Dollar fails to recover as investors zoom in on trade talks

US-China negotiations continue

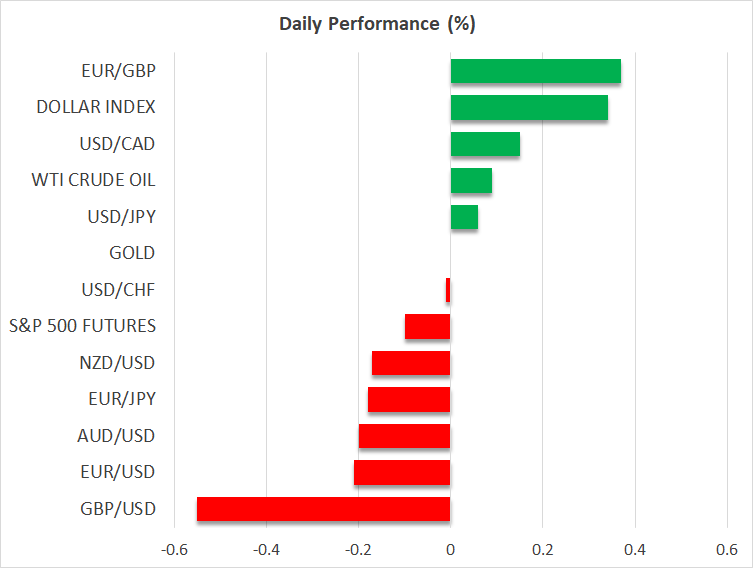

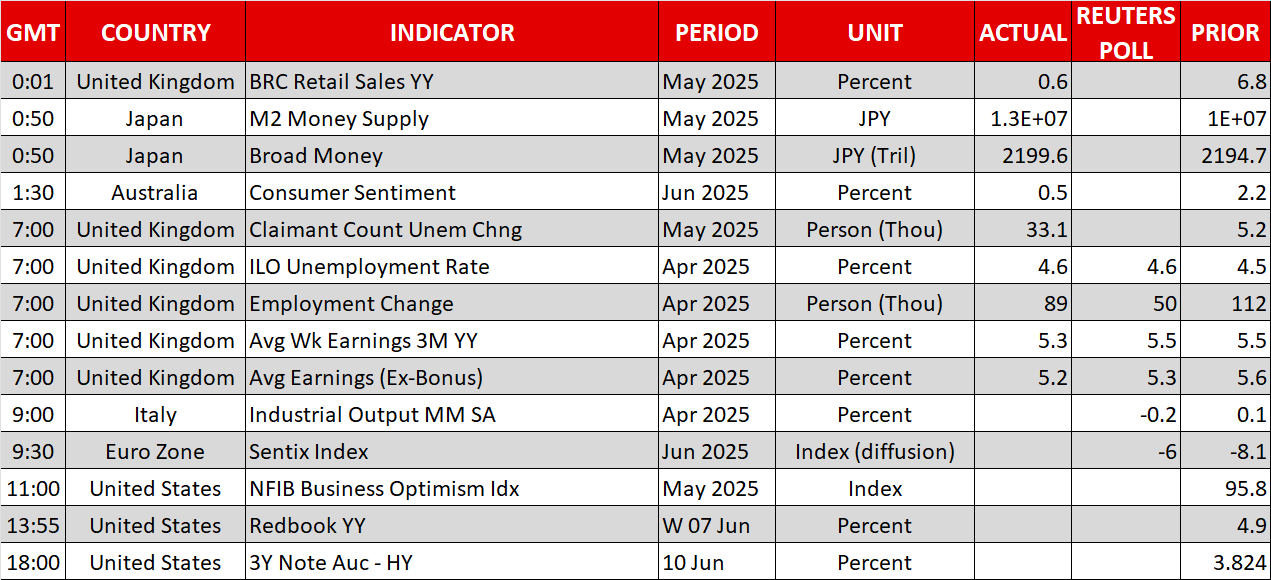

The US dollar is attempting to benefit from the risk-on newsflow, as the US-China negotiations continue in London. The first day of discussions was “fruitful”, according to US Commerce Secretary Lutnick, but this might not be the case on Day 2, as the sides delve into more sensitive issues such as technology and rare earth metals. The latter was one of the reasons that negotiations broke down in late May, prompting a high-level Trump-Xi call to restart the process.

Meanwhile, the US administration appears to be firing on all cylinders, as trade talks continue with both Canada and Japan. PM Carney's announcement that Canada will boost its defense spending to 2% of GDP this year – one of the strongest demands from President Trump – has hinted at an imminent US-Canada agreement.

Similarly, Japanese PM Ishiba is expected to have private talks with Trump at the G7 meeting to be held in Canada on June 15. With Japan's trade negotiator preparing to visit again the US, Ishiba and Trump could put the finishing touches on a trade deal that has been under negotiation for nearly two months.

Most US equity indices approach their all-time highs

Risk appetite is clearly dependent on the outcome of the latest round of negotiations between the US and its main trading partners, with US stocks having a mixed day on Monday. Having said that, the overall sentiment in stocks is positive, as both the S&P 500 and Nasdaq 100 indices have reached their highest levels since late February.

These indices have essentially erased the tariff-invoked correction and are currently hovering just 2% below their respective all-time high of 6,147 and 22,236. However, the same cannot be said for the more traditional Dow Jones Industrial Average index, which is still 5% below its all-time high and potentially signaling that the traditional economy is still struggling.

US data in focus

With Walmart’s CFO stating that consumer spending has been 'largely consistent', slightly easing concerns of a significant slowdown in consumer appetite, the market’s focus is gradually shifting to Wednesday’s US CPI report.

Following last Friday’s mixed labour market report that failed to send a clear message about the US economic outlook, the burden falls to inflation. Economists are forecasting a small acceleration in both the headline and core indices, potentially cementing the outcome of next week’s Fed meeting.

Notably, markets are pricing in 46bps of easing in 2025, almost matching the two 25bps rate cuts penciled in by FOMC members in the March dot plot. Similarly, key investment houses are removing rate cuts for their 2025 forecasts, gradually moving towards the market’s view.

Interestingly, the US Treasury is offering 3, 10 and 30-year bonds this week, with the latter most likely expected to test the market’s appetite for long-term bonds amidst the US budget bill negotiations in the Senate.

British pound falls on data; Silver in the spotlight

After the weak BRC retail sales figures on Monday, a rather soft labour market report - with the claimant count change climbing to the highest level since July 2024 - has resulted in a small pound selloff. Chances of a rate cut at next week’s meeting have not really changed, with investors focusing on the August 7 gathering instead.

More interestingly, silver is attracting attention after climbing around 11% in just six sessions, despite the fact that gold has failed to make significant gains in the same period. Silver is trading at $36.40 at the time of writing, with social media abuzz with bullish charts. From a technical perspective, the next couple of sessions are key for the longevity of the current bullish breakout.

.jpg)