Is dollar growth over? Likely so

Is dollar growth over? Likely so

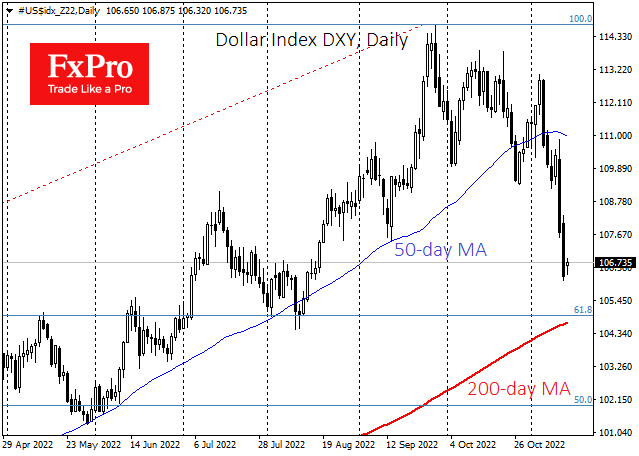

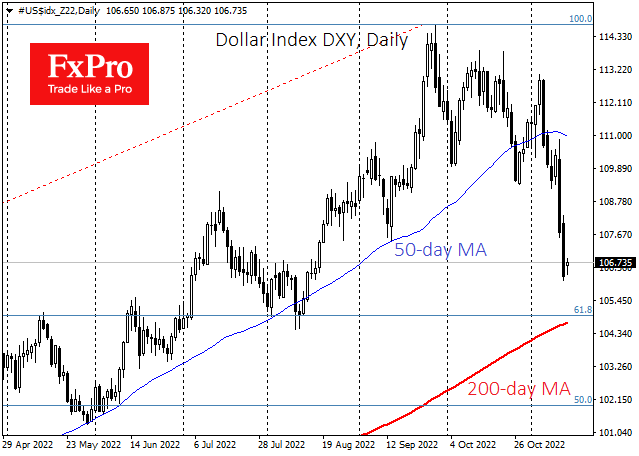

The dollar index lost 4% last week, the most significant drop since March 2020. Such powerful moves against the trend often signal a further trend reversal. However, it will probably be a slower pace of decline and not a one-way street as we see it over the previous ten days.

The pressure on the dollar has intensified over the past two weeks on speculation that the Fed will slow down the pace of policy tightening and that the maximum interest rate in this monetary cycle could be lower than previously feared. Signals from Fed members and slower-than-forecast inflation supported this view, triggering a wave of demand for risky assets.

At the same time, monetary regulators in other countries were in no hurry to soften their rhetoric, returning markets to a familiar situation where the Fed acts first and more aggressively than its peers in lowering and raising rates. But overall, it does not stand out for any rigidity.

The monetary watchdogs in the Eurozone have continued to signal in recent weeks that they are prepared to maintain the high speed of rate hikes, which fed their purchases in the Euro. That pressure could be fuelled by sales of dollar assets from the reserves of the SNB and the BoJ.

USDCHF and USDJPY returned under the emotionally significant levels of 1.0 and 150, attracting market-oriented and trend-following participants' interest.

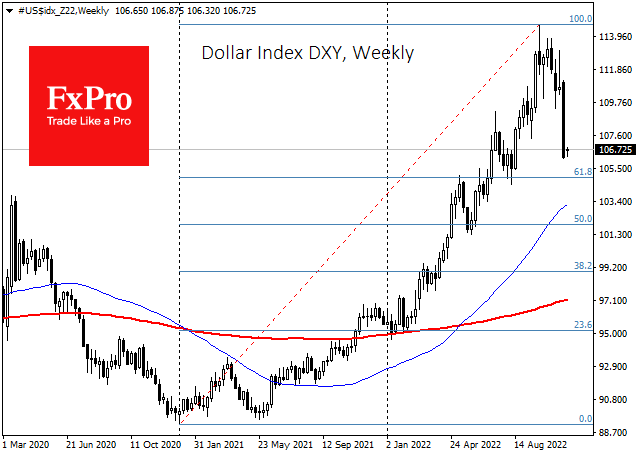

The nearest target for the Dollar Index correction is 105, actively operating as a resistance and support between May and August. This is also where the 61.8% Fibonacci retracement level of 2021-2022 comes in. A decisive failure below would confirm that we see the Dollar moving into a decline and not just a correction in a long-term uptrend. In this scenario, the Dollar Index heads into the 90-100 area, where it has been comfortable since 2015, with a potential pullback to the upper bound of this range in the first quarter of 2023.

History has other examples. In late 2008, two weeks of a significant sell-off in the dollar were followed by three months of gains, and the DXY rewrote local highs, finally reversing only in March 2009. However, it is essential to remember that in both March 2020 and March 2009, the EUR reversal was sustained when supported by the equity market surge we also witnessed last week.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)