New Zealand Dollar Near Two-Year Low: USD and China are ‘to Blame’

By RoboForex Analytical Department

The NZD/USD pair has fallen to 0.5590 as of Friday, marking a two-year low driven by a strong US dollar and concerns over China’s economic performance. The decline in the New Zealand dollar comes ahead of the release of the US jobs report for December, a critical data point that will shape market expectations for the Federal Reserve’s monetary policy trajectory. Investors largely anticipate that the Fed will maintain its cautious stance on rate adjustments, lending strength to the USD while pressuring other currencies.

US factors weighing on NZD/USD

The Federal Reserve’s December meeting minutes highlighted ongoing concerns about inflation. The minutes revealed the Fed’s reluctance to implement aggressive monetary policy easing considering persistent inflation risks. Adding to this cautious approach are fears that US President-elect Donald Trump’s proposed tariff policies could soon exacerbate inflationary pressures. As a result, the Fed is unlikely to ease monetary conditions quickly or extensively, providing robust support for the US dollar.

China’s economic challenges impacting the NZD

Weak inflation data from China, New Zealand’s largest trading partner, adds to the NZD’s troubles. The subdued inflation figures point to waning domestic demand in China, a worrying signal for global trade-dependent economies like New Zealand. Weak Chinese demand for goods and commodities directly threatens New Zealand’s exports, further pressuring the NZD/USD pair.

New Zealand’s domestic struggles

Domestically, New Zealand is grappling with a deep recession driving expectations of further monetary easing. The Reserve Bank of New Zealand (RBNZ) will meet in February, and the baseline scenario points to another 50-basis-point rate cut, reducing the official cash rate from the current 4.25% to 3.75%. By the end of 2025, the rate could decline to around 3.00% as the RBNZ seeks to support the struggling economy with more affordable credit.

To sum up, rising recessionary pressures, weak domestic demand, and limited external demand from China paint a challenging picture for the New Zealand dollar.

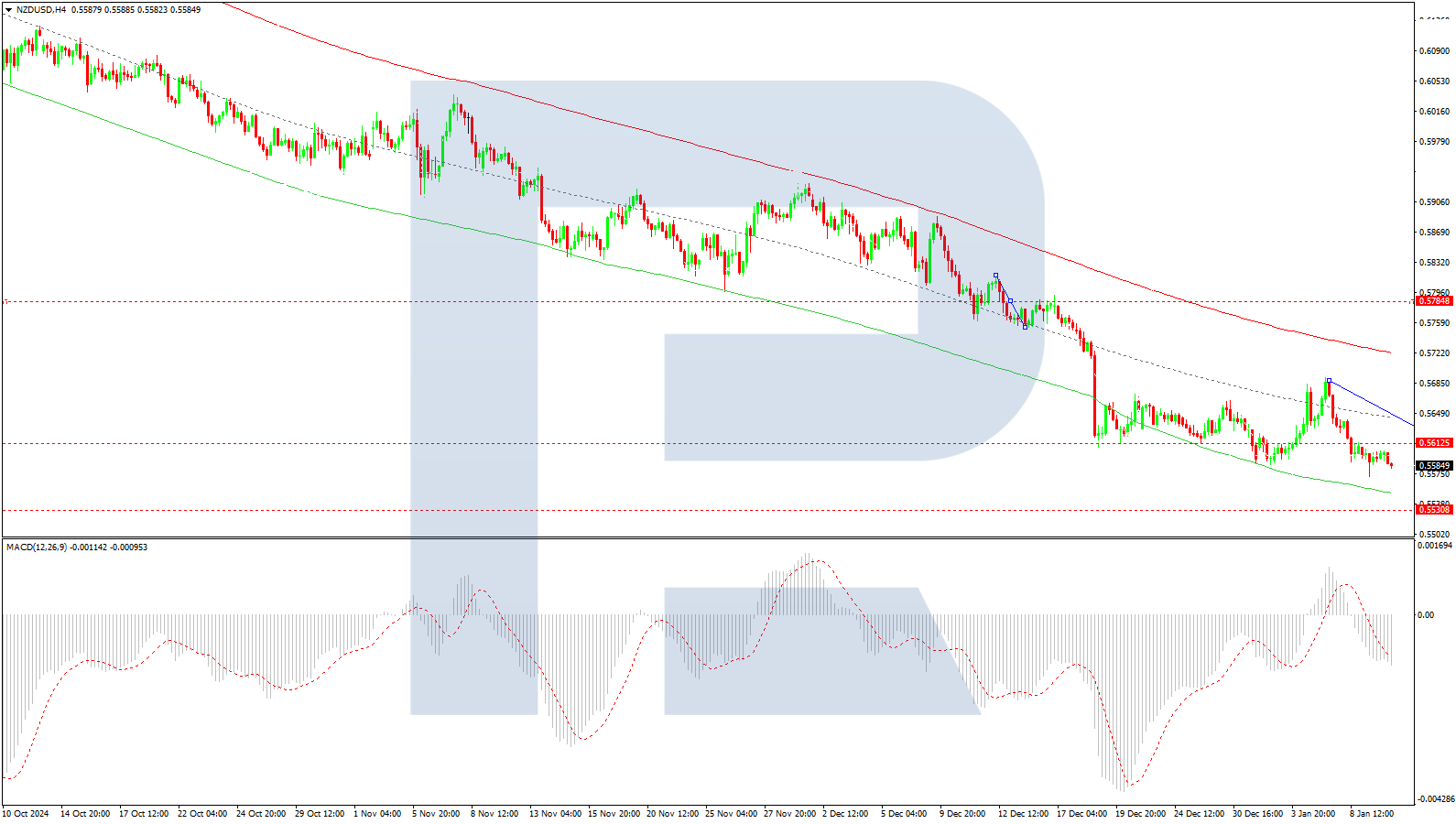

Technical analysis of NZD/USD

On the H4 chart, the NZD/USD continues its downward trajectory after breaking below the critical level of 0.5785. The market has formed a consolidation range around 0.5612, likely to resolve with a bearish breakout. The next target lies at 0.5530, where a brief correction to retest the 0.5612 level (from below) is possible. A sustained break below 0.5530 could pave the way for an extended decline towards 0.5200, the primary target for the ongoing downtrend.

This scenario is supported by the MACD indicator, with its signal line positioned below the zero mark and pointing downward, indicating strong bearish momentum.

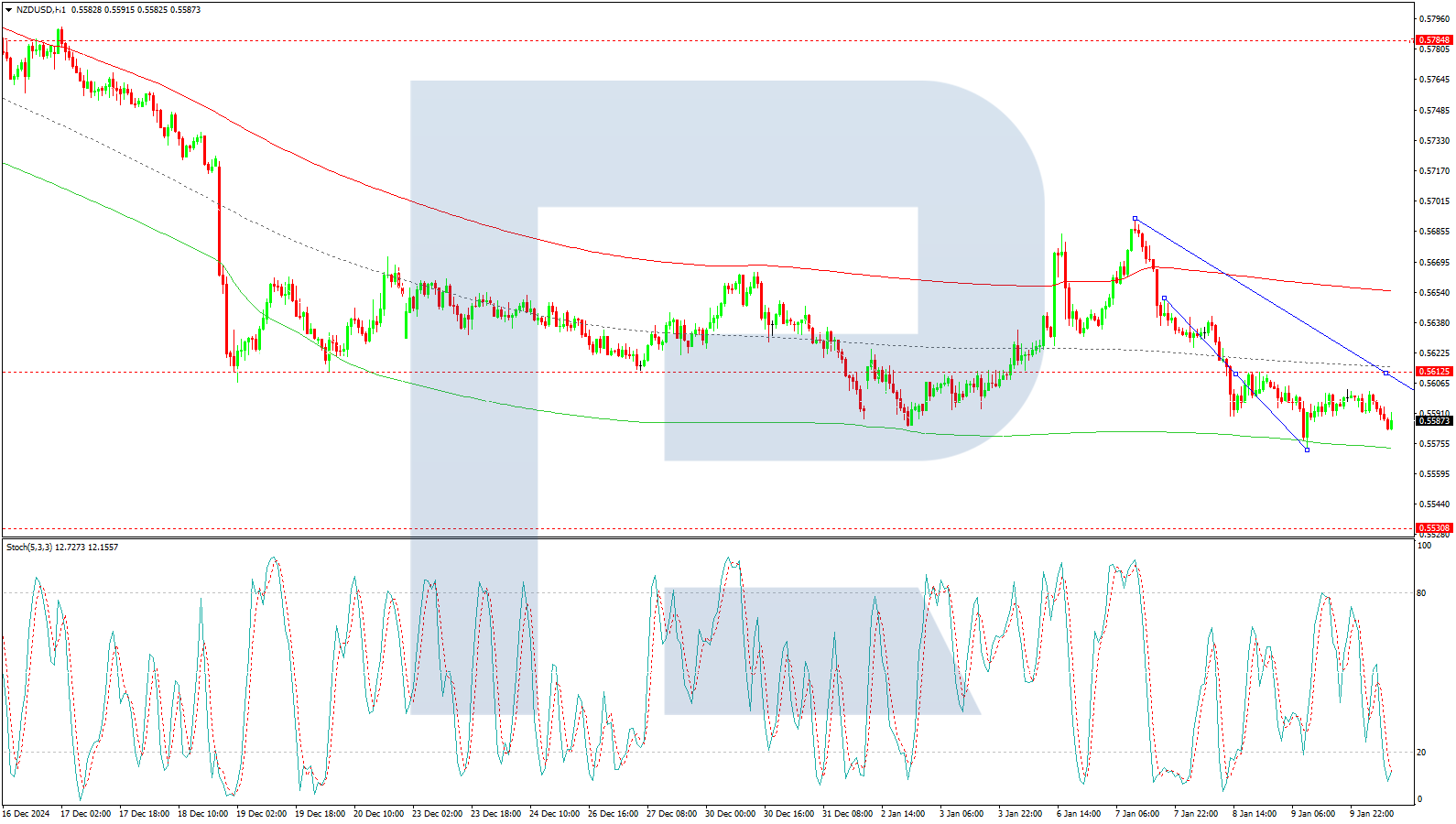

On the H1 chart, the market shows a consolidation range around 0.5612, signalling indecision. However, a downward breakout is expected, paving the way for a continued drop to 0.5530. Following this, a corrective wave back to 0.5612 is possible before the pair resumes its descent toward 0.5200.

The Stochastic oscillator supports this outlook, with its signal line hovering near the 20 level. This reflects intense downside pressure and validates the continuation of the bearish trend.

Broader outlook

The outlook for NZD/USD remains bearish, driven by both domestic and global factors. The Fed’s cautious approach, coupled with a robust US dollar and weak Chinese demand, presents formidable challenges for the NZD. Domestically, New Zealand’s recessionary pressures and anticipated rate cuts by the RBNZ are likely to keep the currency under sustained pressure.

Unless there is a significant reversal in China’s economic conditions or a shift in the Federal Reserve’s policy stance, the NZD/USD pair is expected to remain downward, with 0.5200 emerging as a key level to watch.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.