USDJPY forming a bottom at 140 with upside potential to 160+

USDJPY forming a bottom at 140 with upside potential to 160+

The media often focuses on the impact of America's debt problems on the dollar, but events in Japan have every chance to be more dramatic. Japan is buried under a debt burden exceeding 230% of GDP. This is double the average burden for developed countries and by a wide margin exceeds the nearest major peers (Greece at 142%, Italy at 137%, and the US at 122%), if we exclude small countries like Sudan, Singapore, and the like.

High debt limits a government's ability to absorb risk, much like an overloaded car: the difference may be subtle on a smooth road, but it becomes glaring on a rough one. At a time when even the solvency of the US is in question, it should come as no surprise that investors are asking the same question of other debtors.

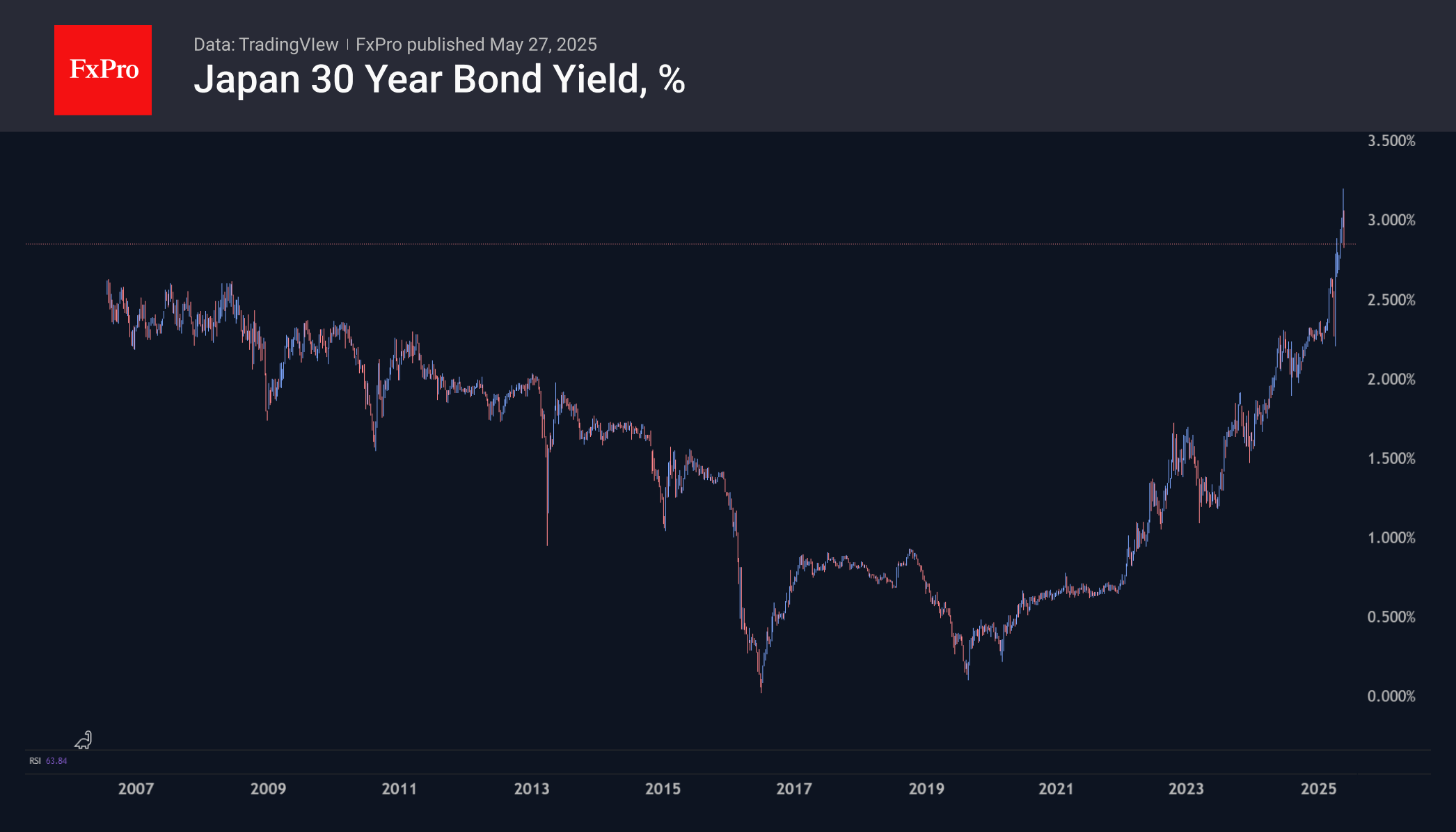

In practical terms, this means pressure on the price of long-term bonds as traders demand higher yields. Yields on 30-year notes rose to 3.20% last week, although they have now been pushed back to 2.85%, a dramatic change from the plateau at 0.65% from mid-2020 to late 2021. That's still higher than we saw in the period before zero interest rates began, when the peak area was near 2.6% between 2006 and 2008.

Since these are not just numbers for investors, but a serious increase in the government's debt servicing costs, we should expect a reversal in monetary policy. The Bank of Japan has been gently moving away from negative rate territory and reducing the intensity of QQE for the past few years. This included helping to stabilise a currency that had reached its lowest level against the dollar since 1987. Acting the opposite of the Fed, the Bank of Japan has seen USDJPY decline 11% from a peak of 162 to 140 last month.

That is, Japan needs to support the bond market through a return to massive QQE and a declaration of a reversal in monetary policy. There is room for such a move as the yen has retreated from its lows. Moreover, for export-oriented Japan, a weaker yen will help boost exports, which in the face of trade wars could be crucial for rising import prices.

If we are right, USDJPY is close to forming a long-term bottom and reversing to the upside, the beginning of which we may have seen at the start of this week. The pair bounced from 140 in 2023 and 2024, and we see signs of a reversal now. At its lows at 142 at the start of the week, the USDJPY was less than 2% away from its 200-week average, a major long-term trend line, the exceeding of which triggered the last rally in 2021. USDJPY may not face any meaningful upside obstacles until the 158-160 area, which could take 3 to 6 months if we focus on the past few impulses.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)