Euro/dollar loses ground after ECB and US GDP data

ECB fails to push back on rate cut bets

The European Central Bank kept interest rates unchanged yesterday and did not really provide any fresh signals about the path of monetary policy. President Lagarde stressed that it was still premature to discuss rate cuts, but investors did not take her words at face value, as she also emphasized stagnant economic growth and the sharp decline in core inflation.

Most importantly, Lagarde did not explicitly push back against market bets that her central bank will slash interest rates in April. That gave traders the green light to add to those bets. The implied probability for an April rate cut rose above 90% in the aftermath, which in turn inflicted damage on the euro.

Market participants are essentially betting that a softer economic data pulse will force the ECB’s hand into cutting rates in April. That was confirmed by a subsequent media report that said ECB officials might change their tone soon and open the door for rate cuts, if incoming data confirms inflation has been extinguished.

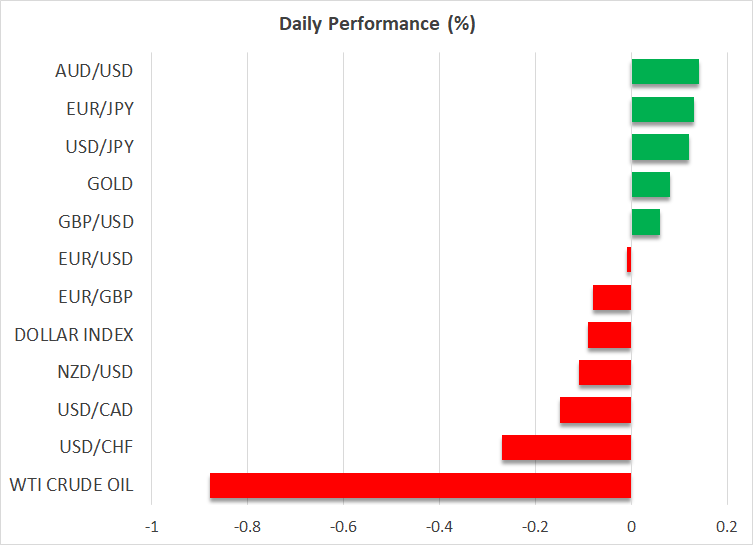

As for the euro, there isn’t much to be optimistic about. The Eurozone economy continues to teeter on the verge of a technical recession and there isn’t any real stimulus on the horizon to kickstart growth. A weaker growth profile could keep the euro on the ropes, especially against the dollar that is reaping the benefits of a resilient US economy.

US GDP tops estimates, yen spooked by inflation data

In the United States, GDP growth clocked in at an annualized pace of 3.3% in the fourth quarter, surpassing economist projections and putting the final touches on a stellar year for the world’s largest economy. Strong consumption and heavy government spending were the main contributors to growth, alongside net trade.

Even though the GDP print smashed expectations, the dollar did not receive much of a boost, most likely because the inflation metrics in this report surprised to the downside. With inflation losing its kick, traders maintained their bets that the Fed will launch an easing cycle by the summer.

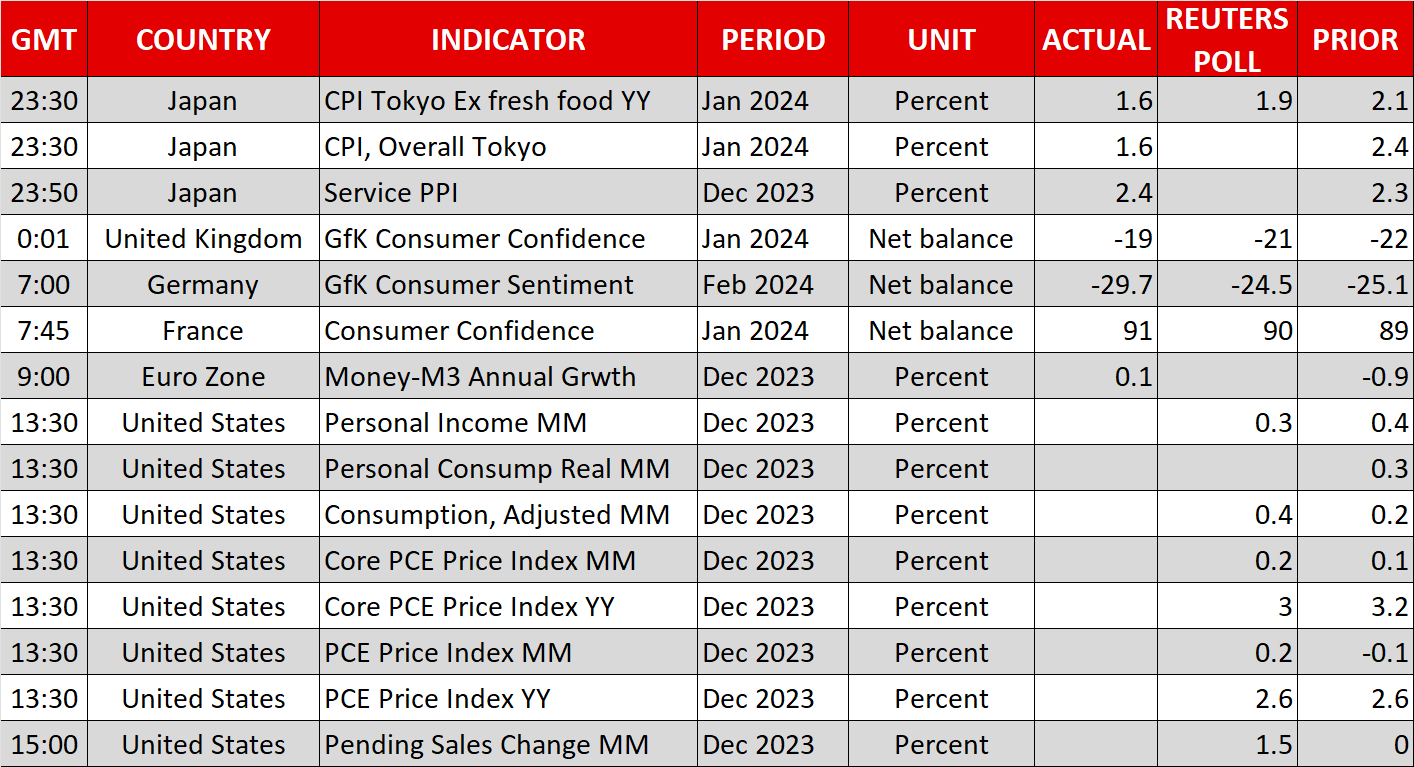

Over in Japan, the yen is under pressure on Friday following some disappointing inflation stats from Tokyo. Inflation in the Japanese capital slowed to 1.6% in January, from 2.4% previously, dealing a blow to speculation that the Bank of Japan could raise interest rates in April.

The sharp slowdown in inflation raises the question of whether the BoJ has missed the time window to exit negative interest rates, even if the spring wage negotiations are favorable in the end.

Wall Street hits new record highs, then retreats

US equity markets reached new record highs on Thursday, drawing fuel from a goldilocks GDP report that instilled confidence in the soft landing narrative, as economic growth remained robust while inflation continued to cool.

Despite a 12% collapse in Tesla shares, the S&P 500 still gained 0.5% to close at new heights, extending the eye-popping rally since late October. That said, futures point to a slightly lower open today following lackluster earnings from Visa and Intel.

The decisive battle will take place next week amid a litany of earnings from Wall Street’s tech titans - Apple, Microsoft, Google, Amazon, and Meta - which will reveal whether strong economic conditions and the artificial intelligence boom are juicing corporate profits. There’s also a Fed meeting and a US employment report on the schedule next week.

As for today, the core PCE price index may attract less attention than usual, as the GDP report has already provided a teaser of how PCE inflation evolved in December.

.jpg)