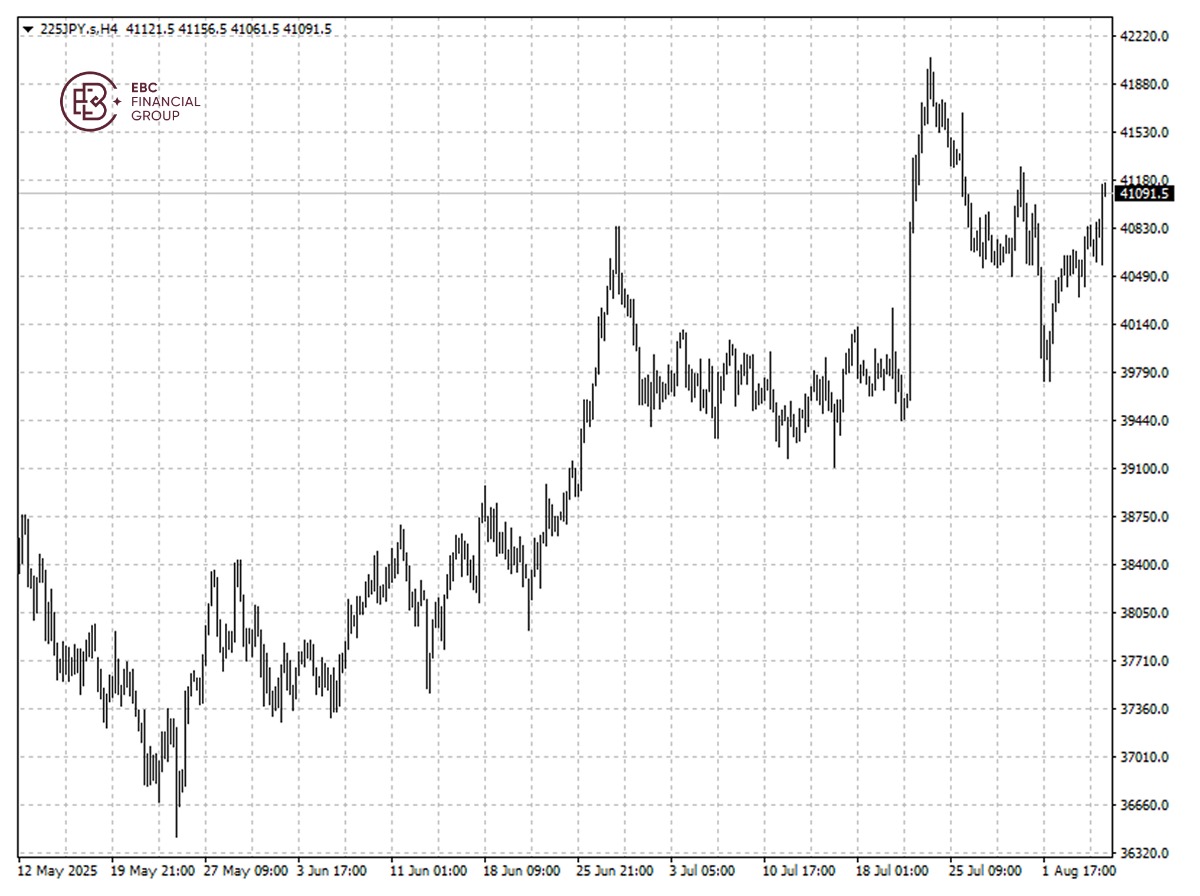

EBC Markets Briefing | Nikkei reclaims 41,000 despite chip tariffs

The Nikkei 225 shot up on Thursday following Trump's vow to impose a 100% tariff on imports of semiconductors and chips. South Korean chip majors could be exempted from it though.

A combination of clearer BOJ messaging, steady corporate reforms and a better-than-feared US tariff deal has market participants betting against a repeat of the 2024 crash in the market.

Expectations that Japan's ruling parties may give in to opposition calls for consumption tax cuts after a recent election setback are fuelling hopes of a boost for retail and other domestic-oriented sectors.

Goldman Sachs Japan and Bank of America Securities have hiked their forecasts for the Nikkei in recent weeks, citing hopes that the 15% tariffs won't derail Japan's economy as much as feared.

Bu political uncertainties are disturbing. PM Shigeru Ishiba has faced criticism and pressure to stand down from within his own party since a dismal showing in upper house elections last month.

A Japanese Labour Ministry panel has proposed a 6% increase in the national average minimum wage for this fiscal year, the biggest such jump since at least 2002, the Nikkei business newspaper reported on Monday.

The Nikkei index has again broken above the 41,000 psychological resistance, so we see another leg higher in the short term towards the high at 41,278.5 hit in late July.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.