Caution prevails ahead of Nvidia earnings, dollar and gold climb

Stocks take another tumble, Nvidia awaited

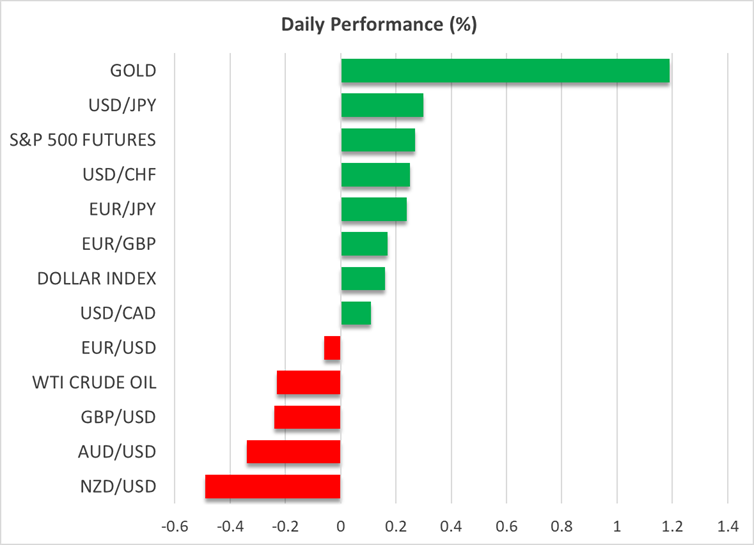

Equity markets were somewhat steadier but remained under pressure on Wednesday as investors anxiously wait for Nvidia’s Q3 earnings results to gauge the strength of AI demand amid the recent jitters about excess valuations. The S&P 500 closed in the red for the fourth consecutive session on Tuesday, extending its month-to-date losses to 3.3%. The Nasdaq 100’s pounding has been even heavier, losing more than 5% this month.

Despite the scale of the losses, Wall Street is a safe distance from correction territory. But that could change if Nvidia’s earnings worsen the gloom rather than lift it. There’s a good chance the chip giant will beat its revenue estimate of $54.6 billion, but investors will be more concerned about what CEO Jensen Huang says about the upcoming quarters, as China remains a risk for the company.

Any panic about chip demand not holding up in 2026 could easily push US indices into corrective mode. However, with markets already quite bearish heading into the earnings, a strong rebound is also a possibility if Huang sounds upbeat.

In the meantime, nerves are calmer today, with US futures flat and European bourses slipping in and out of positive territory.

Fed hawks crowd out lone dove Waller

Aside from valuation concerns, economic worries have also been mounting, as the US labour market is showing cracks, but the Fed is keeping its focus firmly on inflation. A rate cut in December is looking increasingly unlikely following a string of hawkish remarks, mainly from regional Fed presidents, over the past week.

Governor Christopher Waller is the only one that has endorsed a December cut in recent days, but the odds for a 25-bps reduction received only a modest boost after his comments on Monday.

With inflation stuck around 3.0%, the Fed thinks its 50-bps of cumulative cuts in September and October are enough to support the labour market. The absence of key data is a factor in the Fed’s preference to pause in December before potentially easing again in January.

The US jobs data mess

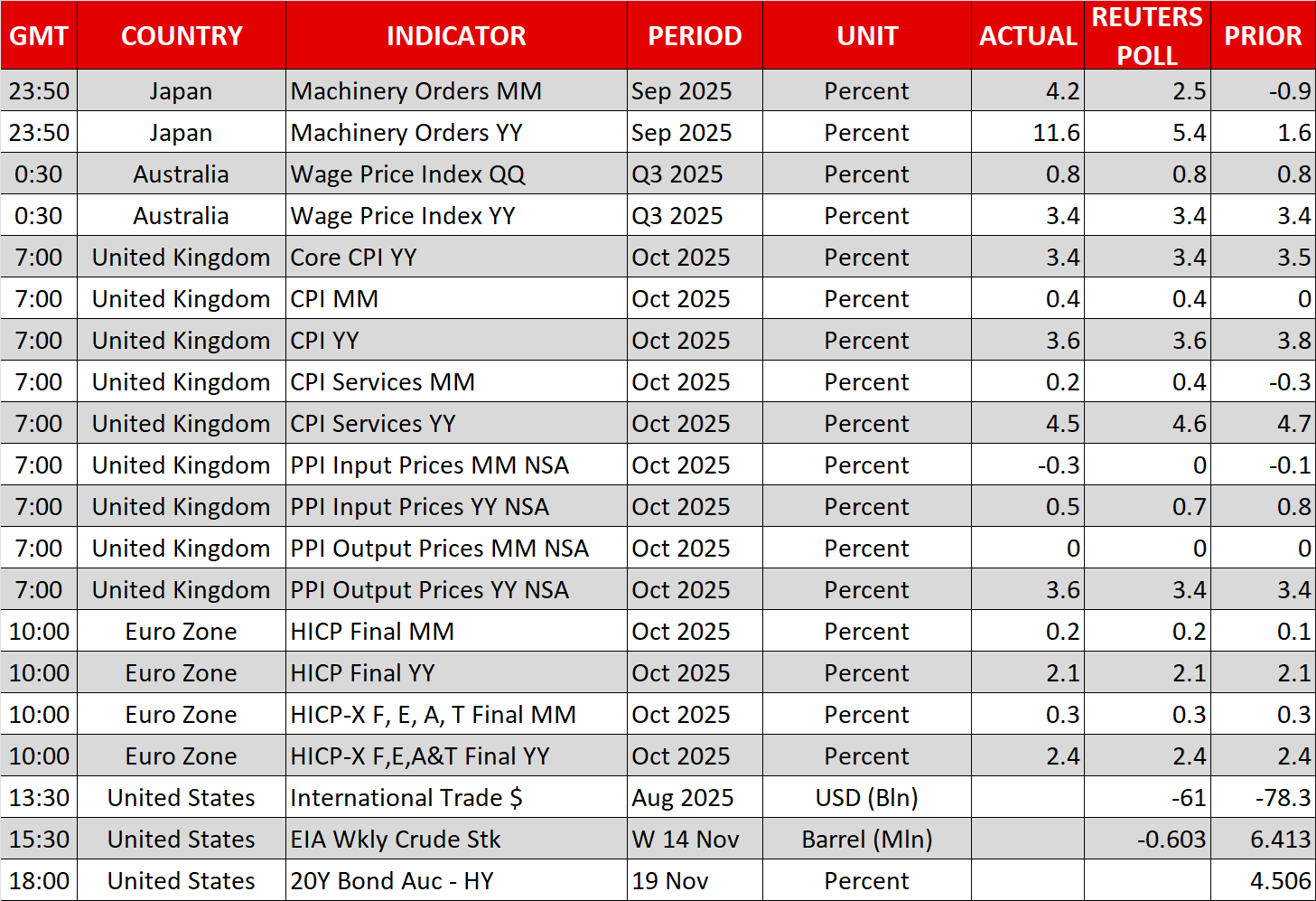

The delayed September payrolls report is due to be released on Thursday and the October report may follow soon after, albeit only half of it, as the unemployment rate for the period will almost certainly not be published.

However, the Fed will probably be more interested in the November numbers, which may not become available before its December policy meeting.

But this patience is being questioned by investors as ADP data shows the US economy shed an average of 2,500 jobs per week in the four weeks to November 1. The US Labor Department will resume its weekly publications of initial jobless claims on Thursday, but an accidental release of part of the missing data from during the government shutdown revealed continuing claims edged up to 1.957 million in the week ended October 18, which some see as another red flag.

Ahead of those crucial releases on Thursday, the minutes of the Fed’s October meeting due later today at 19:00 GMT will be watched for any additional clues as to policymakers’ thinking about December.

Dollar/yen mired in debt risks, approaches 156 level

The US dollar is trading at one-week highs against a basket of currencies, extending its gradual upward climb from last week’s lows. Receding rate-cut expectations haven’t provided the usual boost to the greenback, as aside from worries about a deteriorating jobs market, there are also lingering doubts about US debt sustainability.

The White House is floating the idea of $2,000 tariff rebate cheques for every low- and middle-income American, likely motivated by President Trump's plunge in opinion polls.

Debt concerns are also weighing on the yen, pushing up Japan’s 10-year government bond yield to the highest since 2008, as new prime minister Sanae Takaichi is pushing for a fiscal package that could reach 17 trillion yen. Combined with the Bank of Japan’s hesitance in hiking interest rates, the yen is fast approaching the 156 per dollar level, prompting stronger intervention language from Japan’s finance minister.

Pound softer after UK CPI falls as expected

Inflation in the UK slowed in October from 3.8% to 3.6% y/y, in line with forecasts, while underlying prices rose by 3.4%, moderating from September’s 3.5% pace. Most notably, services inflation cooled more than expected to 4.5%, heightening expectations that the Bank of England will lower rates in December.

The pound slipped against the dollar to around $1.3125 after the data, as investors now turn their attention to next week’s Autumn budget statement, which may yet sway minds at the BoE.

Gold attempts recovery, Bitcoin rebound falters

Gold prices were up about 1% on Wednesday, buoyed by the worsening rout in equity markets. Although the stock selloff is easing today, there’s probably some catchup involved as gold had been underperforming during this latest risk-off episode amid the scaling back of Fed rate cut bets.

A positive outcome from Nvidia’s earnings could hamper gold’s recovery but come to crypto’s rescue. Bitcoin is down again today after yesterday’s bounce back was unable to gain much traction. Bitcoin and other cryptos have been hammered by massive liquidations in the sector, much of which is tied to the slump on Wall Street.

.jpg)