New Zealand's labour market – a new reason to pause the RBNZ's rate cuts

New Zealand's labour market – a new reason to pause the RBNZ's rate cuts

The New Zealand dollar was able to swim against the tide on Wednesday, strengthening against the dollar more than its other competitors on positive labour market statistics. NZDUSD has gained 0.6% since the start of the day to 0.5930, hitting a weekly high.

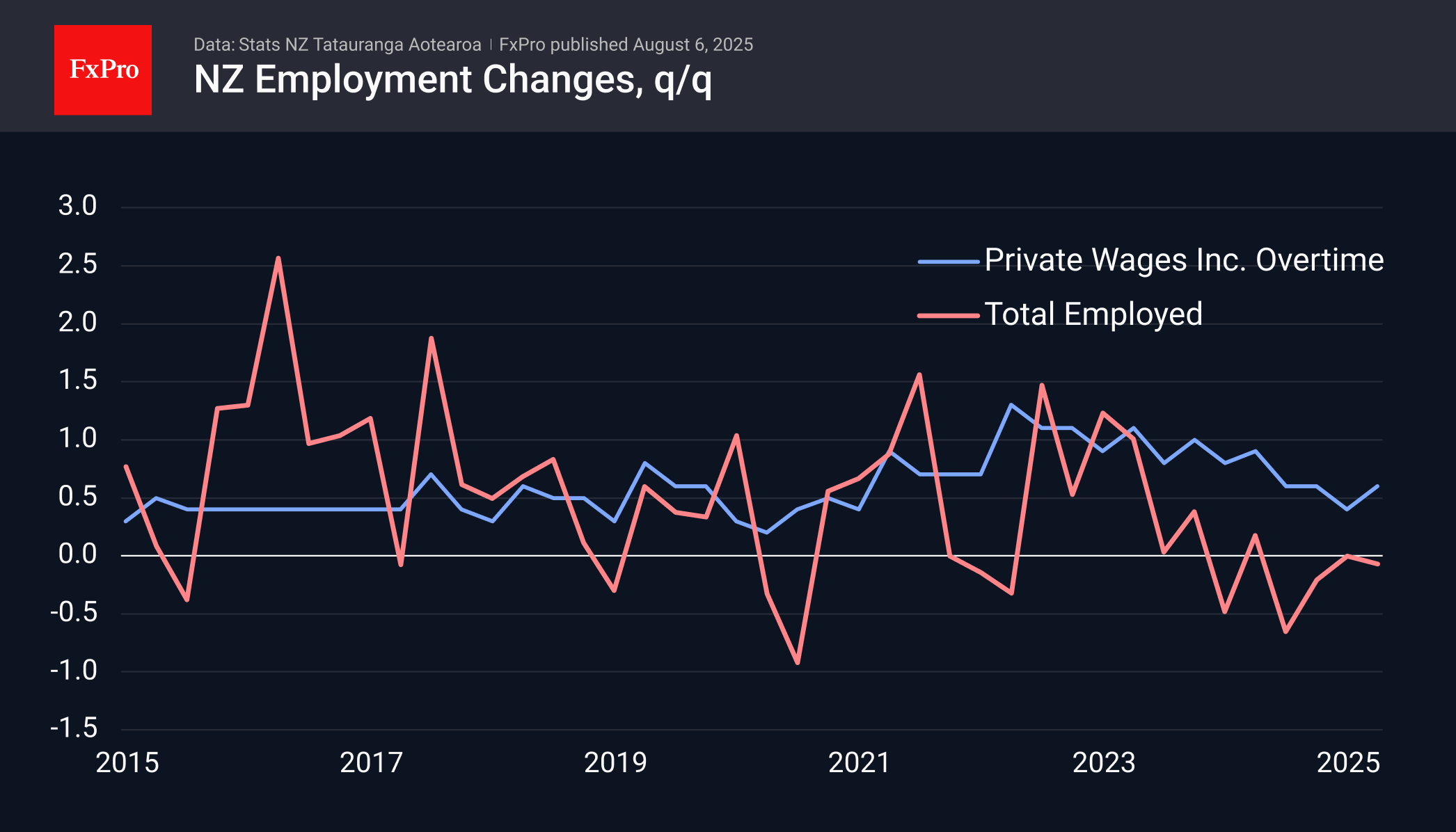

In the second quarter, the number of people employed fell by 0.9% compared to the same period a year earlier, but this data was in line with average forecasts. At the same time, the unemployment rate was better than expected, rising from 5.1% to 5.2%, while 5.3% was expected. Salaries rose 0.6% for the quarter and were 2.2% higher than a year earlier — quite healthy figures above forecasts.

There is hope that the labour market is seeing a reversal in wage growth compared to the 0.4% increase in the first three months of the year. This looks like the first signs of the economy's response to the cycle of policy easing that began a year ago. During this time, the RBNZ cut its key rate by two percentage points to 3.25%.

Labour market indicators complement inflation statistics, which show an acceleration from 2.2% at the end of last year to 2.7% year-on-year at the end of the second quarter. Such an acceleration could be a strong argument in favour of at least pausing the rate cuts at the next meeting on August 20.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)