Declining house prices in the US are currently bad news for the dollar

Declining house prices in the US are currently bad news for the dollar

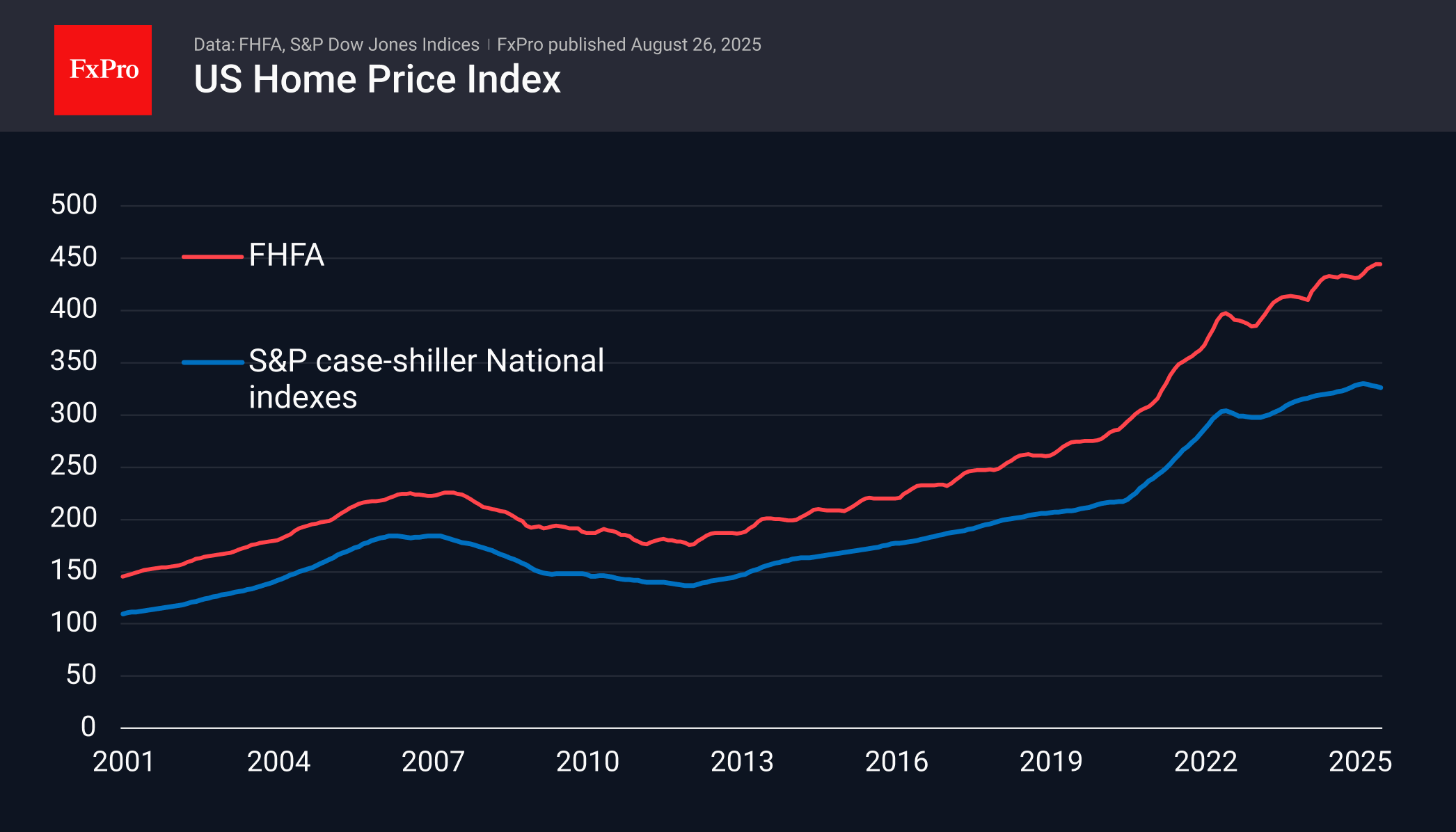

According to the FHFA assessment, real estate prices in the US have been falling for the last three months in a row. A separate report by S&P/Case-Shiller noted that the annual growth rate in 20 major metropolitan areas slowed to 2.1%, the lowest in two years. The last sustained decline in prices was in 2022, and before that, in 2007–2011. The latest episode was the result of a correction after a sharp rally during the pandemic, while the earlier decline was the painful aftermath of the mortgage crisis.

Other reports confirm the cooling of the housing market. Sales are at the lower end of the range of recent years, and prices have been falling in recent months.

Such housing market indicators are a new reason for the Fed to lower the key rate, given the high correlation between the housing market and consumer activity. In the past, not enough attention was paid to this, which was an important trigger for the mortgage crisis. In the current phase of the market cycle, such news is negative for the dollar. But it is worth keeping in mind that markets may switch to risk-off mode if a moderate “cure” does not help.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)