The pound declines after the rebound despite the labour market

The pound declines after the rebound despite the labour market

The UK labour market figures released on Tuesday did not prevent the pound from pulling back after Monday's increase. GBPUSD is falling by approximately 0.9% from early morning highs, reversing two-thirds of the gains following reports that Trump will not immediately implement trade barriers but will begin with a job evaluation process.

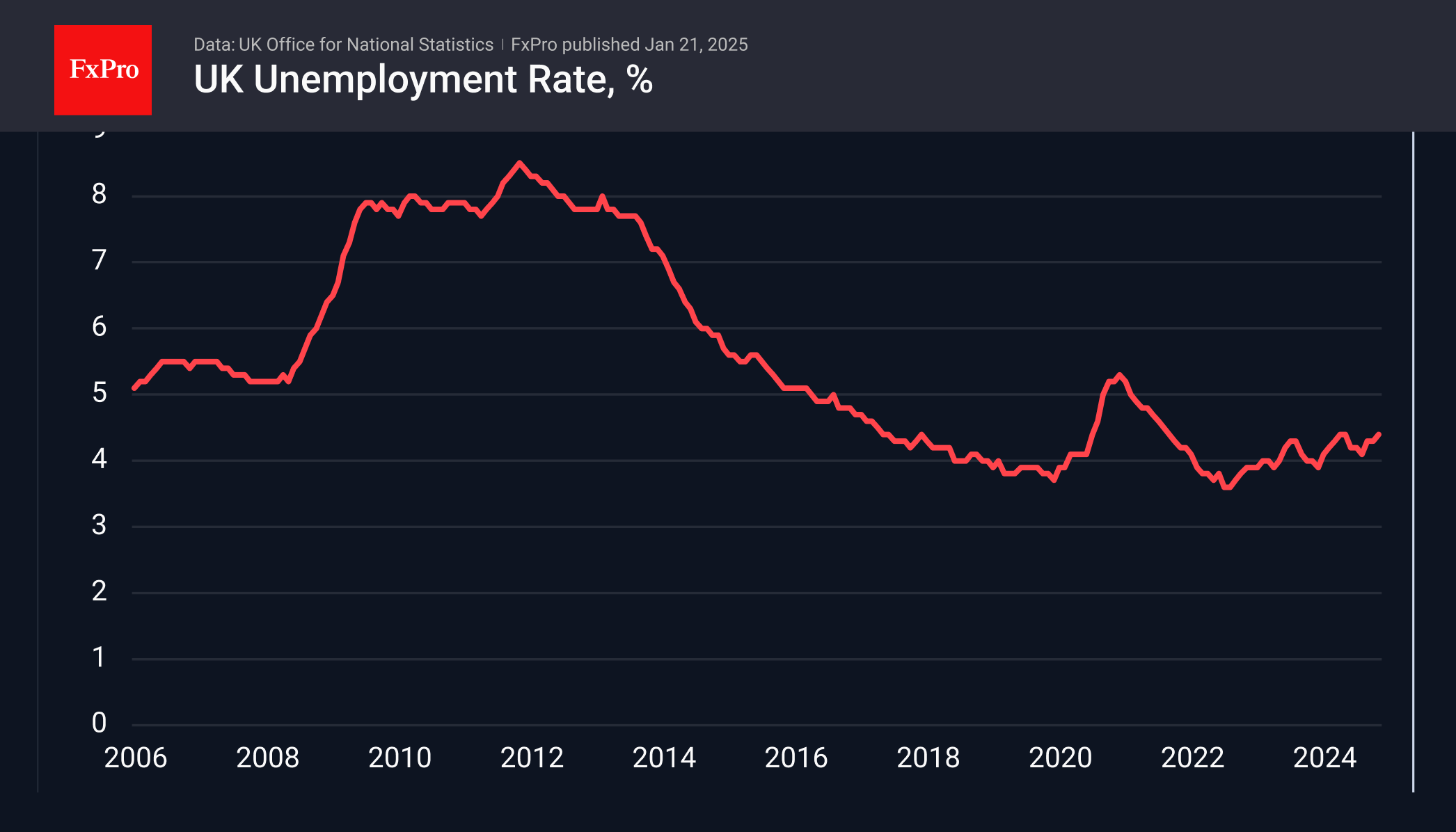

Jobless claims rose by 0.7K in December, against expectations of 10.3K. After two months of decreases totalling 36K, the trend of increasing unemployment from April to September appears to have halted.

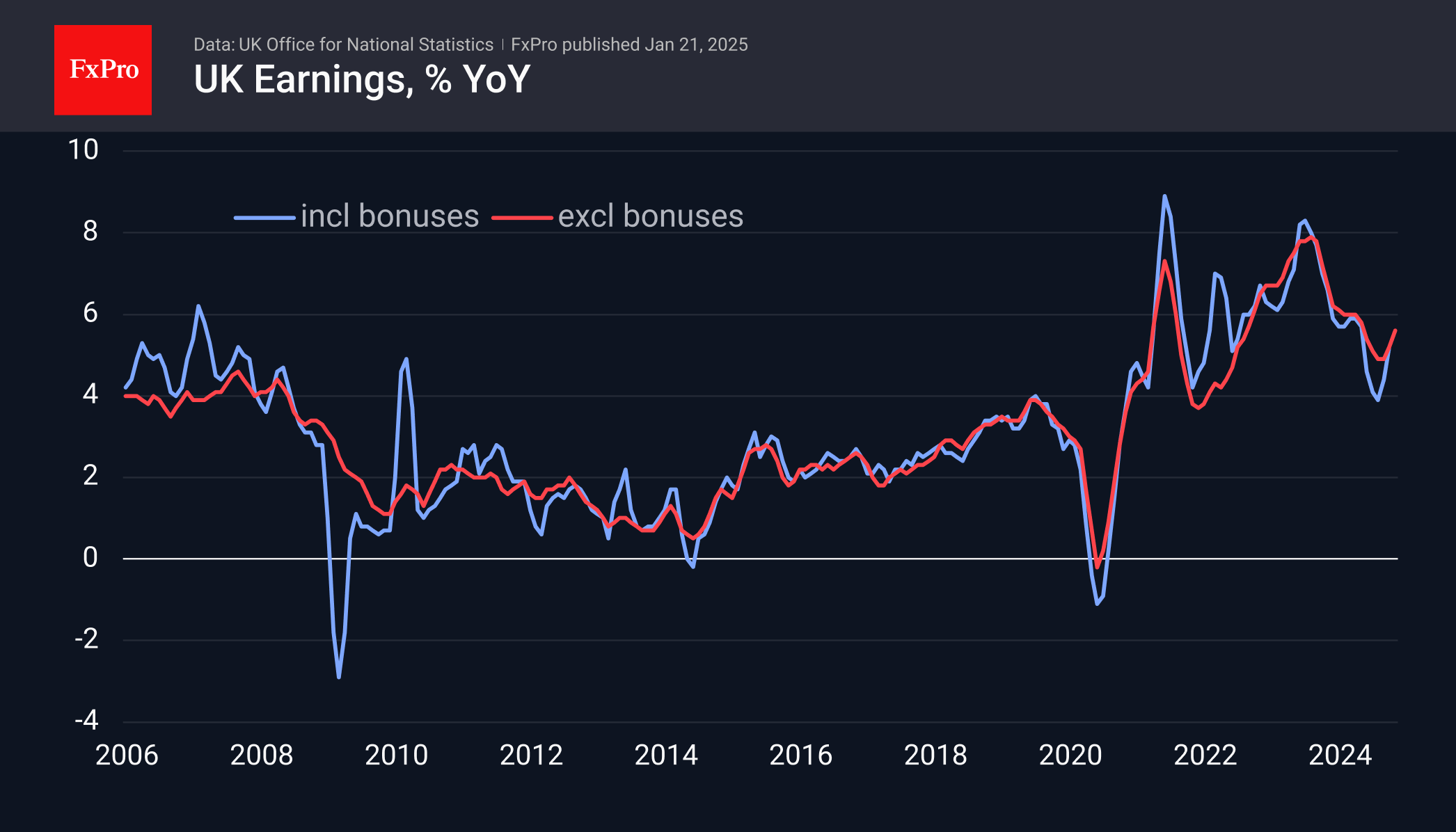

The rate of wage growth accelerated from 5.2% to 5.6% last year, showing a positive trend from August's 3.9%. The acceleration in wage growth could indicate potential inflationary pressures that might lead the Central Bank to adopt a less dovish stance than previously anticipated.

The coinciding timing of the local bottom in the labour market with the cycle of rate cuts starting in August is likely coincidental. Policy changes typically take several months to quarters to impact the economy.

Moreover, the unemployment rate has risen to 4.4%, and the number of unemployed has been increasing for the past eight months. Alongside rising wages, this may reflect a trend of cutting lower-paid jobs, which raises the average wage growth rate but negatively impacts overall spending. The recent news of a 0.6% month-on-month decline in retail sales excluding fuel could be an early warning sign of this trend.

GBPUSD soared up to 1.2340 on Monday but fell by 90 pips to 1.2250 on Tuesday, with strong support from last April acting as resistance. This may indicate the end of the bounce as the pound lost momentum near the 61.8% retracement level of the decline from the December peak to the January low. Confirmation of strong bearish sentiment would be a return to the lows at 1.21. Falling below this level could trigger a Fibonacci extension pattern, potentially leading to a decline to 1.1660. Historically, the Pound has only been below this level for one week in March 2020 and ten weeks in the latter part of 2022.

Trump's firm commitment to reducing the US trade deficit is benefiting bears in GBPUSD, as seen in the trends observed in 2018-2019 during periods of trade disputes.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)