Markets rally and dollar weakens after US CPI data

OVERNIGHT

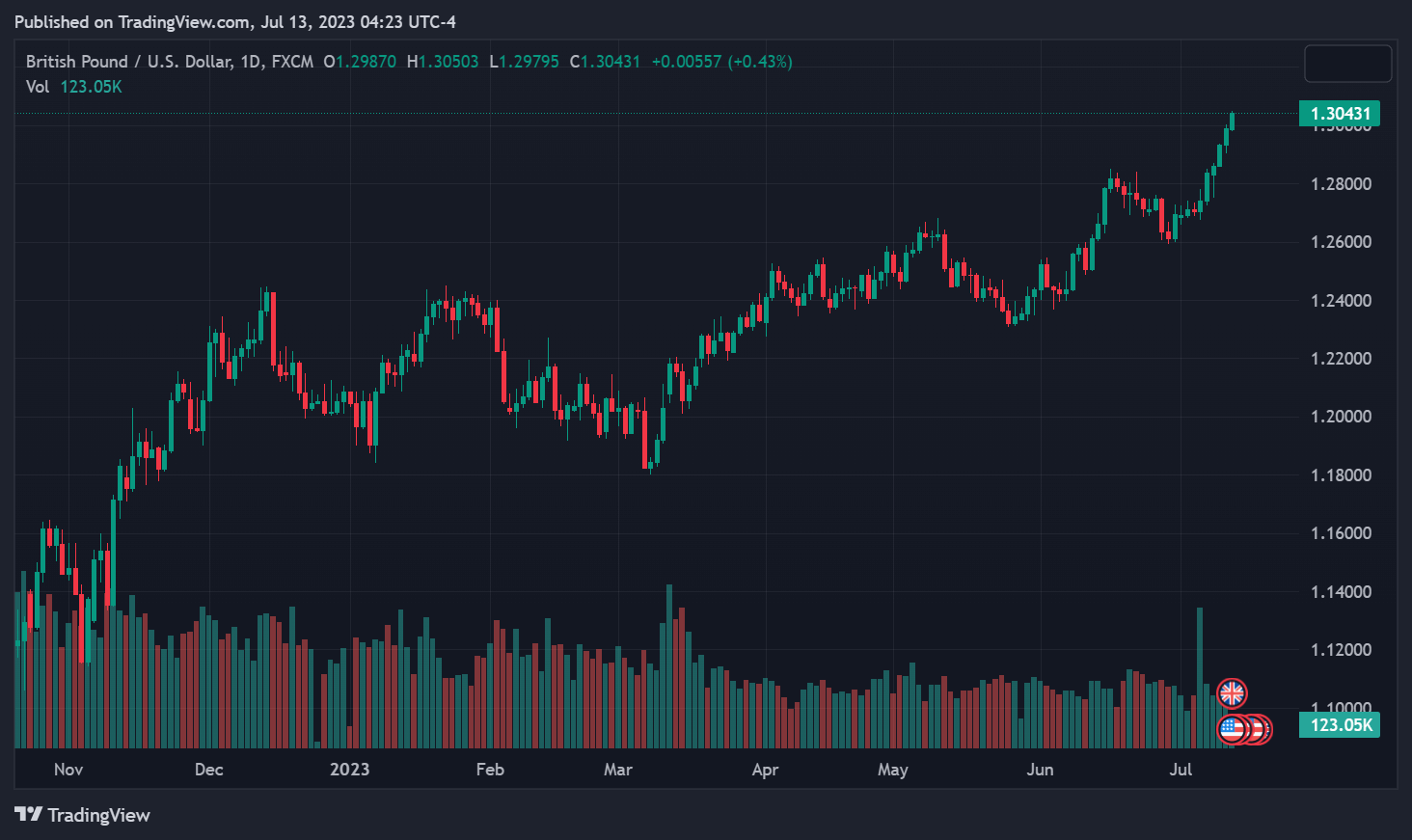

Yesterday’s post-US CPI rally in equities carried over into the Asian trading session, leading to solid gains in major indices. The US inflation data came in softer than expected, raising hopes that a peak in Fed interest rates is drawing nearer, with rate cuts priced in from early next year. Markets shrugged off weak Chinese trade data. A weak UK RICS survey also had minimal impact on the pound which posted gains against a broadly weaker US dollar.

THE DAY AHEAD

UK May GDP, released earlier, showed a contraction of 0.1%m/m. The outcome was better than expected, as the extra bank holiday for the King’s Coronation was expected to result in a larger fall in output (one-off bank holidays are not seasonally adjusted). There was also an ongoing effect on activity from public sector strikes. The detail revealed that service sector output was flat, compared with expectations for a fall, while both industrial and construction output posted declines. A small rebound in GDP in June would result in a flat outcome for Q2 (assuming no revisions). Nevertheless, indications are that underlying private sector activity is stronger than was expected at the start of year.

There are no other major UK data releases this week, with sterling’s focus shifting to next week’s CPI inflation figures as well as retail sales and consumer confidence. In the Eurozone, today’s industrial production data for May are expected to show a small monthly rise of 0.3% or so, but output will likely remain below levels seen in the early part of the year reaffirming the deceleration in activity in the sector.

Of more interest for markets will be the ‘account’ (minutes) of the ECB’s June meeting when it decided to raise interest rates by 25bp to the highest level for over twenty years. The minutes seem set to reaffirm strong hints that they are not done with tightening. Another hike in July seems very likely but beyond that there may be less consensus among policymakers.

In the US, this afternoon’s June producer price figures come on the heels of yesterday’s softer than expected CPI data. They will be watched for indications of further moderation in pipeline inflation pressures. We expect both the headline and core (excluding food and energy) measures to post 0.2%m/m rises which will lower the annual rates to around 0.5% and 2.7%, respectively. US initial weekly unemployment claims data will also provide further indications on the extent to which the labour market is softening. The Fed’s Daly and Waller are scheduled to appear.

MARKETS

US 10-year Treasury bond yields dropped to around 3.85% yesterday following the softer than expected inflation data, a fall of over 10bp, and are little changed overnight. UK 10-year gilt yields closed down 15bp at 4.51%. GBP/USD rose through 1.30 on broader US dollar weakness, but the pound weakened against the euro, Brent crude oil price rose above $80 a barrel for the first time in over two months. There was some limited positive reaction for sterling to the UK GDP data.