Dollar slips as bets for third Fed cut rise ahead of jobs revision

Dollar remains on the backfoot

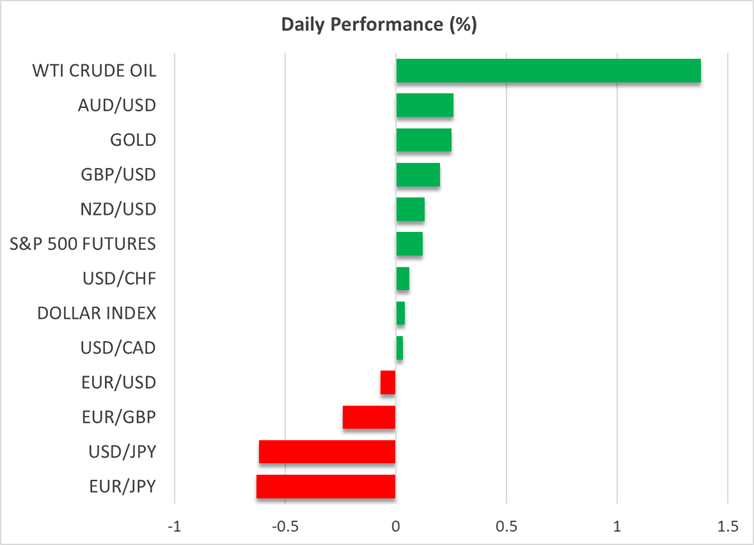

The US dollar is extending its slide on Tuesday, falling to near seven-month lows against a basket of currencies, as investors up their expectations of a more dovish Fed amid growing concerns about the health of the US labour market. Following Friday’s weaker-than-expected payrolls report, the focus will once again be on the jobs market today when the Bureau of Labor Statistics publishes its annual revision to its employment data.

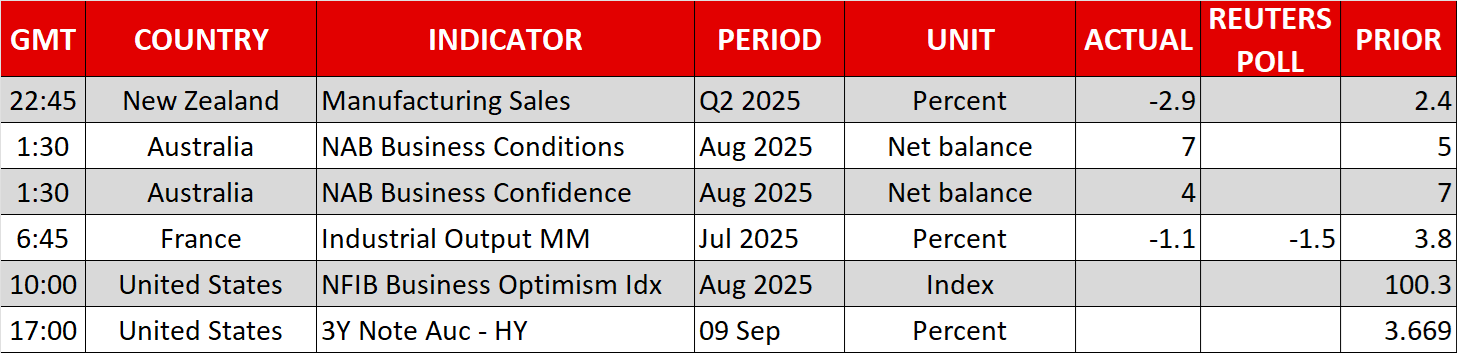

Although the revisions will cover the period from April 2024 to March 2025 and therefore will be somewhat outdated to have direct implications for next week’s FOMC gathering, policymakers will likely need all the help they can get when pencilling in their predictions in the new dot plot.

The recent reliability issues with the monthly payrolls numbers have raised the stakes for the Fed amid the risk of falling behind the curve. Analysts anticipate that there were 800,000 fewer jobs created in the 12 months to March than earlier estimated. The weaker the starting point for the labour market prior to the recent months’ slowdown, the more likely the Fed will deliver a dovish cut in September.

A much bigger-than-expected downward revision could even offset any upside surprises in this week’s PPI and CPI reports, due tomorrow and Thursday, respectively. Investors have already priced in about an 80% probability of a third cut this year and see a nearly 10% chance of a 50-bps cut next week.

Gold surges as bond yields plunge

The increasing bets of aggressive easing by the Fed couldn’t have come at a better time for the bond market, as yields have slumped, more than erasing the gains from the recent debt jitters. The US 10-year Treasury yield has fallen to its lowest since April to just above 4.0%, pressuring the dollar but lifting gold.

The precious metal has scaled new all-time highs for the third straight session today, reaching an intra-day record of $3,659. With barely 10 days into September, gold has already skyrocketed by about 5.7%, with silver enjoying a similar rally.

Whilst it is easy to attribute gold’s rally entirely to the Fed’s soon-to-be-resumed easing cycle, there are several risks underscoring the uptrend. Geopolitical tensions, the trade war and the threat to the Fed’s independence have been brewing for some time but now there are also the fresh political crises in France and Japan.

Euro shrugs off French turmoil

As expected, France’s prime minister, Francois Bayrou, lost the vote of confidence on Monday, with MPs forcing him to step down after failing to back him for his proposed budget cuts. President Macron has signalled he will appoint a new prime minister in the coming days, ruling out a snap election. However, it’s highly uncertain whether a different prime minister will be able to pass through much needed spending cuts to save the country from a potential debt crisis and fresh elections may be inevitable.

For now, however, the rally in US bonds is helping keep a lid on French yields. France’s 10-year yield jumped yesterday as the results of the vote came through but remains well below the highs recorded at the start of the month.

This is helping keep the euro steady, benefiting from the weaker dollar as it climbs above $1.1750. Expectations that the ECB will hold rates steady on Thursday are also supporting the euro.

Yen reverses higher on fiscal stimulus hopes after Ishiba quits

Political instability had also been plaguing the yen recently. However, following the decision by Prime Minister Ishiba on Sunday to resign and details emerging of the candidates that are likely to replace him, the markets’ focus is quickly shifting towards the possibility of fiscal stimulus. The ruling LDP party is moving fast in making preparations for a leadership contest. Reports suggest that a full-scale vote, where there’s a wider participation from party members, could be held as early as October 4.

The yen, which came under pressure yesterday, is rallying across the board today on the hope of looser fiscal policy, which would increase the likelihood of further rate hikes by the Bank of Japan. The dollar is currently down 0.6% to 146.55 yen.

Japanese stocks also surged earlier today but later fell back from record highs, with the Nikkei finishing the day 0.4% lower, while Wall Street futures are losing some steam too following Monday’s modest gains.

On the whole, the mood in equity markets remains positive but the upcoming inflation data clearly pose some risks.

.jpg)