What is next: Trump 2.0 and the BoJ hike

What is next: Trump 2.0 and the BoJ hike

On Monday, January 20th, U.S. markets are closed for Martin Luther King Day celebrations, which will affect the trading hours of exchange-traded instruments such as U.S. stocks, indices and futures. Trump's inauguration is scheduled for the same day, which may affect trading dynamics in the currency market and global stock markets.

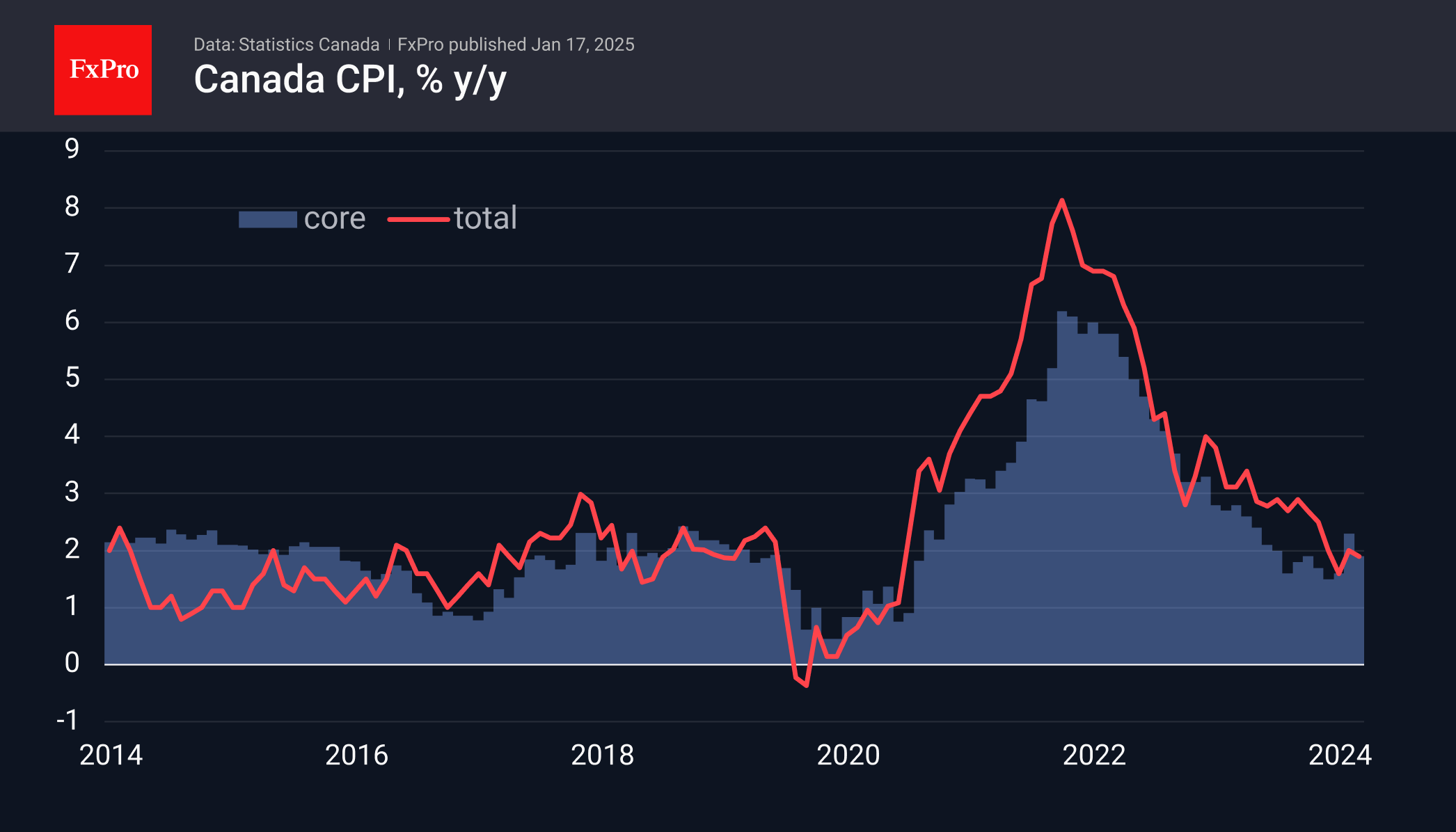

On Tuesday, the dynamics of the Canadian dollar can be affected by the report on consumer inflation. Since August, this indicator has fallen to the 2% target for the Bank of Canada, allowing it to reduce the rate to support the economy. But the big question now is whether the 7% inflation rate spurred the Loonie's collapse over the last quarter. A CPI acceleration could support the Canadian dollar on a reassessment of the outlook.

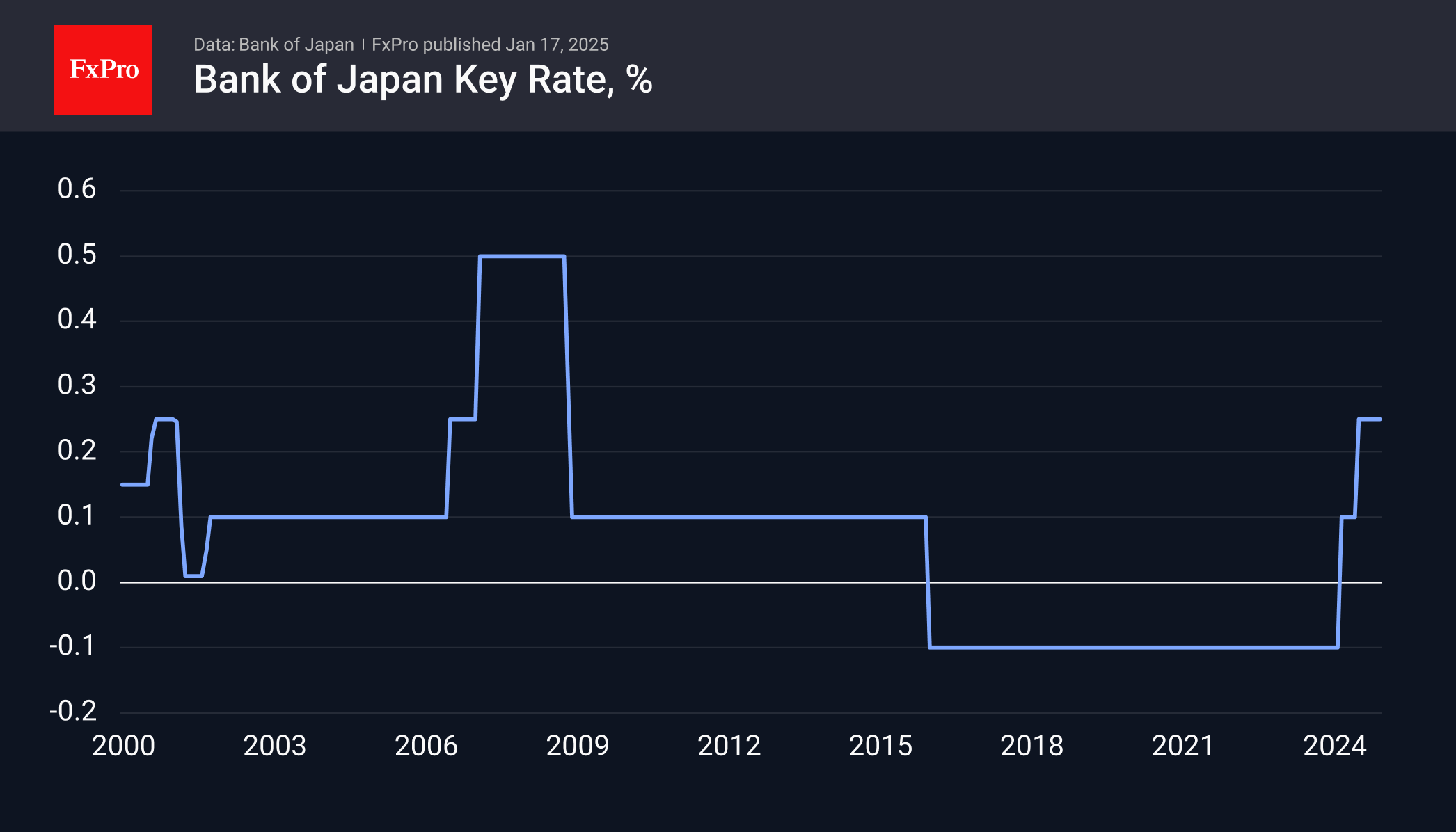

The Bank of Japan may raise its key rate Friday morning, marking the third increase in nearly a year. This very Japanese-style leisurely phase of policy normalisation is likely to continue, guided by the Rising Sun's long-term government bond yields flying to all-time highs. The tightening of the policy could provide fundamental support to the Japanese yen.

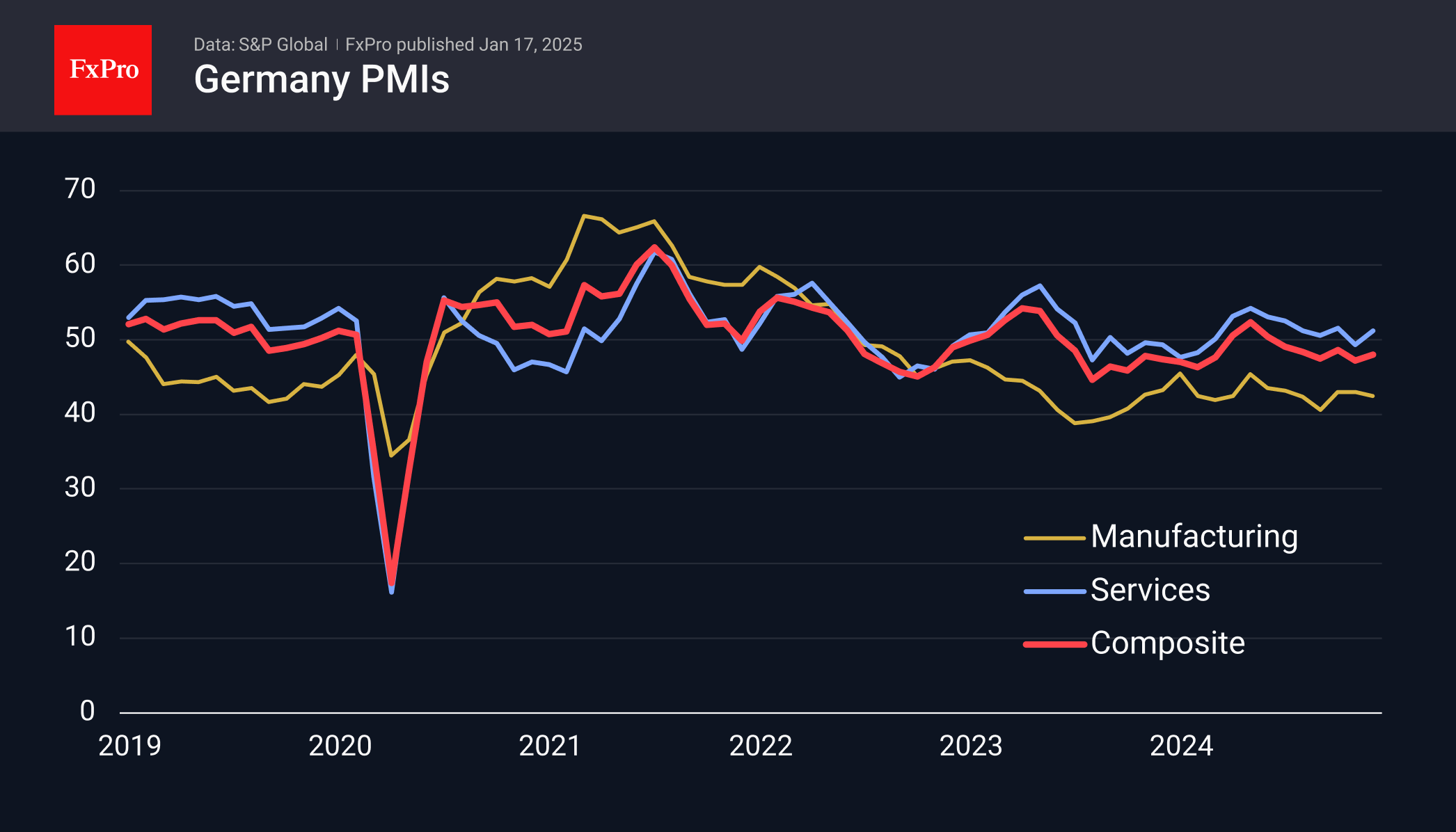

Also, on Friday the preliminary estimates of PMI indices for European countries will be released. These are often very influential indicators, which can visibly affect the dynamics of the euro. This is especially true for Germany.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)