ETHUSD Falls Below Key Support as Bearish Momentum Strengthens

Ultima Markets provides a detailed breakdown of ETHUSD price action for 5 November 2025, as Ethereum continues to trade under sustained bearish pressure following a decisive break beneath key support.

What is Happening with ETHUSD Today?

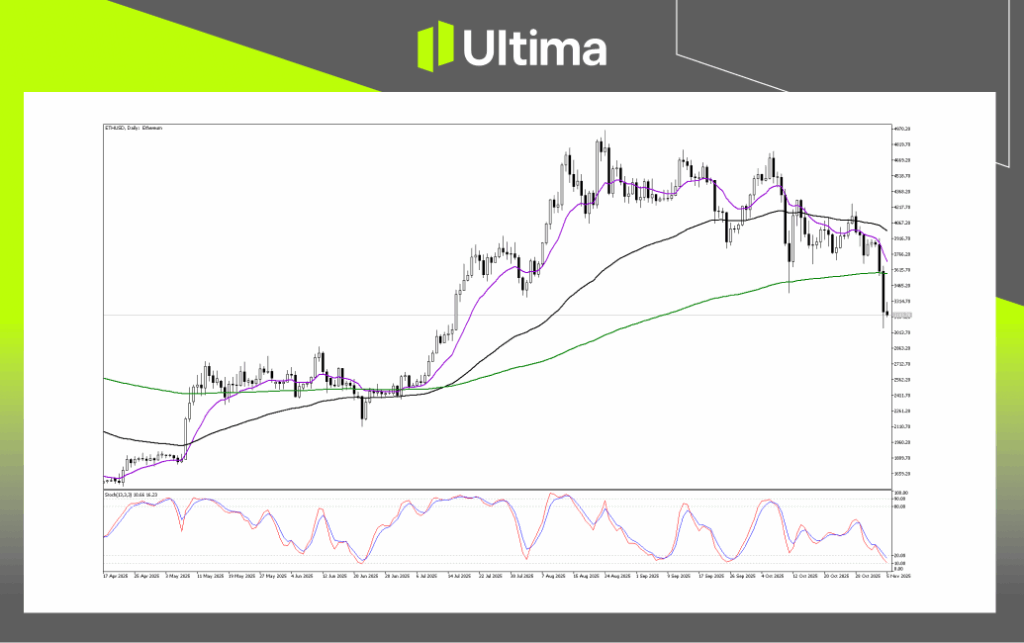

ETHUSD remains in a firmly bearish setup after the short-term moving average crossed below the medium-term trend line, confirming weakness across all timeframes. With the price now positioned below all three major moving averages, the overall market structure points toward persistent selling dominance.

ETHUSD remains in a firmly bearish setup after the short-term moving average crossed below the medium-term trend line, confirming weakness across all timeframes. With the price now positioned below all three major moving averages, the overall market structure points toward persistent selling dominance.

The stochastic oscillator has entered oversold territory, suggesting that downward momentum may be overextended in the near term. While this occasionally precedes a technical rebound, oversold conditions in strong downtrends can persist for longer than expected. A temporary pause or mild consolidation could occur before the next potential leg lower.

The immediate focus for traders is the $3,100 area, representing the most recent candle’s low. A decisive move below this level would likely open the way to the next technical zones around $3,000 to $2,900, where prior resistance from July may now serve as short-term support. Should this zone fail, broader downside targets extend toward the June consolidation band between $2,400 and $2,300, and ultimately the previous major swing low near $1,900 to $1,800.

Why is ETHUSD Falling?

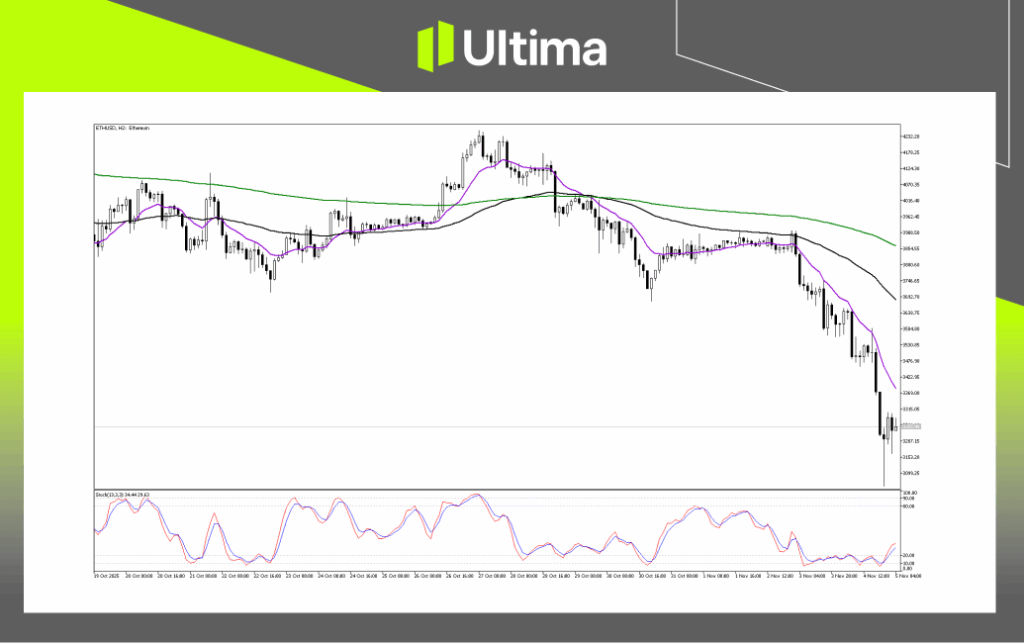

Intraday momentum confirms the dominant downtrend, marked by a consistent series of lower highs and lower lows. The short-term moving average continues to act as dynamic resistance, limiting every minor recovery attempt. If the pair closes decisively below $3,250, further bearish continuation toward $3,100 and $3,000 appears likely.

For buyers to regain traction, ETHUSD would need to reclaim both the short-term moving average and the $3,500 resistance level to initiate a corrective recovery toward $3,700. Only a sustained break above $3,900 would signal a more meaningful shift in sentiment and suggest the potential for a trend reversal.

ETHUSD Pivot Indicator Explained

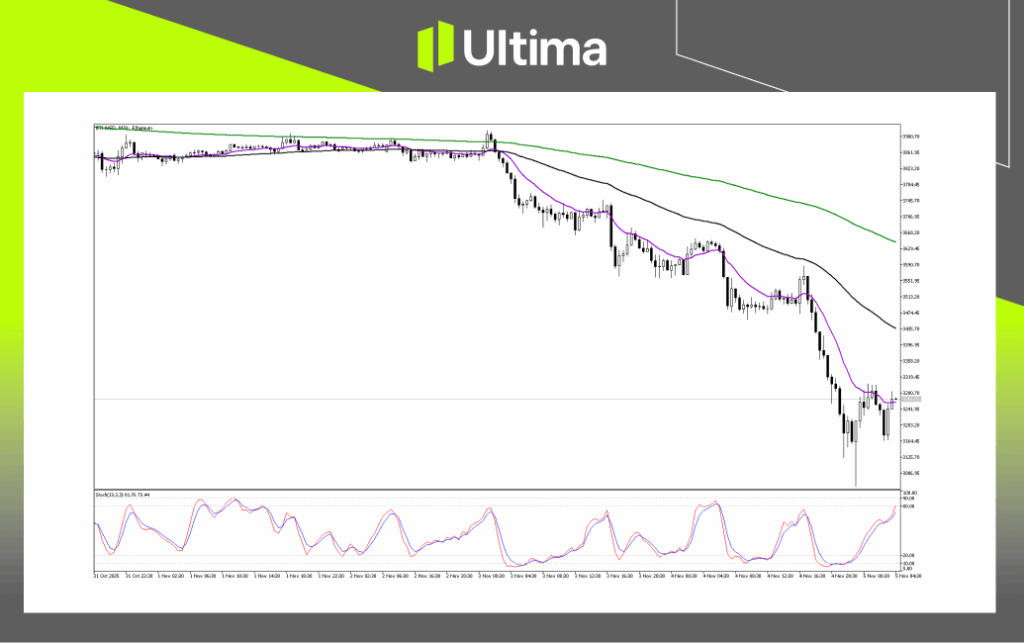

From a pivot standpoint, ETHUSD trades far below all three downward-sloping moving averages, a classic confirmation of bearish momentum. The fastest average currently acts as a strict ceiling, rejecting repeated rally attempts. A 30-minute close below $3,165 could be the first early warning of renewed downside pressure, while a break beneath $3,100 would confirm that sellers remain firmly in control and may drive prices toward the psychological $3,000 level.

From a pivot standpoint, ETHUSD trades far below all three downward-sloping moving averages, a classic confirmation of bearish momentum. The fastest average currently acts as a strict ceiling, rejecting repeated rally attempts. A 30-minute close below $3,165 could be the first early warning of renewed downside pressure, while a break beneath $3,100 would confirm that sellers remain firmly in control and may drive prices toward the psychological $3,000 level.

If a counter-trend bounce develops, it would likely face strong resistance around $3,300 to $3,500, offering sellers an opportunity to re-enter at improved levels. Overall, the short-term path of least resistance remains to the downside.

ETHUSD Market Outlook Today

ETHUSD continues to show weakness across both intraday and higher-timeframe charts. Traders should monitor near-term support zones for signs of short-lived stabilization, but the overarching bias remains bearish unless prices reclaim the mid-$3,000 range.

How to Navigate the Forex Market

Success in the forex market is grounded in data-driven preparation. Use multi-timeframe analysis, define invalidation levels before entries, and remain alert to event risk that may affect liquidity. This report offers a technical framework for ETHUSD and should not be considered a recommendation or personal advice.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.