Fragile risk appetite might be tested by Fedspeak and US data

Equities feel the brunt, US government eyes further company stakes

With the US dollar enjoying one of its best trading days on Wednesday, risk assets remained under pressure yesterday. Specifically, the Dow Jones 30 index led the sell-off, reversing the slightly improved appetite seen during the European session. Similarly, bitcoin is now hovering at $111k, with altcoins suffering the most; Ether and Solana are posting 13% and 11% weekly declines respectively.

Most equity indices are also in the red this week, as investors might be feeling uncertain about the Fed rate outlook after Chair Powell’s commentary on Tuesday, and may start to question Trump’s shopping spree. Following the Nvidia and Intel agreements, there is strong speculation that the Trump administration is seeking a stake in one of the biggest US-based miners. Such a move would fit with reports that G7 countries are considering price floors and subsidies for rare earth production to reduce China’s dominance in this sector.

Fedspeak in the spotlight

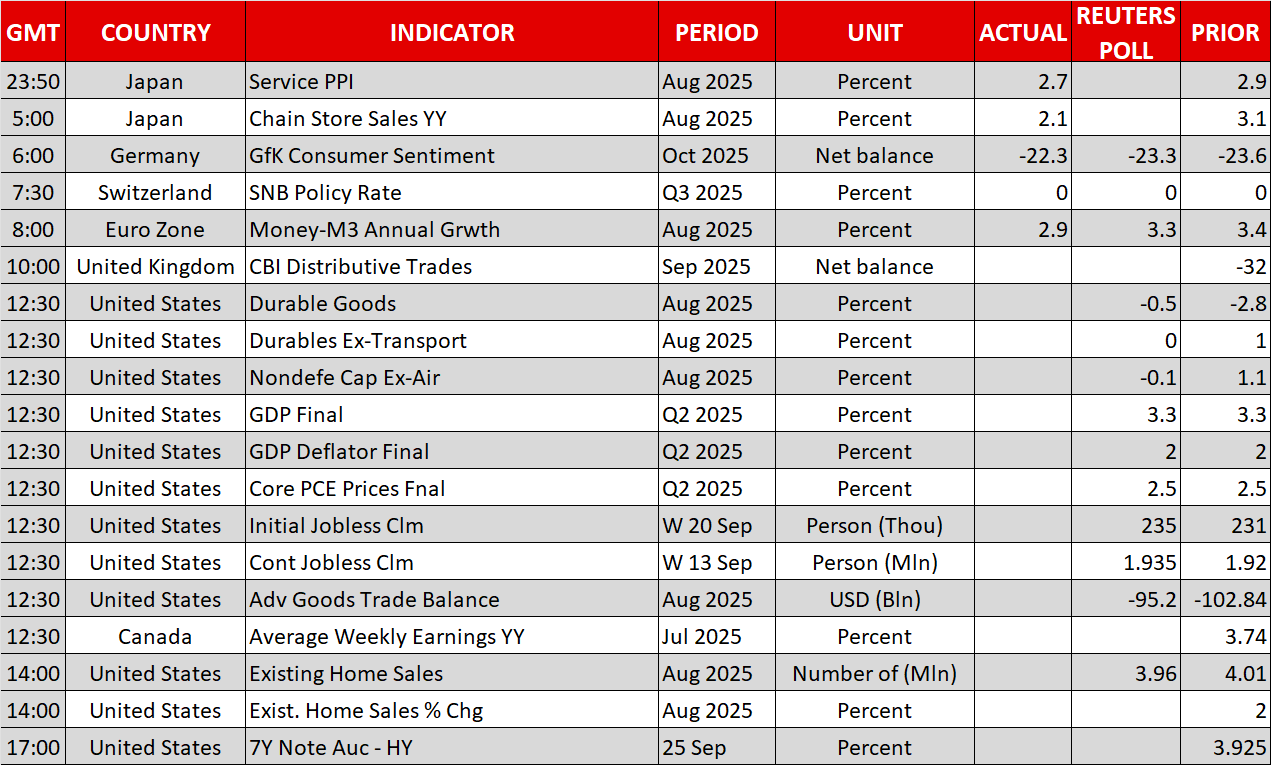

With San Francisco Fed President Daly hitting both hawkish and dovish notes in yesterday’s speech, and Treasury Secretary Bessent reiterating the US administration’s desire for much lower rates, the focus shifts to the very busy calendar of Fed speakers. Specifically, regional Fed Presidents Goolsbee, Williams, Schmid, Logan and Daly, as well as Fed board members Bowman and Barr will be on the wires today.

Goolsbee and Bowman are expected to sound dovish again, advocating for consecutive rate cuts. Barr and Daly are mostly centrist, while Schmid and Logan are considered to be in the hawkish camp. Interestingly, Williams tends to be more moderate with a dovish inclination, as the NY Fed is in charge of the day-to-day operations of the Federal Reserve System, including open market operations and repos.

With markets being sensitive to hawkish Fedspeak, investors will be monitoring the centrists and hawkish Fed speakers for any strong hints on whether they will support an October cut or share Chair Powell’s opinions. Remarks about the stock market are not anticipated today, since Powell’s “equity prices are fairly highly valued” comment was not really welcomed by most market participants.

Data also in focus ahead of Friday's PCE report

US data will also take the centre stage today. The final GDP print for the second quarter of 2025 will be released at 12:30 GMT, and, barring a major surprise, it is expected to confirm the 3.3% annualized growth. More importantly, durable goods orders and the weekly jobless claims might prove market-moving, particularly the latter if it remains in sub-235k territory, confirming that the jump seen in early September was a one-off.

A strong set of data today, despite questions about their quality, might raise doubts about an October cut. However, with markets currently assigning a 92% probability to such a move, it will take more than a few data points to reverse expectations. Luckily for the Fed hawks, next week’s release of the ISM surveys, the ADP employment report, and the nonfarm payrolls print could go a long way towards easing fears about a labour market slowdown.

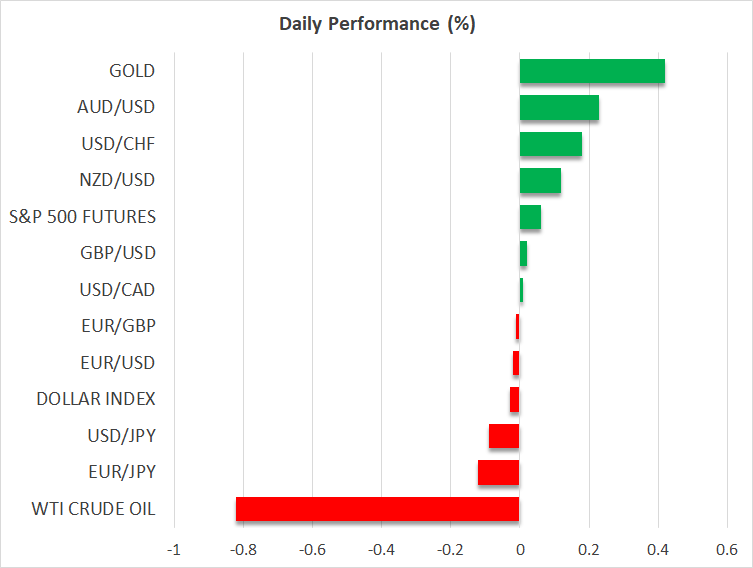

Gold stabilizes, oil rally pauses

Gold has retreated from its new all-time high, now hovering around the $3,750 area. There are reports that Trump is trying to end the Gaza war, but only time will tell if he will be successful since his track record is not exactly spotless. Additionally, trade negotiations continue to generate headlines, as, while the US-China talks linger and Trump is scheduled to sign the TikTok agreement today, South Korea is considering reneging on its $350bn investment promise following the deportation of 300 South Korean workers from a US-based plant.

On the flip side, oil appears rejuvenated after Trump’s remarks at the UN regarding Russia, and is now retesting the resistance set at the $65 zone. A bullish breakout towards the 200-day simple moving average at 67.30 could be on the cards.

.jpg)