EBC Markets Briefing | Swiss franc sought-after despite low rate

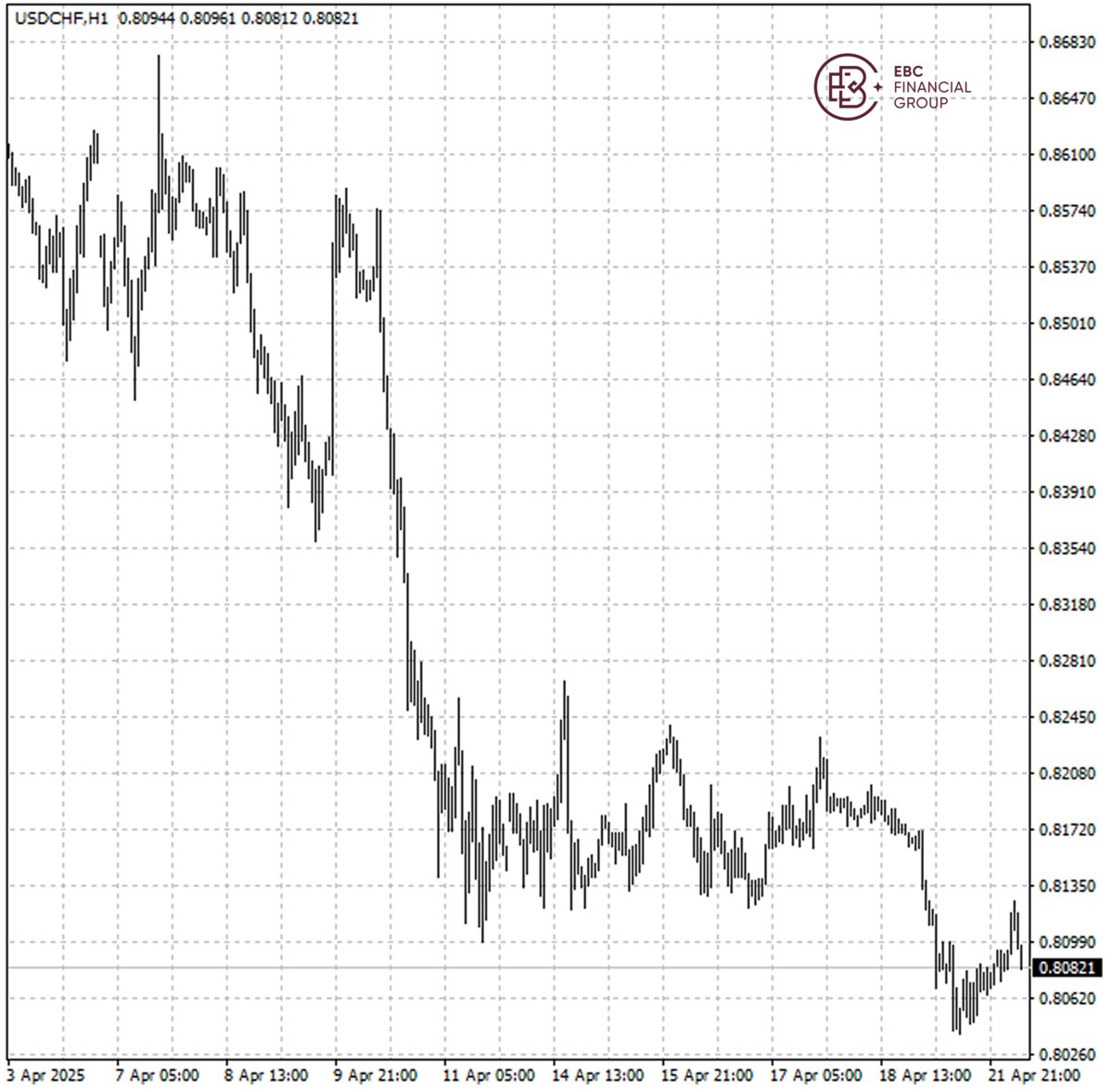

The dollar was close to the decade-low against the Swiss franc on Tuesday as Trump's unrelenting attacks on the Fed chairman further eroded investor confidence in the US economy.

Trump ramped up his criticism of Powell on Monday in a Truth Social post, calling him a "major loser" and demanding that he lower interest rates "NOW" or risk an economic slowdown.

China has warned it will hit back at countries that make deals with the US that hurt Beijing's interests, as the trade war between the world's two biggest economies threatens to drag in other nations.

A strong Swiss franc boosted by souring mood has piled pressure on the country's export-oriented economy and potentially pushed the SNB closer to negative interest rates with inflation near zero.

Swiss inflation stayed at its lowest level in nearly four years in March. The central bank recently said that its baseline scenario anticipated gradually easing underlying inflationary pressure, particularly in Europe.

Speculators reduced their net short position on the Swiss franc to the lowest since December last week, according to CFTC data. Gold and the Japanese yen were also supercharged following reciprocal tariffs.

The currency remained in the overbought territory, but its downside room could be limited in the short term after being supported by the lower end around 0.8140 per dollar of the previous trading range.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.