Oil loses value despite an extremely bullish background

Oil loses value despite an extremely bullish background

If you read the news and don't look at the prices, it's hard to imagine a more bullish background for oil, but its quotes, although at their highest levels since March, still lost more than 1% on Monday compared to Friday's close and are 3.5% below the level at the opening of trading on Monday.

Israel has started targeting Iran's oil and gas facilities. In Iran, threats of a blockade of the Strait of Hormuz, through which up to 30% of the world's LNG and 20% of oil passes, are becoming increasingly vocal.

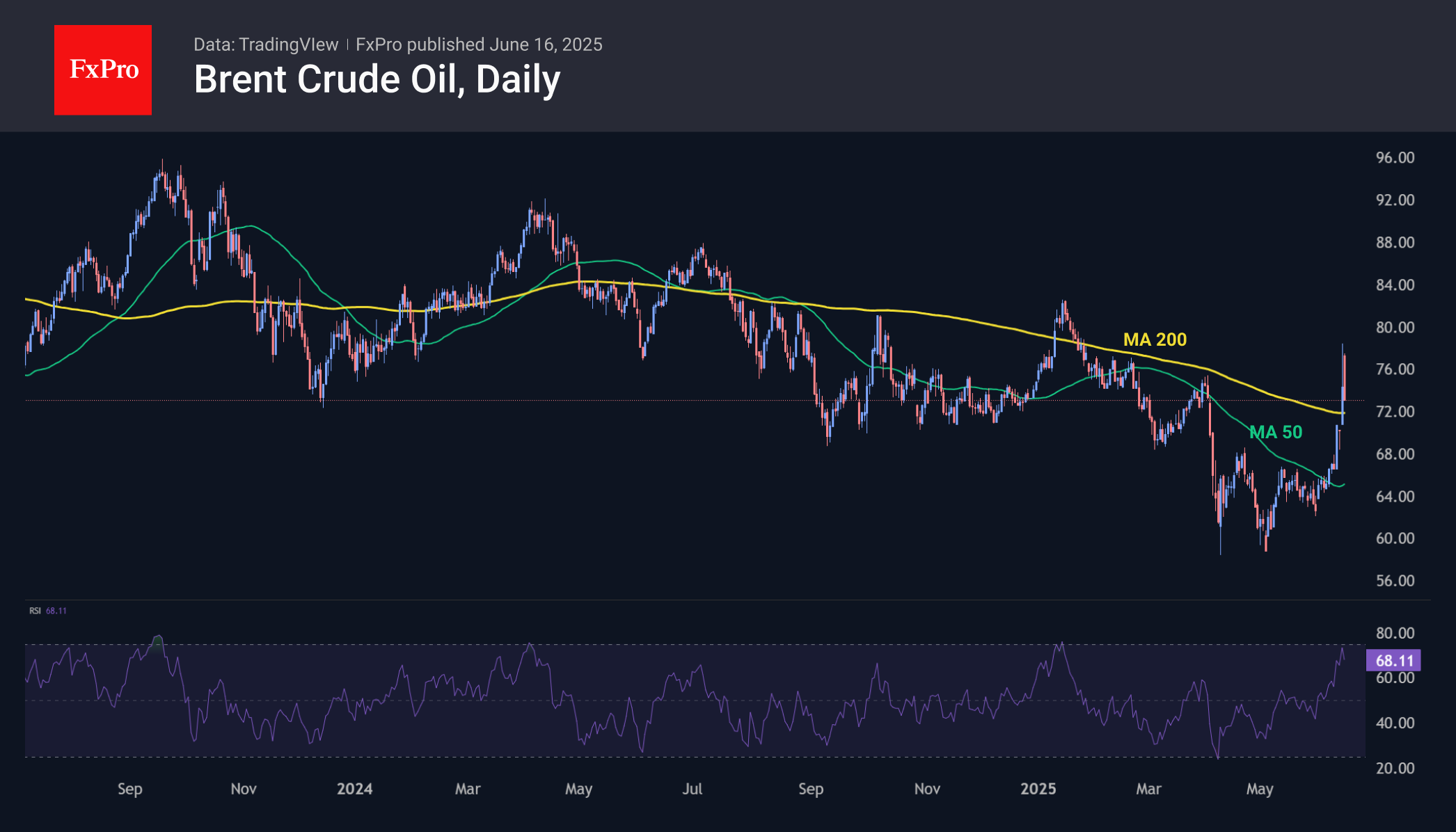

However, this news was not enough to break Friday's highs of $76.3 per barrel of Brent. The price is drifting downwards towards the lower boundary of consolidation in the second half of Friday at $72.5. This is still 10% higher than last week's starting levels, but hardly impressive.

By comparison, oil plummeted 22% from around $75 in response to Trump's April announcement of global tariffs, which did not directly affect oil.

The market is in no hurry to translate fears into a risk premium. This is probably due to the greater influence of macroeconomics on prices, as commodity exporters in recent years have preferred not to use energy as a weapon, as was the case in the 1980s. On the contrary, in modern history, oil and gas have been subject to sanctions by importers.

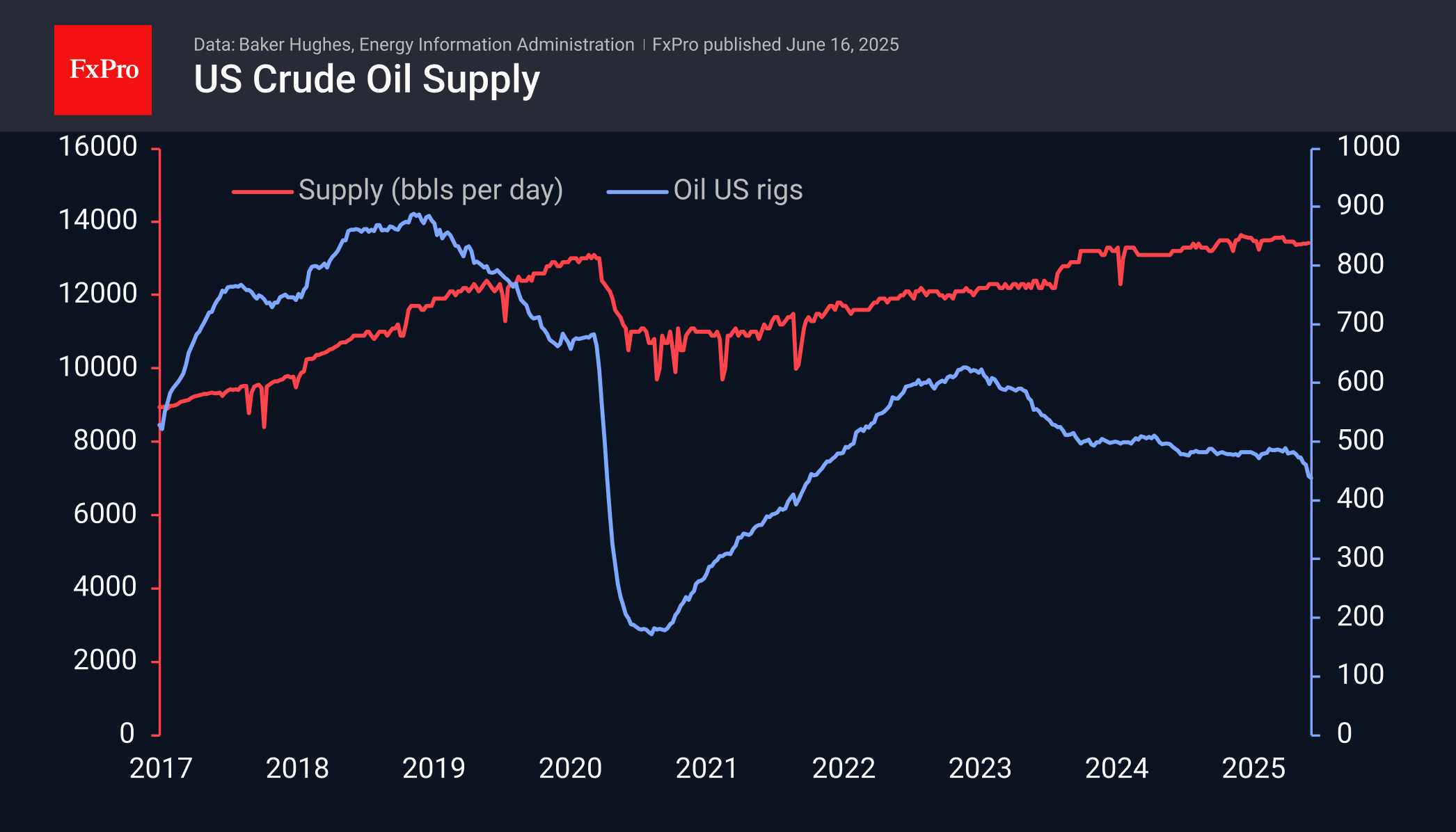

The trend of declining drilling activity also continues in the United States. Data published on Friday by Baker Hughes showed a decrease in the number of oil rigs by 3 to 439, a new low since October 2021.

Formally, bulls can chalk up last week's close above the 200-day moving average, which is currently at $71.50. But Monday's sharp decline calls into question the sustainability of this trend. Most likely, the surge was caused by a short squeeze, and now large players are selling oil to retailers, taking advantage of the high-profile news background and the sharpest shift of private traders from net sellers to buyers.

The RSI technical oscillator repeated the peak levels of the last two years at 75 on a daily timeframe, which marked the peaks in oil prices.

Last week's events pushed oil above the former strong support level that had been in place for the past three years. However, strong and rather unexpected selling pressure indicates that the bears have the advantage, as they may use the latest surge as a convenient point to sell.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)