Surprise from Flash PMI in the eurozone allowed the euro to continue its fight

Surprise from Flash PMI in the eurozone allowed the euro to continue its fight

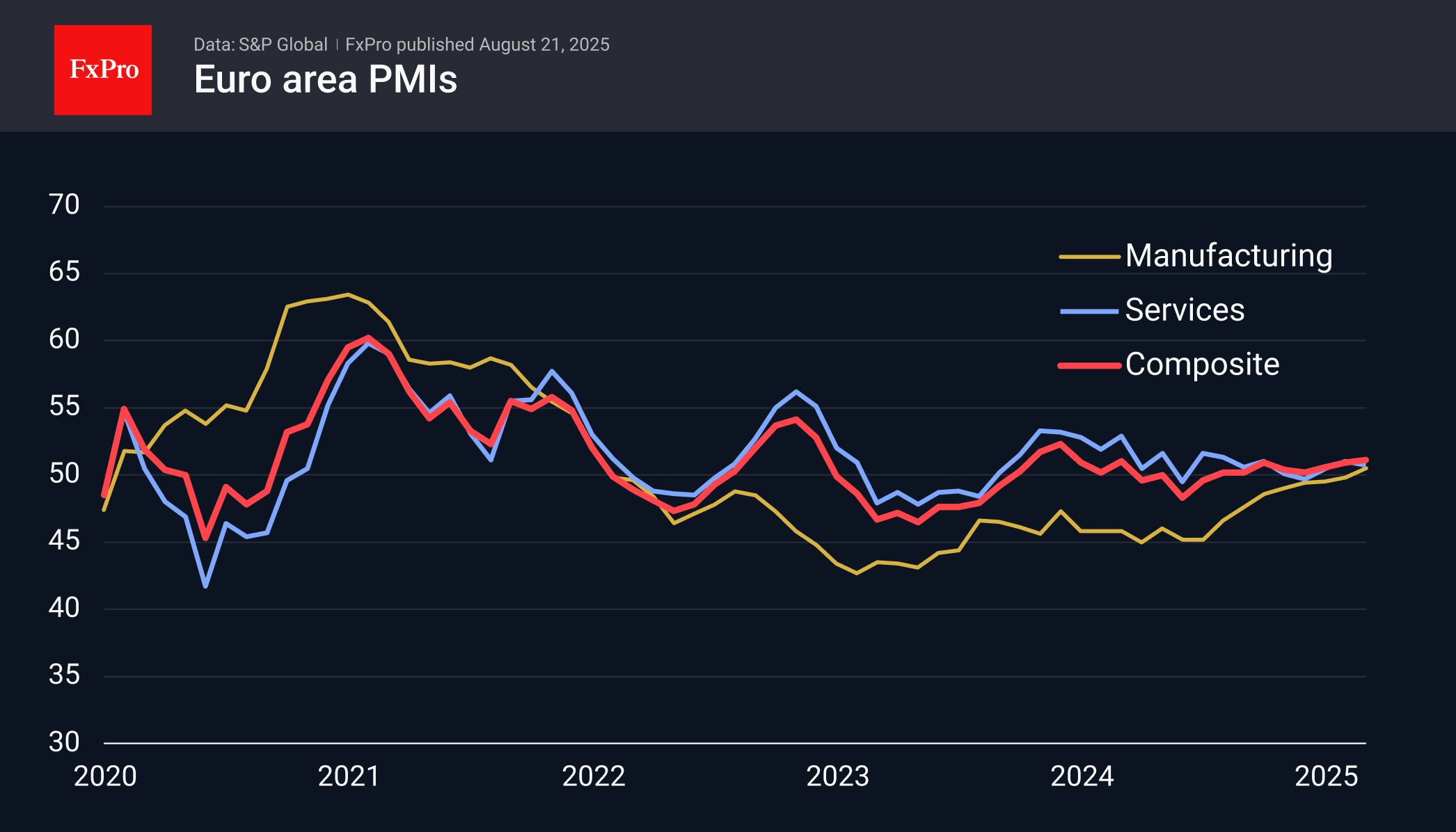

According to preliminary PMI estimates, the Eurozone industry moved from contraction to growth in August for the first time in more than two years.

The manufacturing PMI climbed to 50.5, its first return to growth territory since June 2022 and up from 48.8 the previous month. The data contradicted the expected decline to 49.6, indicating a more stable state of the economy.

The services activity index fell from 51.0 to 50.7. This level is also the average value for the indicator over the past year, hovering around it all this time. Improvements in industry have been the main contributor to the positive dynamics of the composite PMI in recent months. However, these data are somewhat at odds with foreign trade statistics and industrial production and order data in Germany.

Among individual countries, France's 31-month high in manufacturing PMI and Germany's 38-month high deserve attention.

Historically, PMI indicators have been a good leading indicator for financial markets, so it is not surprising that the EURUSD rose by 0.3% as publications for individual eurozone countries were released after two attempts to push the price down to intraday lows near 1.1625 on Wednesday and Thursday.

The data release supported the EURUSD recovery above the 50-day moving average, around which bulls and bears have been tugging since early August. The currency market is fully focused on signals from Powell on Friday, ignoring other data. EURUSD will likely spend most of this anticipation near 1.1650.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)