EBC Daily Snapshot Jun 18, 2024

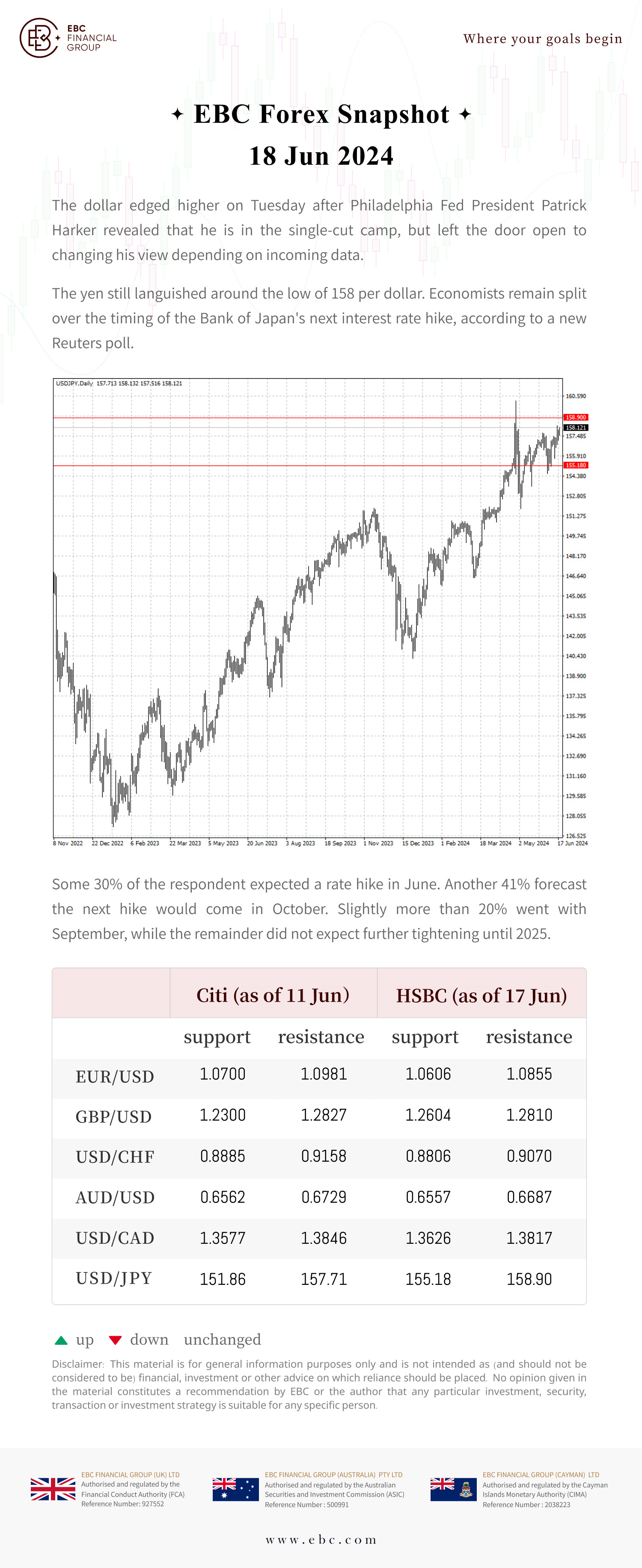

The dollar rose Tuesday as Philadelphia Fed President Harker predicted one rate cut this year but may adjust based on future data.

EBC Financial Group

|

505 dias atrás

EBC Financial Group

4.8

14 reviews

Tipo: STP, ECN

Regulamento: FCA (UK), ASIC (Australia), CIMA (Cayman Islands)

read more

Stocks plunge on AI valuation worries, gold and yen bounce back

Risk aversion mounts amid increasing doubts about AI valuations. Nasdaq leads the declines on Wall Street, Nikkei tumbles 2.5%. Gold and yen attract safe-haven bids but panic may already be easing.

XM Group

|

25 minutos atrás

ETHUSD Falls Below Key Support as Bearish Momentum Strengthens

ETHUSD remains under heavy selling pressure after slipping below key support near $3,100. Momentum indicators confirm a broad bearish bias, with lower-timeframe charts suggesting the next target could be $3,000.

Ultima Markets

|

28 minutos atrás

Forex goes to safe havens

• The shutdown may end soon.

• Increased volatility supports the dollar.

• The Bank of Japan recalls deflation.

• The pound is frightened by tax increases.

FxPro

|

43 minutos atrás

Forex goes to safe havens

• The shutdown may end soon.

• Increased volatility supports the dollar.

• The Bank of Japan recalls deflation.

• The pound is frightened by tax increases.

FxPro

|

43 minutos atrás

GBP/USD takes a hit on UK budget jitters

GBP/USD slides to 1.3000 on tax-hike fears. Bears break 2025 uptrend as technical signals point to oversold conditions.

XM Group

|

1 h 8 min atrás

If the 4-year cycles are still alive, BTC faces a pullback to $70K

Crypto market drops 2.4%, hitting $3.3T — its lowest since July, sliding into bear territory below 200-day average.

FxPro

|

1 h 27 min atrás

If the 4-year cycles are still alive, BTC faces a pullback to $70K

Crypto market drops 2.4%, hitting $3.3T — its lowest since July, sliding into bear territory below 200-day average.

FxPro

|

1 h 27 min atrás

Gold Holds at October Lows Amid Shifting Rate Expectations

On Wednesday, gold traded around 3,940 USD per troy ounce, stabilising near its lowest levels since early October. The precious metal remains under pressure from a recalibration of interest rate expectations, as markets adopt a more cautious outlook on further easing by the Federal Reserve.

RoboForex

|

2 h 8 min atrás