The Dollar's new edge: from shield to sword

If the US dollar was previously a shield, it is now turning into a sword. Washington is using the greenback as a weapon in sanctions and tariffs. The White House is exerting pressure on the Fed to cut rates, while the US national debt continues to rise. Unsurprisingly, investors have stopped using the US dollar as a safe-haven asset, and its share in gold and foreign exchange reserves has fallen from 70% at the beginning of the 21st century to less than 60%.

Forty-five per cent of investors surveyed by Bank of America believe the US dollar is overvalued. This is less than the 50% recorded in October. 48% predict that the EURUSD will continue to trade in the 1.1–1.2 range in 2026. 30% expect the main currency pair to move into the 1.2–1.3 range.

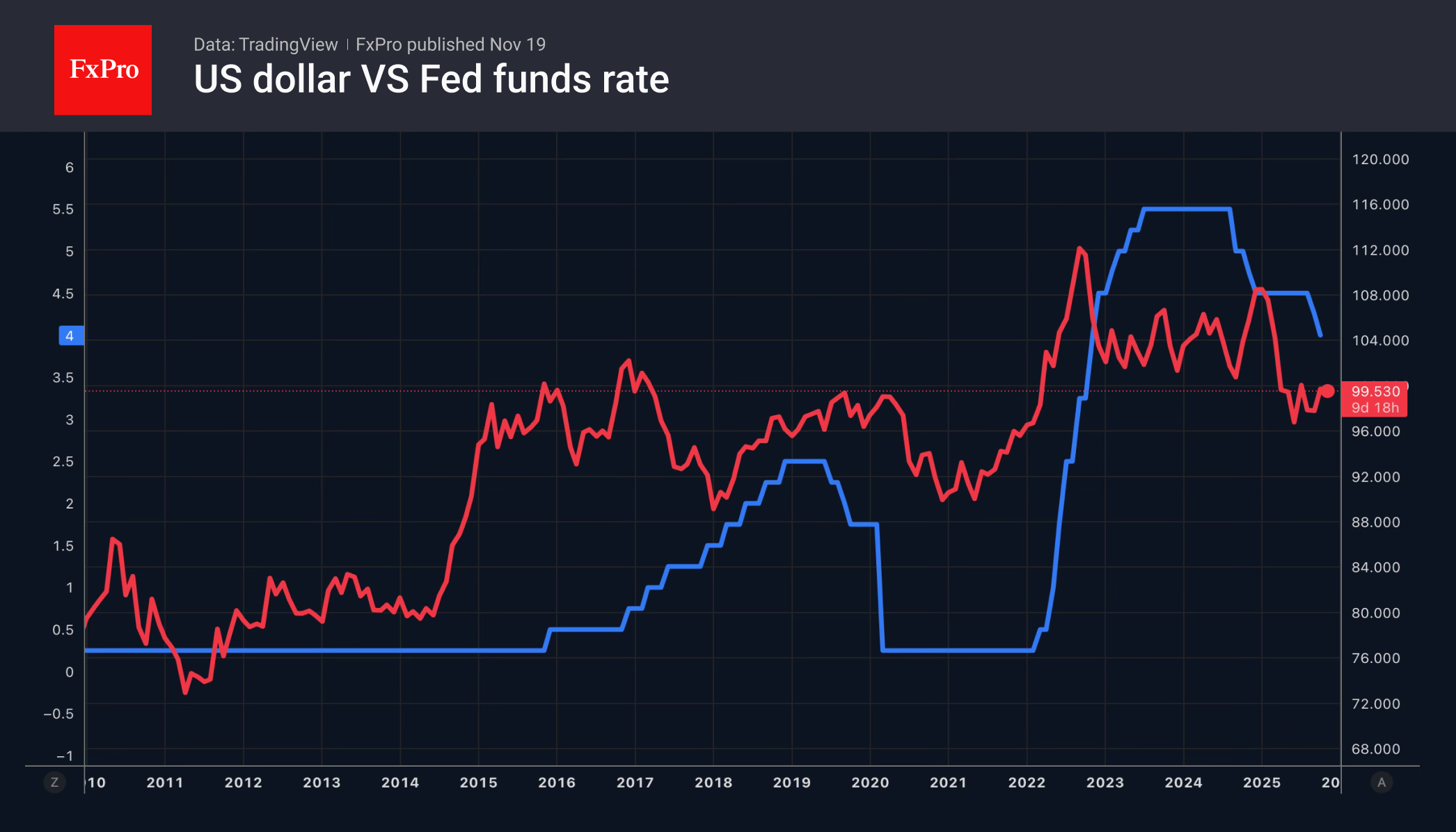

Despite the bleak long-term outlook, the greenback is showing its teeth here and now. The markets clearly overestimated the scale of monetary expansion and were punished for it. A month ago, derivatives indicated a probability of more than 90% for a federal funds rate cut in December.

Despite the bleak long-term outlook, the greenback is showing its teeth here and now. The markets clearly overestimated the scale of monetary expansion and were punished for it. A month ago, derivatives indicated a probability of more than 90% for a federal funds rate cut in December.

Currently, it is less than 50%. Investors believe that the lack of data will force the Fed to pause rate cuts, which plays into the hands of the dollar.

Traders fear that the minutes of the October FOMC meeting will reveal a victory for the hawks. The chances of continuing the cycle of monetary expansion at the end of 2025 will fall even further. Nevertheless, the decline in EURUSD ahead of the publication of an important document indicates that the US dollar is being bought on rumours. Will this be followed by selling on facts?

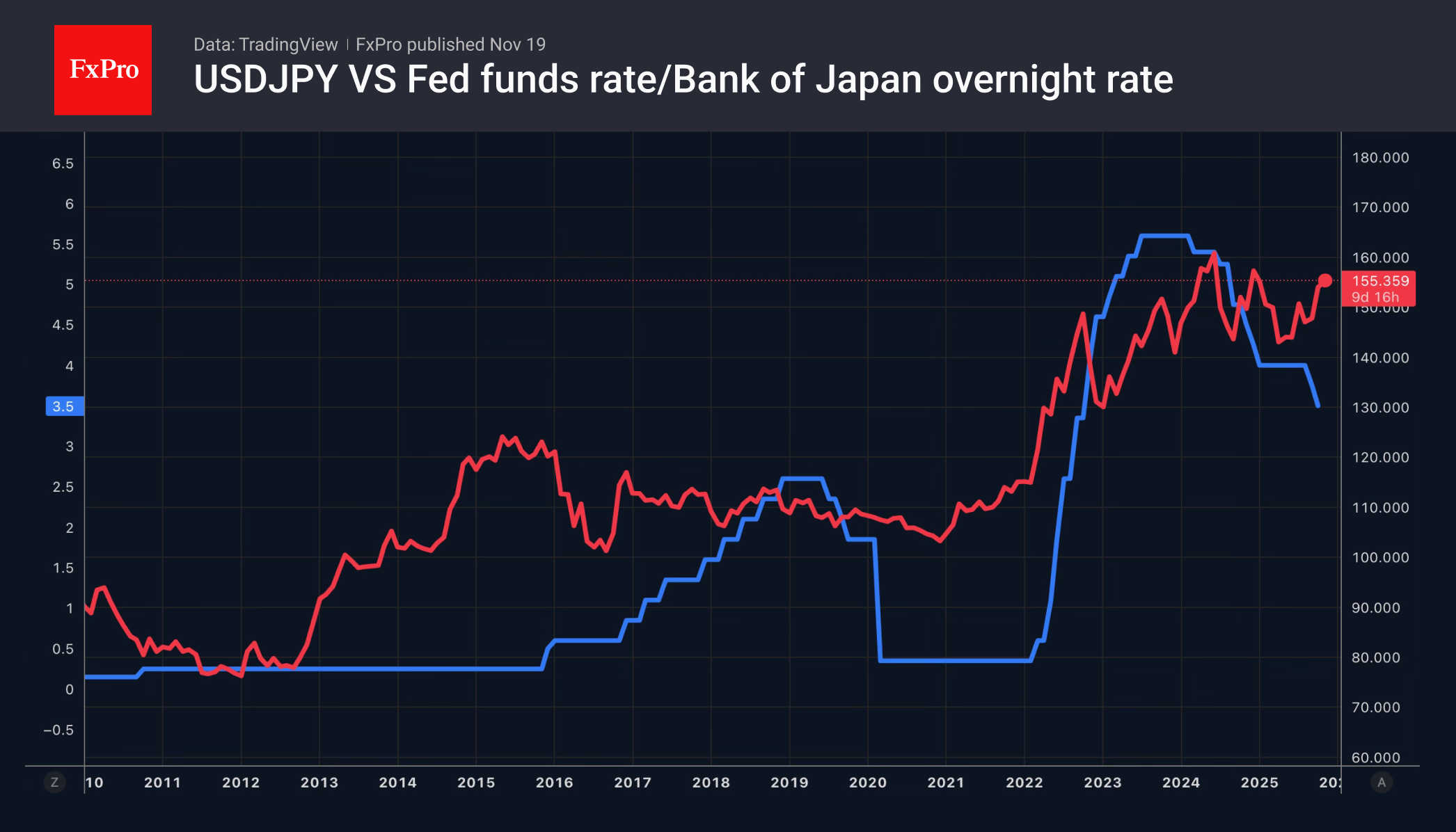

Another puzzle is the yen. The rapid rally of USDJPY against the backdrop of a cautious central bank and expectations of large-scale fiscal stimulus from Sanae Takaichi indicates its weakness. However, 30% of investors surveyed by Bank of America name the Japanese currency as their top favourite for 2026. It is followed by gold, which is preferred by 26%. The pound sterling is chosen by only 3%.

The fate of USDJPY will depend on divergence in monetary policy. After meeting with Prime Minister Kazuo Ueda, he said that the Bank of Japan would continue its normalisation cycle. However, Sanae Takaichi's economic advisers say that the BoJ is unlikely to raise the overnight rate before March.

The fate of USDJPY will depend on divergence in monetary policy. After meeting with Prime Minister Kazuo Ueda, he said that the Bank of Japan would continue its normalisation cycle. However, Sanae Takaichi's economic advisers say that the BoJ is unlikely to raise the overnight rate before March.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)