UK inflation weakens the Pound

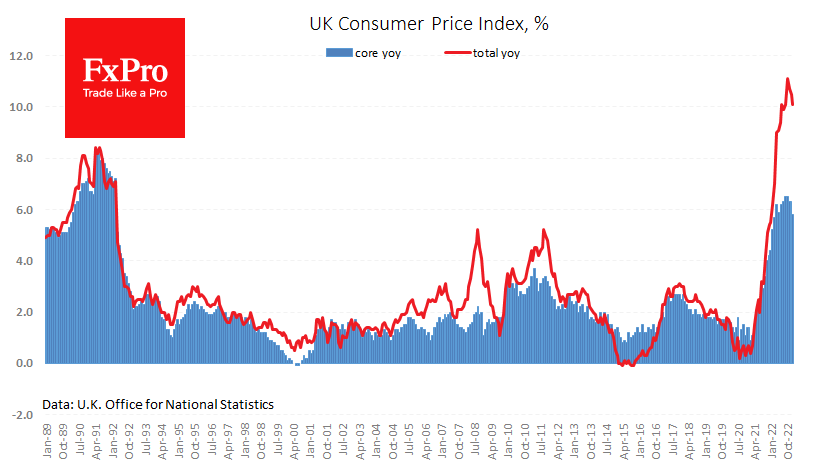

The UK’s rate of consumer price inflation remains one of the fastest in the developed world, although January's figures were softer than expected.

CPI fell by 0.6% last month, against expectations of a 0.4% drop. Annual inflation slowed from 10.5% to 10.1% (10.3% forecasted). The weaker-than-expected data put downward pressure on the Pound, as it eased some pressure on the Bank of England to raise interest rates.

The Input Producer Price Index was also weaker than expected, falling 0.1% m/m against expectations for a 0.2% rise and slowing to 14.1% - an impressive slowdown of more than ten percentage points from a peak of 24.6% in June.

However, there is a greater likelihood that UK inflation will be more 'sticky' than continental Europe. The retail price index held its annual rate at 13.4% in January. Producer prices rose by 0.5%, much more than the 0.1% expected.

Due to the base effect, the inflation rate is falling, which is a relief. However, it should be noted that there is still a long way to go to reach the 2% CPI target, as the unemployment rate is low and internal inflationary pressures are building up to replace the external inflation caused by last year's soaring commodity and energy prices.

The FxPro Expert Analyst Team

-11122024742.png)

-11122024742.png)