NZD/USD hovers near its 2023 lows

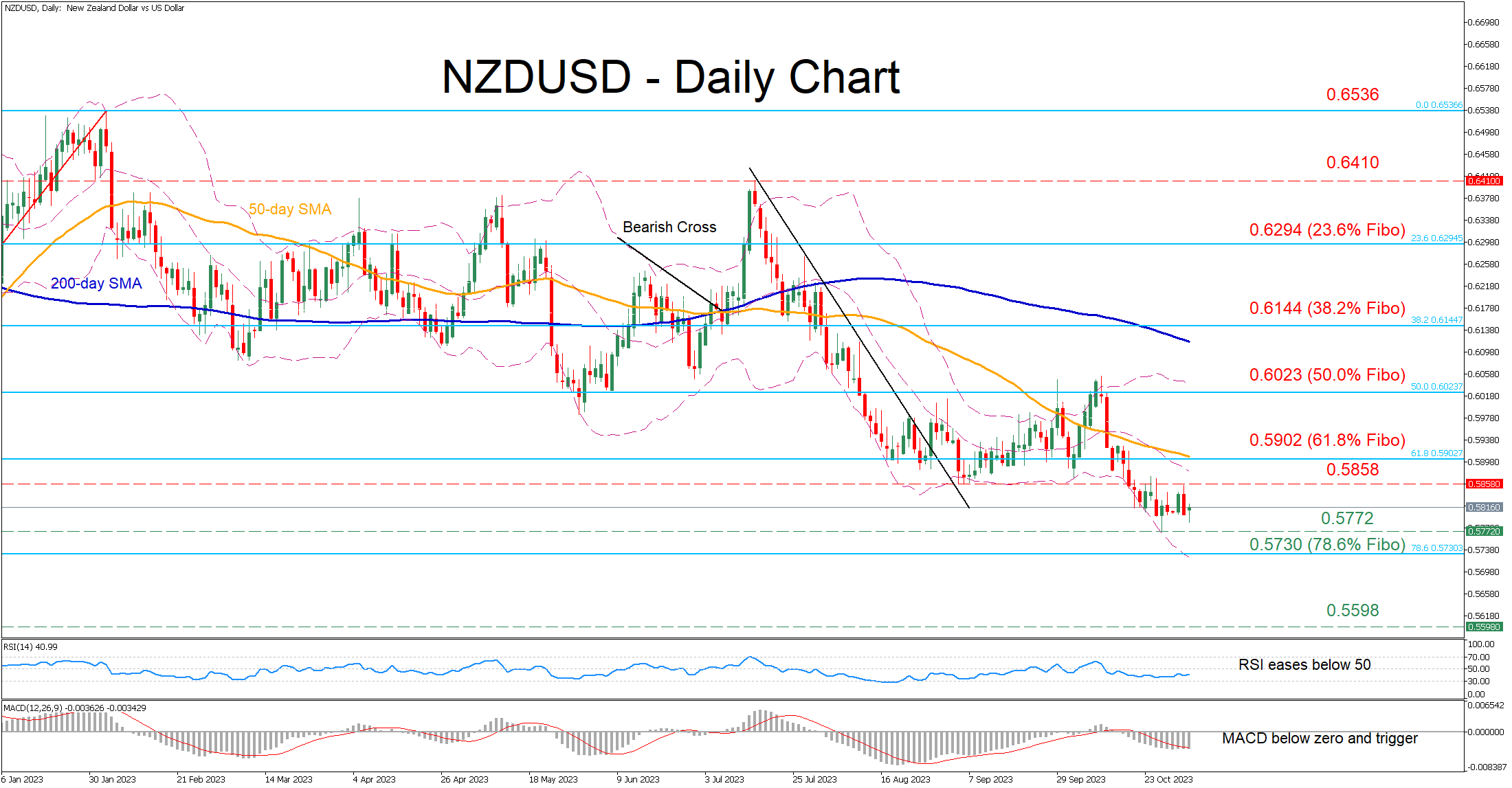

NZDUSD has begun another round of weakness following the steep retreat from its October highs just a tad above the 50.0% Fibonacci retracement of the 0.5510-0.6535 upleg. Although the pair managed to find its feet at a fresh one-year low of 0.5772, the short-term oscillators are reflecting persistent downside risks.

Should the selling interest intensify further, initial support could be met at the 2023 low of 0.5772. Sliding beneath that floor, the pair may descend towards the 78.6% Fibo of 0.5730. A violation of that region could open the door for the September 2022 support of 0.5598. On the flipside, if the bulls regain control, the price might challenge the September low of 0.5858, which also acted as resistance lately. Piercing through that wall, the pair could advance towards the 61.8% Fibo of 0.5902 before the 50.0% Fibo of 0.6023 appears on the radar. Even higher, the 38.2% Fibo of 0.6144 might curb further upside attempts.

On the flipside, if the bulls regain control, the price might challenge the September low of 0.5858, which also acted as resistance lately. Piercing through that wall, the pair could advance towards the 61.8% Fibo of 0.5902 before the 50.0% Fibo of 0.6023 appears on the radar. Even higher, the 38.2% Fibo of 0.6144 might curb further upside attempts.

Overall, despite pausing its steep downtrend, NZDUSD has been stuck in a sideways pattern, appearing unable to stage a recovery. Hence, traders should not rule out a fresh lower low as near-term risks remain skewed to the downside.

.jpg)