Soft inflation has pressed the Pound, but hardly the BoE

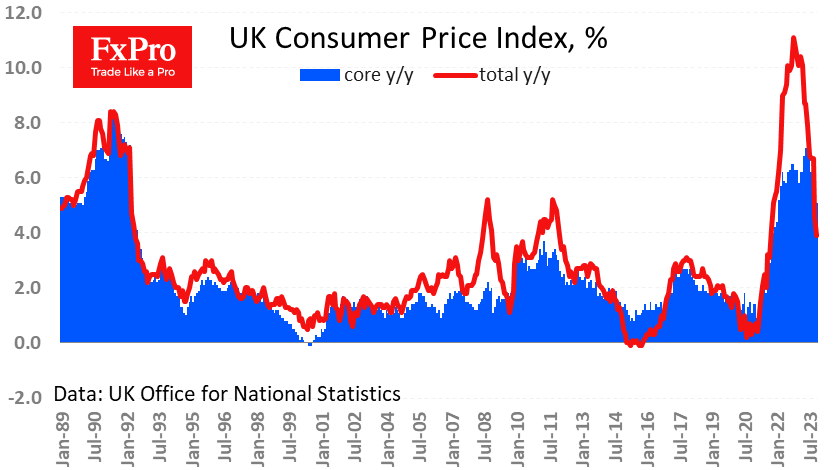

Britain's impressive slowdown in inflation has increased speculation around a rate cut next year. The headline consumer price index lost 0.2% in November, and the annual rate slowed from 4.6% to 3.9% - impressively below the expected 4.3%. Inflation excluding food and energy slowed from 5.7% to 5.1%, versus an expected 5.6%. This is the slowest rate of growth since September 2021 in the former and since January 2022 in the latter.

The latest data has convinced us that the UK has climbed out of the territory of the highest rate of price growth since the early 1990s. Current rates were also seen in 2008 and 2011.

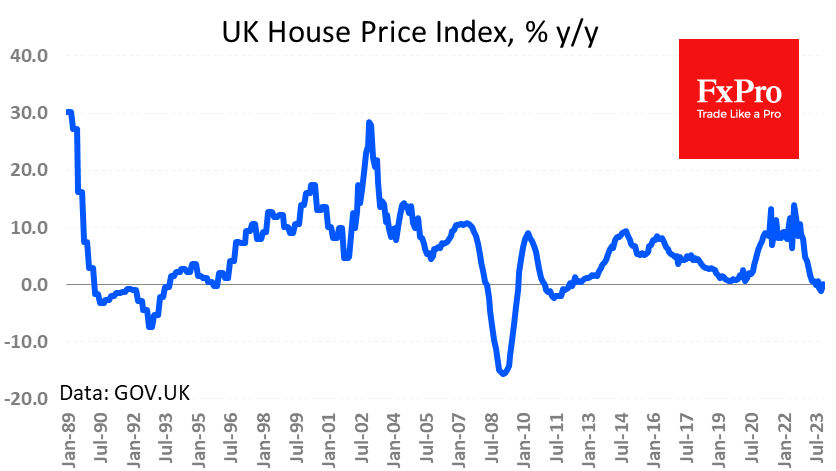

A separate report published a little later noted a 1.2% y/y fall in house prices in October, although the average forecast was for a 0.0% fall. The current decline is the deepest since 2011.

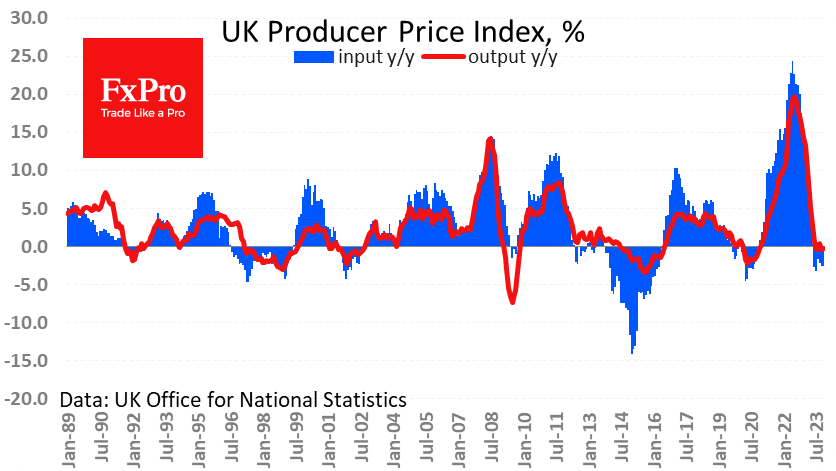

Producer prices maintained their pace of contraction, as Inpit PPI lost 2.6% y/y while Output was down 0.2%. The negative pace has persisted here for half a year, lowering the degree of concern around rising final prices. However, PPIs fell less than expected, suggesting a slightly stickier inflation. At the same time, retailers and manufacturers may further pass on costs to end consumers due to 7.2% y/y wage increases, keeping fears of a classic wage-price spiral alive.

The Pound reacted with a 0.75% drop on the inflation reports, temporarily back to $1.2630 - the area of this week's lows. At the same time, it's worth bearing in mind that the Bank of England displayed a hawkish attitude last week in spite of the Fed's dovish reversal. It seems that the UK Central Bank is in no hurry to change its rhetoric just because of the pace of wages.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)