Gold edges up ahead of Ukraine talks, dollar steady

Ukraine talks main focus at start of week

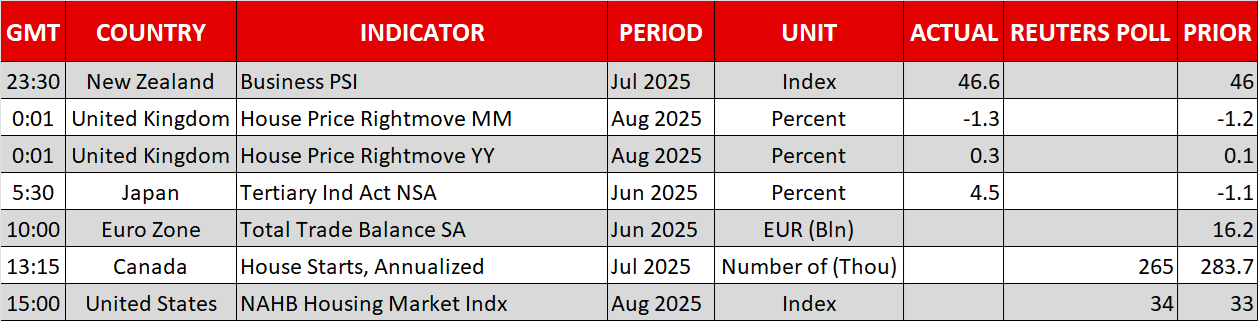

After an eventful Friday, trading has gotten off to a very quiet start this week, although the calm is not expected to last as there’s plenty coming up that have the potential to shake markets up. US President Trump met with Russia’s President Putin in Alaska on Friday, but the highly anticipated summit on Ukraine bore little fruit.

There was no breakthrough for progress towards a ceasefire, with Trump instead now pushing for a permanent peace agreement. In his bid for a quick end to the war, Trump seems more than open to the idea for a land swap between Ukraine and Russia to appease Putin.

But neither Ukraine nor European leaders are likely to agree to such a deal, at least not at such an early stage in the negotiations. Ukraine’s president and leaders from several European countries, including France and the UK, will hold talks with the US President at the White House later today, in what looks set to be another showdown between Trump and Zelensky.

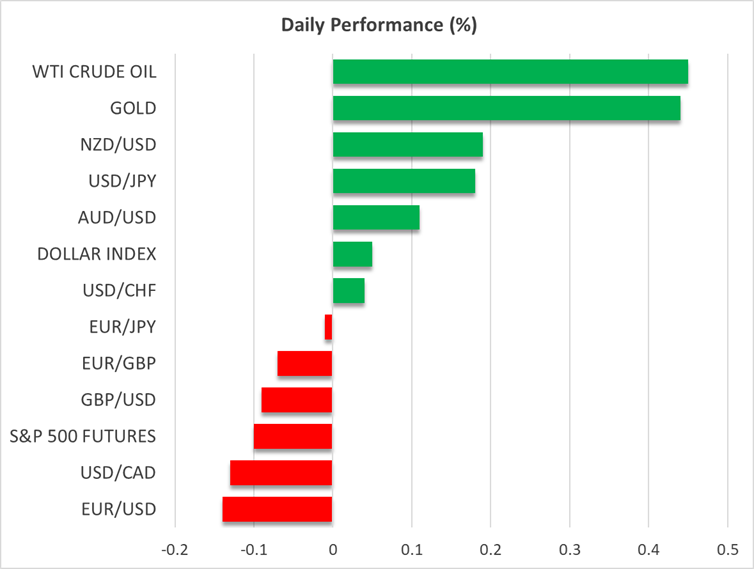

Gold perks up but oil remains under pressure

Gold is inching higher ahead of the crucial talks, taking aim of the $3,350 level and recovering sharply from an earlier dip to a more than two-week low of $3,322.92 in Asian trading. There could be further gains for gold if Trump is unwilling to listen to his European allies at today’s meeting at the White House.

But whatever the outcome, it’s unlikely to be decisive enough to push gold outside of its four-month old sideways range and a bigger risk is this week’s Jackson Hole Symposium where Fed Chair Jerome Powell is expected to pave the way for a September rate cut.

Oil prices, meanwhile, remained on the backfoot on Monday following Friday’s losses. After threatening fresh sanctions on Russian oil exports, including secondary tariffs on customers such as India, Trump appears to have softened his stance after his meeting with Putin. This significantly reduces the immediate threat of supply constraints, weighing on oil futures.

Dollar muted after conflicting data, Powell eyed

The US dollar is struggling for direction on Monday amid mixed signals about the US economy. With the discussions on ending the Ukraine war seemingly going nowhere, all the focus now is on Friday’s address by Powell at Jackson Hole. Powell will likely formally give the green light to a rate cut at the Fed’s next meeting in September.

The risk heading into the Fed’s annual economic symposium is that markets might be disappointed by Powell not sounding dovish enough. Whilst there have been a number of red flags about the US economy lately, particularly the poor July jobs report, there’s not enough evidence just yet to suggest that a recession is on the cards. More importantly, inflationary pressures continue to persist, as indicated by last week’s producer price data and uptick in the University of Michigan’s latest consumer inflation expectation readings.

The disparity between the July CPI and PPI numbers could be a sign that businesses are not passing on the higher tariff costs onto consumers, who continued to spend at healthy levels last month. But then this would also imply a hit to profit margins, which would be negative for equities.

The dollar was last trading around 147.30 yen, while the euro was slightly lower at $1.1682.

The yen’s brief rally last week came to an abrupt end after the Japanese government denied that comments by US Treasury Secretary Scott Bessent about the Bank of Japan being behind the curve was intended to add pressure on the Bank to raise interest rates.

Optimism supports equities but cryptos plunge

Stocks on Wall Street drifted mostly lower on Friday as investors pared back some of their more dovish bets for Fed rate cuts following the PPI and retail sales data. Still a September rate cut remains strongly priced in, with the bigger question mark being around the pace of easing beyond September.

But although some of the positive momentum has waned, there’s still plenty of optimism amid double-digit earnings growth by mega-cap stocks as well as on the back of the de-escalation in the trade war, which has boosted stocks in Asia. Japan’s Nikkei 225 index closed at another record high today.

On the earnings front, US retailers will be in the spotlight this week.

Cryptos are no longer feeling the optimism, however, as last week’s pullback from the recent surge doesn’t seem to be over. Bitcoin is extending its sharp reversal from record highs to drop another 2% today.

.jpg)