Global manufacturing activity under the spotlight

OVERNIGHT

Stocks across the Asia Pacific are mostly trading higher, building on the positive moves seen in other global equity indices on Friday. Further signs of cooling US inflation have been behind the recent pick-up in risk sentiment alongside strong trading updates from some major global corporates. Equities across China were also trading higher despite the latest Caixin manufacturing PMI survey showing that activity expanded at a slower pace in June. The survey’s headline balance slipped to 50.5 from 50.9 in May, albeit the outturn was slightly firmer than market expectations of a 50 reading, which would have been consistent with stagnation. The moderation in the Caixin index comes after last week’s release of the ‘official’ PMI index, which showed manufacturing activity remaining in contractionary territory for a third straight month.

THE DAY AHEAD

The outlook for manufacturing elsewhere around the globe will be in the spotlight today with PMI updates for a number of major economies due today. In the US, the manufacturing ISM survey is expected to have held steady in June at 47.0 versus May’s reading of 46.9, consistent with an eighth consecutive month of contracting activity. The new orders component of the survey has printed below the 50 mark in every month since last September, providing an indication that demand has been sluggish for some time. In fact, May data showed demand destruction at its fastest pace since May 2020. Further readings below 50 for both the new orders component and the headline composite measure would corroborate regional US manufacturing surveys and the PMIs, which suggest that the sector overall remains in decline.

Across Europe, including the UK, manufacturing PMI updates are final releases and are expected to confirm the message from the preliminary reports that activity across the sector continues to contract. In the UK, we expect the headline manufacturing PMI to be unrevised from its ‘flash’ estimate at 46.2, holding below the key-50 level for an eleventh straight month. A similar story is expected from the Eurozone manufacturing PMI, where the headline is forecast to print at 43.6, marking the twelfth consecutive month below 50. Updates from Spain and Italy will be new and may drive a modest revision in the headline Eurozone PMI figure, albeit they are unlikely to change the overall narrative that manufacturing activity across the bloc remains slugglish.

Early tomorrow morning in the Asia-Pacific region, it looks like it will be a close call whether the Reserve Bank of Australia increases interest rates again by 25bp to 4.35% or leave them unchanged at 4.10%. Australia’s May CPI inflation was notably weaker than expected which may favour a hold, with markets currently pricing in about 30% probability of a hike, but in any event the RBA will likely leave the door open to more tightening.

MARKETS

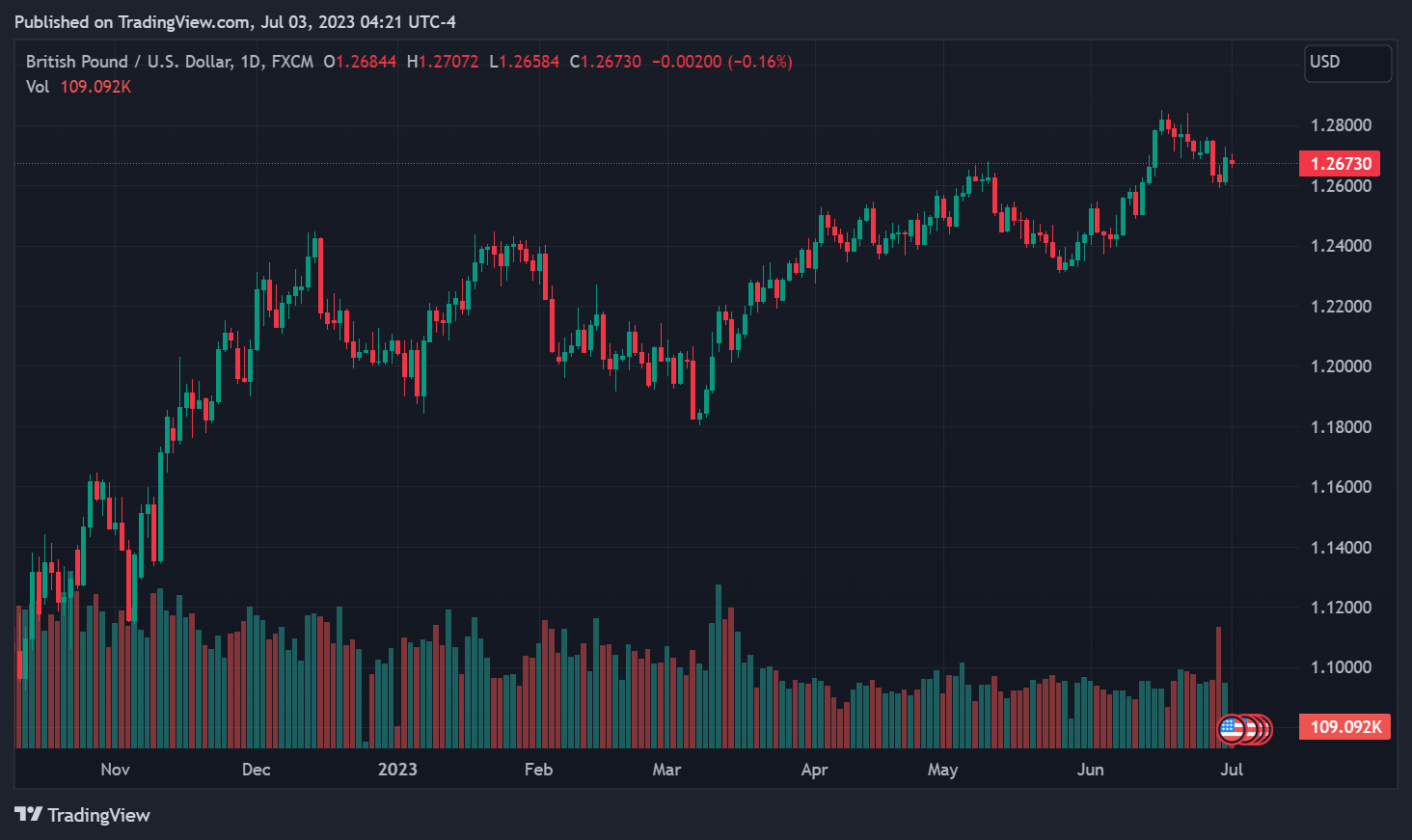

The US dollar is trading firmer at the start of the new week, reversing some of the losses seen on Friday following the softer-than-expected US core PCE deflator outturn. GBP/USD has pushed back below 1.27, while EUR/USD has eased below 1.09.