Daily Global Market Update

Pound Dollar's Dynamic Shift

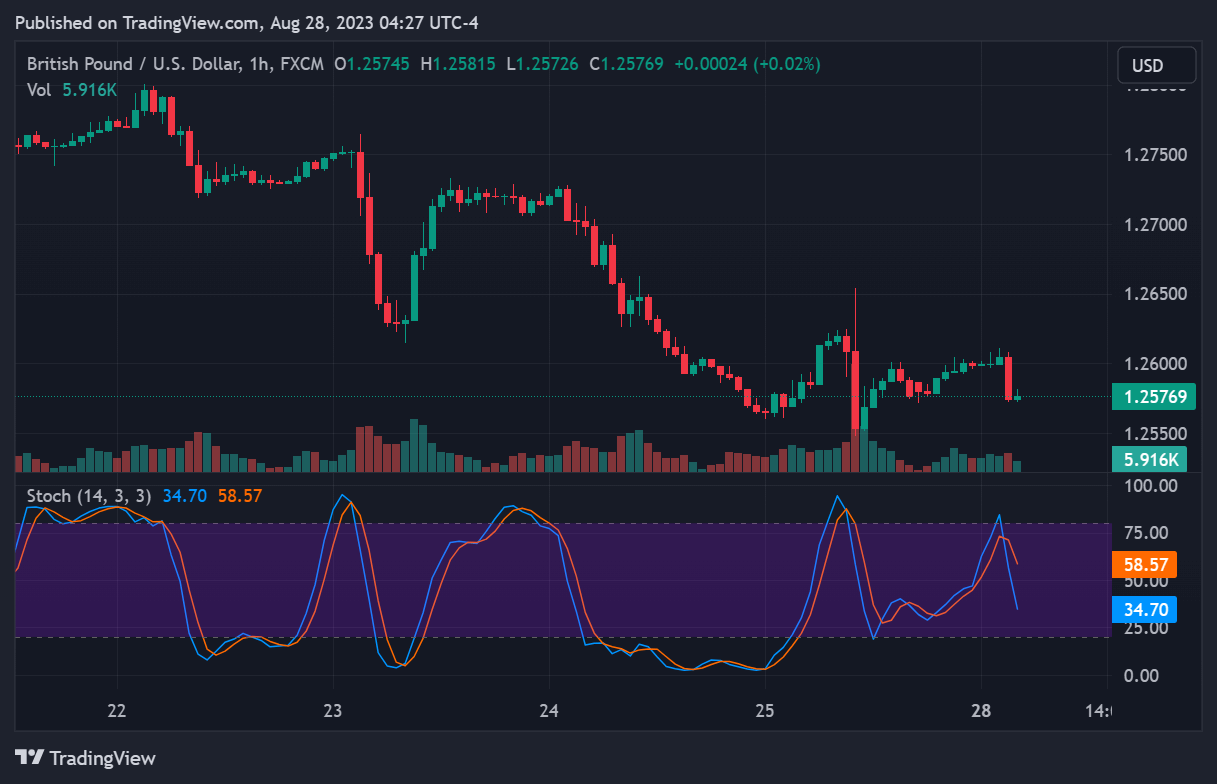

The pound dollar pair saw an explosion of 1.4% in the preceding trading session. The stochastic indicator is suggesting negative market conditions.

Gold's Subtle Movement

The gold dollar pairing experienced a slight dip of 0.1% in the last session. The Ultimate Oscillator suggests a bullish market condition.

Euro's Steady Stance

The euro dollar price showed no significant change in the last trading day. According to the Stochastic indicator, the market appears oversold.

Dollar-Yen's Static Trade

The dollar-yen pair traded without significant shifts in its last session. The Williams R indicator suggests an overbought market.

World Financial News

Japan's underlying inflation is slightly below the Bank of Japan's 2% target, as expressed by BOJ Governor Casio Ruida at a Federal Reserve research symposium. This viewpoint supports the ongoing monetary policy. Additionally, major tech players like Apple, Microsoft, Tesla, and Meta have lost an astounding $625 billion in market capitalisation this month, possibly due to seasonal trends. August historically records weaker performance for equities. The brisk pace of U.S. economic growth, amidst a slowdown in other key global regions, could present risks if it compels Federal Reserve officials to hike interest rates beyond current expectations.

Anticipated Economic Releases

Stay tuned for today’s major economic events:

• Australia's Retail Sales - 0130 GMT

• Japan's Co-incident Index - 0500 GMT

• Ireland's Retail Sales - 1000 GMT

• U.S Dallas Fed Manufacturing Business Index - 1430 GMT

• Japan's Unemployment Rate - 2330 GMT

• U.S Three-Month Bill Auction - 1530 GMT