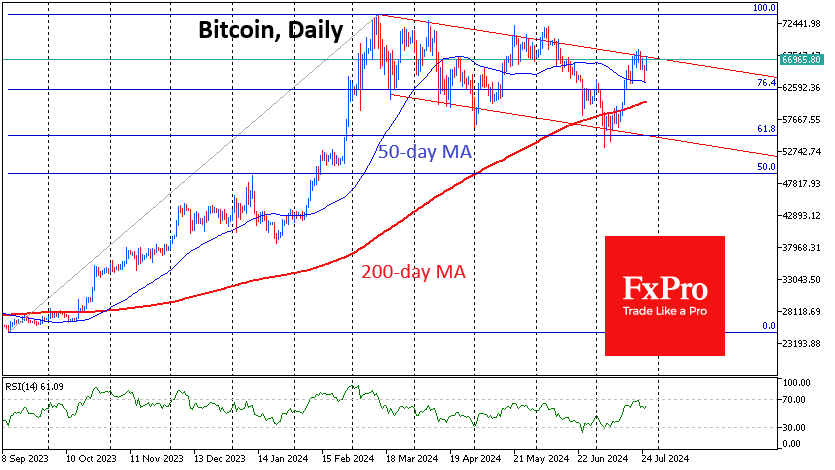

Bitcoin rose 4.4% over the last 24 hours to $67.0K, taking the crypto market with it. It bounced off the 50-day moving average and continued to gain strength on Friday. This is an indication of the strength of the bulls, who have managed to defend the medium-term uptrend. At current levels, bitcoin has returned to the upper boundary of the descending channel formed in March.

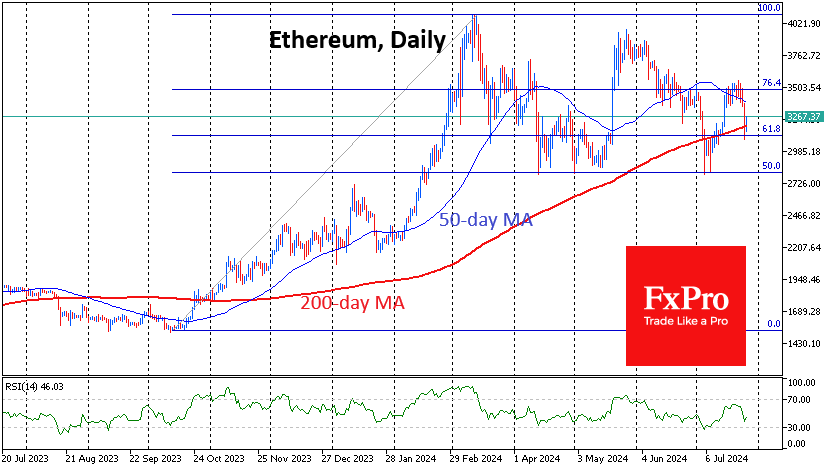

Ethereum is finding support near its 200-day moving average, which also demonstrates the bulls' desire to keep the coin in a long-term growth trend and confidently buy on dips towards $3000. Ethereum is now trading near $3200 and has no technical hurdles ahead until the $3500 area where local profit-taking could occur.

News Background

The sell-off largely replicates the pattern seen at the launch of the Bitcoin ETF in January.

According to SoSoValue, net outflows from spot Ethereum ETFs totalled $133.2 million as of 24 July. Inflows into "new" ETH-based ETFs were not enough to offset $326.9m of client withdrawals from Grayscale's ETHE.

The Bitstamp exchange has reported that it has received the assets of the bankrupt Mt. Gox, following a similar report from the Kraken exchange. The payouts came after a series of transactions that saw the platform's guarantor move 48,641 BTC worth more than $3 billion.

In contrast, spot bitcoin ETFs returned to positive flows with net inflows of $44.5 million on the day. Cumulative inflows since the launch of BTC ETFs in January totalled $17.5 billion.

According to VanEck's baseline scenario, Bitcoin could reach $2.9 million by 2050, given its acceptance as a global medium of exchange and reserve currency. In a bearish scenario, the price will only rise to $130,300.

Marathon Digital, the largest mining company in the US, bought $100 million worth of bitcoins. The decision was made considering the recent market correction and the company's return to its strategy of holding all mined bitcoins on its balance sheet.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)