The Fed's easing triggered the dollar's rise against the NZD, CAD and JPY

The Fed's easing triggered the dollar's rise against the NZD, CAD and JPY

The key rate cut and the Fed's forecasts for further policy easing failed to create momentum for the dollar's weakening. Moreover, the yen, as well as the New Zealand and Canadian dollars, are testing multi-month lows against the USD, while the pound, euro and Swiss franc are forming a reversal from their extremes.

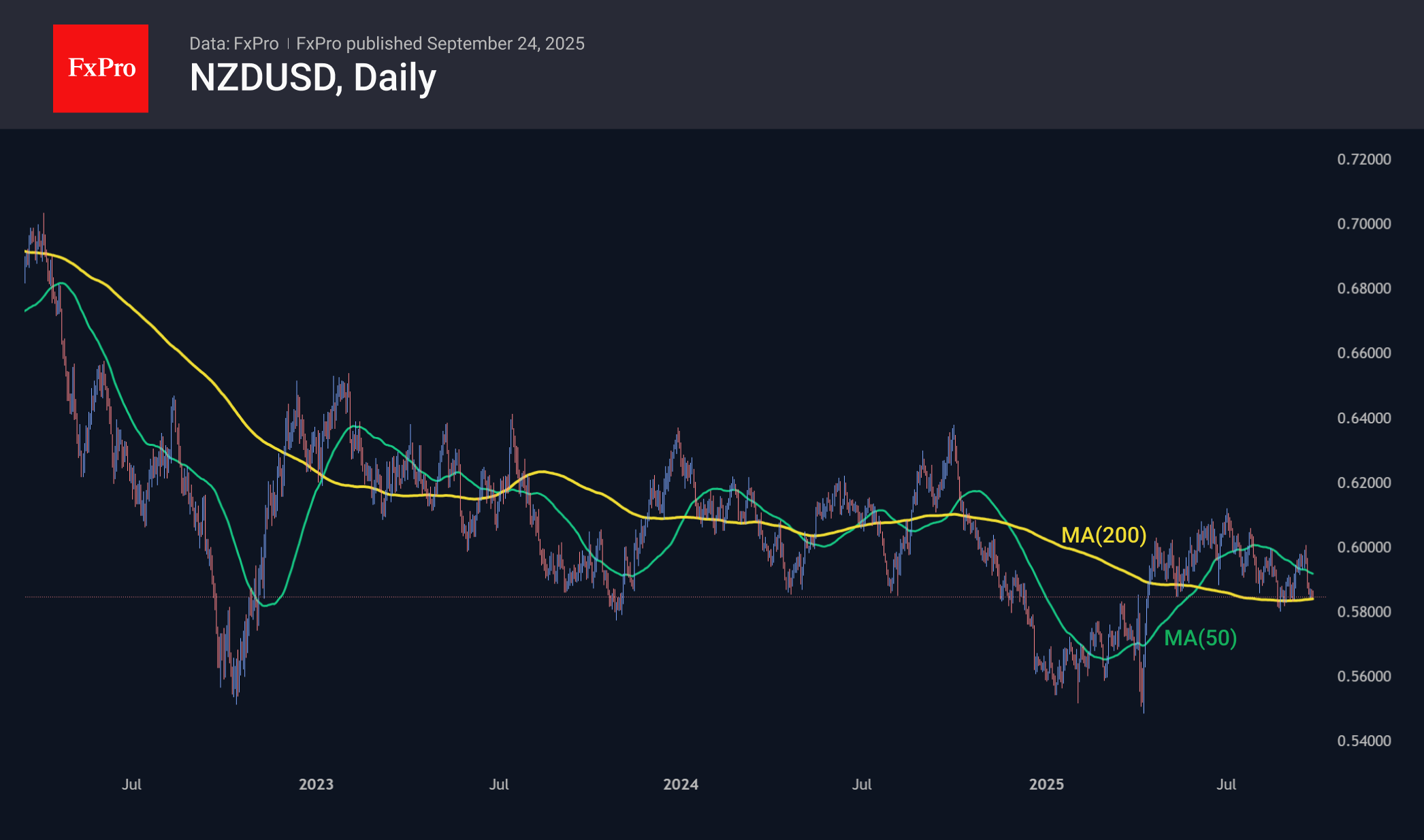

Since the end of last week, the New Zealand dollar has retreated to 0.5840, touching the 200-day moving average. Last month and in May, it managed to bounce off it. However, this month, the local peak of NZDUSD was set immediately after the Fed's decision. More sensitive to fluctuations in demand, the kiwi may play the role of a canary in a coal mine, losing 2.75% over the week on a positive shift in the monetary policy differential for the currency, which was confirmed by stock indices and precious metals updating their highs. Previously, NZDUSD often followed the general risk appetite. However, it became suspiciously under pressure in the middle of the summer, despite the improvement in global economic assessments, particularly in China. An important signal of victory for sellers will be consolidation below the 200-day moving average, which has been followed by declines of 3.5% to 20% in the last five instances. For greater reliability, one can also wait for a signal in the form of a fall below the area of recent lows at 0.5800.

Another commodity currency, the CAD, also hit its local high against the dollar on 17 September, losing more than 1% during that time. This relatively small movement pushed the USDCAD to a 4-month high. This is a surprising movement, given the rise in the price of gold and oil, which are key components of exports. Since July, USDCAD has been trending upwards, with the upper limit now at 1.40, where the 200-day moving average also passes. Breaking through this round level could open the way to the area of historical extremes at 1.45, where the pair briefly reaches during periods of abnormal market volatility.

USDJPY is also close to colliding with its 200-day average at 148.3, trading near the area of highs since July. In early September, we saw an attempt by the pair to develop a downtrend, but it was halted by the Bank of Japan's rather dovish stance and the strengthening of the dollar against the yen after the Fed meeting in the middle of last week. USDJPY remains in an uptrend, supported by the rising trendline from the April and early July lows. An attempt to break below it on 17 September was unsuccessful. A rise above 149 would be an important technical breakthrough, but widespread media and retail trader attention may only come after a rise above 150, repeating the 2024 climb with a potential peak at 158-160.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)