The Crypto Market Takes a Breath after the Storm

Market Picture

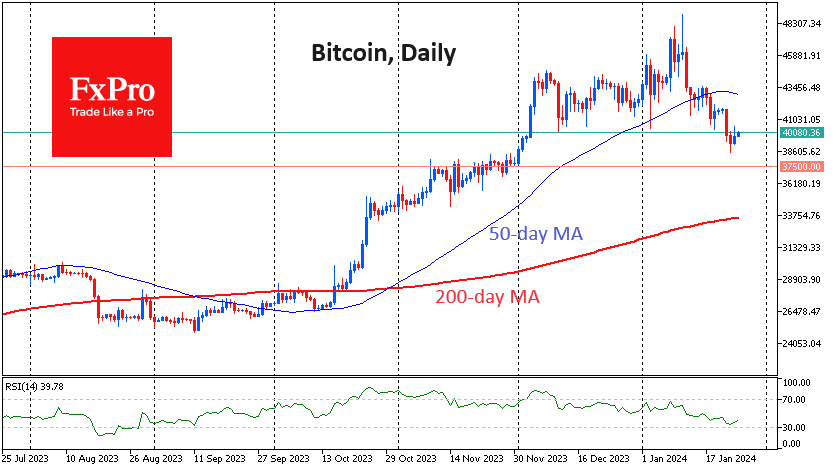

The crypto market saw lower volatility in the last 24 hours, with capitalisation at $1.56 trillion and the price of Bitcoin hovering around $40K. Major altcoins have also avoided strong moves. The Fear and Greed Index is wandering around a neutral 50.

A cautious uptrend can be discerned in Bitcoin since Tuesday, as some players are looking to lock in profits from short positions or buy after a sharp sell-off. We note that Bitcoin was not oversold before stabilising, and bears may use the current lull to hoard liquidity before another sell-off.

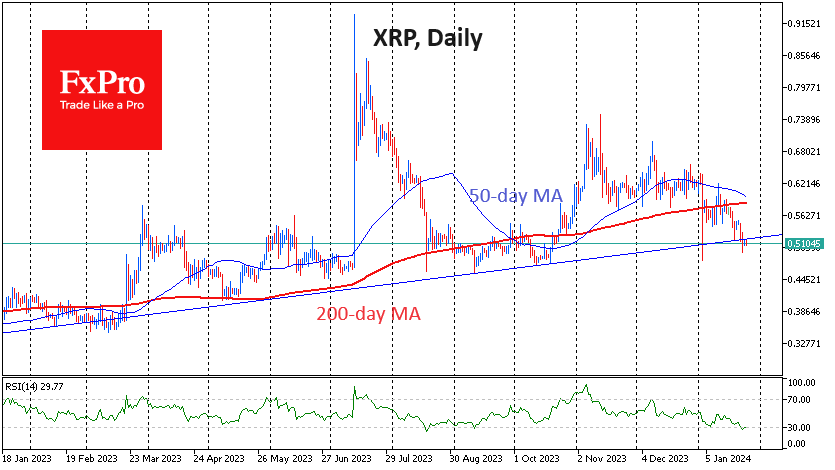

Unlike Bitcoin, XRP has almost completely erased the gains of the rally since October, returning to the $0.51 area. On the daily timeframes, the RSI has touched oversold territory, setting the stage for increased volatility and the potential for a reversal in the coming days. However, there is a cause for alarm. Since November 2022, XRP has been forming an upward trend, and the movement of the last few days has broken it.

News Background

According to a Deutsche Bank survey, more than a third of respondents believe Bitcoin will fall below $20K by the end of the year. And only 15% of respondents expect to see BTC above $40K by then.

PlanB, the creator of the Stock-to-Flow model, on the other hand, believes Bitcoin will consolidate around $40K and prepare for a rise to $60K.

CoinShares noted the potential for increased inflows into Ethereum if the Dencun hardfork is successful and a spot ETF based on the asset is possibly approved.

Spot Ethereum-ETFs do not require a judicial process for approval, SEC Commissioner Hester Peirce said, referring to the court's decision to convert the Grayscale Bitcoin Trust into a spot ETF.

The US FINRA found potential violations in 70% of information materials about cryptocurrency products. Fair and balanced advertising rules explicitly prohibit ‘false, exaggerated, promising, unsubstantiated or misleading statements’.

Switzerland approved the first retail platform that will allow citizens to trade tokenised securities and digital assets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)