UK wages post stronger than expected growth

OVERNIGHT

Asian equity markets are mostly lower this morning reflecting uncertainty about the global interest rate environment. In China, GDP recorded a stronger than expected rebound in Q1 as Covid restrictions were eased. However, March data showed uneven growth with retail sales surprising on the upside but industrial output weaker than expected. The minutes of the Australian central bank meeting showed that policymakers considered another 25-basis point interest rate hike before agreeing on a pause.

THE DAY AHEAD

Just released UK labour market data posted a much stronger-than-expected rise in employment growth of 169k in the three months to February. Meanwhile, annual regular pay growth was 6.6% over the same period and the previous figure was revised up to the same level. The unemployment rate rose modestly to 3.8% from 3.7% previously but overall, the report seems unlikely to lessen Bank of England policymakers’ concerns about domestic inflationary pressures.

The German ZEW measure will be one of the first indications of April economic activity in the Eurozone, although as a survey of financial analysts’ expectations it is less reliable than the PMI data due Friday. March saw a dip in the expectations component for the first time in six months, and the current situation reading for the first time in five, possibly due to concerns about banks. However, given that there have been no further signs of problems in that sector both indices are forecast to have picked up again this month.

The housing market is one of the areas of the US economy that has been most hurt by higher interest rates. However, February saw housing starts jump to their highest level since last September. So, today’s data for March will be watched for signs whether that was just a short-term fluctuation reflecting milder than usual weather at the start of the year or a sign of a more fundamental improvement.

Early Wednesday, March UK price data are expected to show a sharp decline in annual inflation. That is primarily due to energy prices with last year’s sharp rises, as the Russian-Ukrainian conflict escalated, contrasting with this year’s declines. Their impact will be partly offset by higher food prices but overall, we expect a substantial fall in CPI inflation to 9.9% from 10.4% in February. We also expect a moderation in ‘core’ inflation to 6% from 6.2% primarily because of lower goods price inflation. In contrast, service sector inflation is forecast to remain sticky.

MARKETS

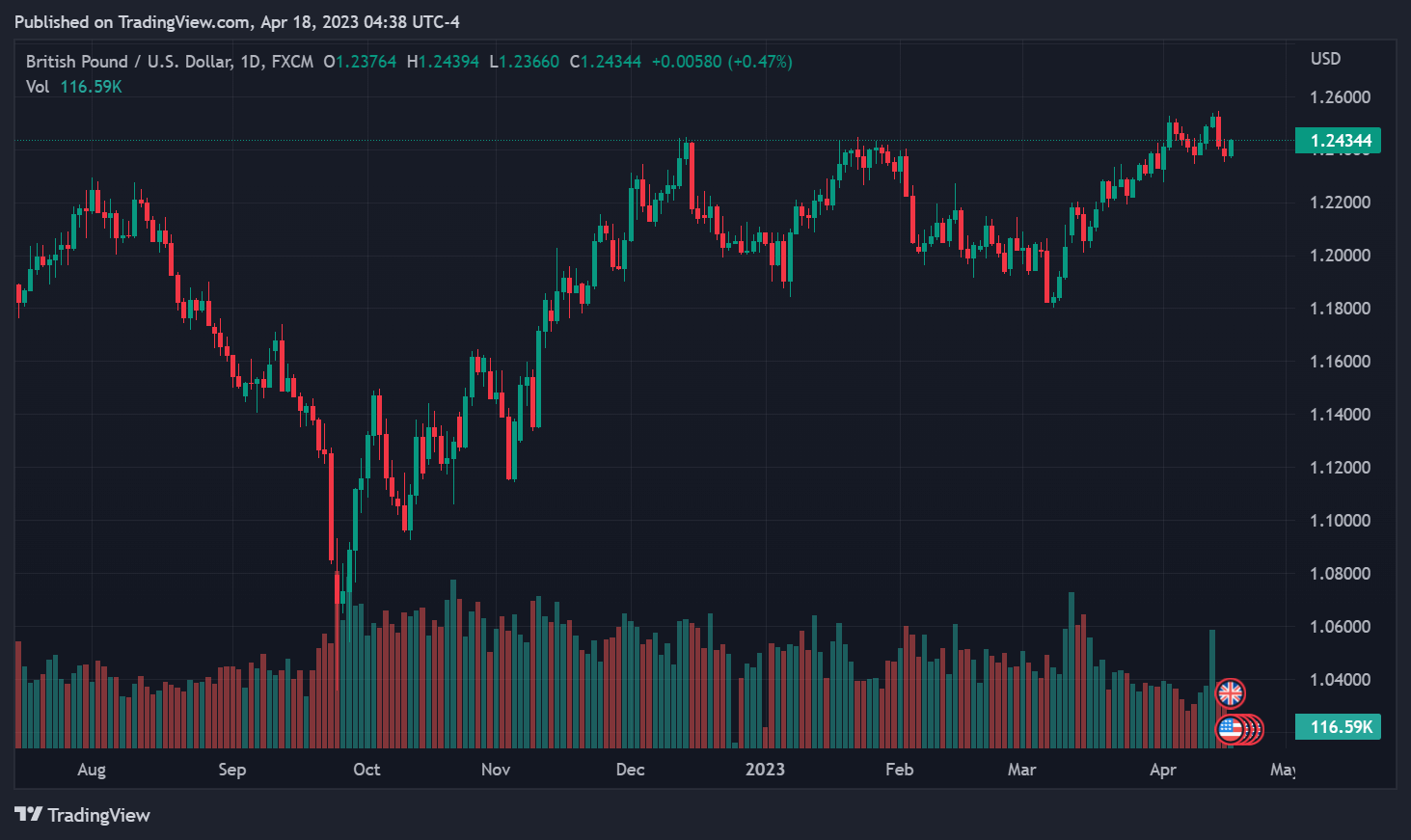

US Treasury yields rose yesterday after stronger than expected economic data and hawkish comments from a Federal Reserve official. UK gilt yields posted a more modest rise. In currency markets, the US dollar rose yesterday against both the euro reflecting the turnaround in US interest rate expectations. But ster ling has been given a lift this morning by the labour market report.

ling has been given a lift this morning by the labour market report.