USDJPY turns up but remains constrained

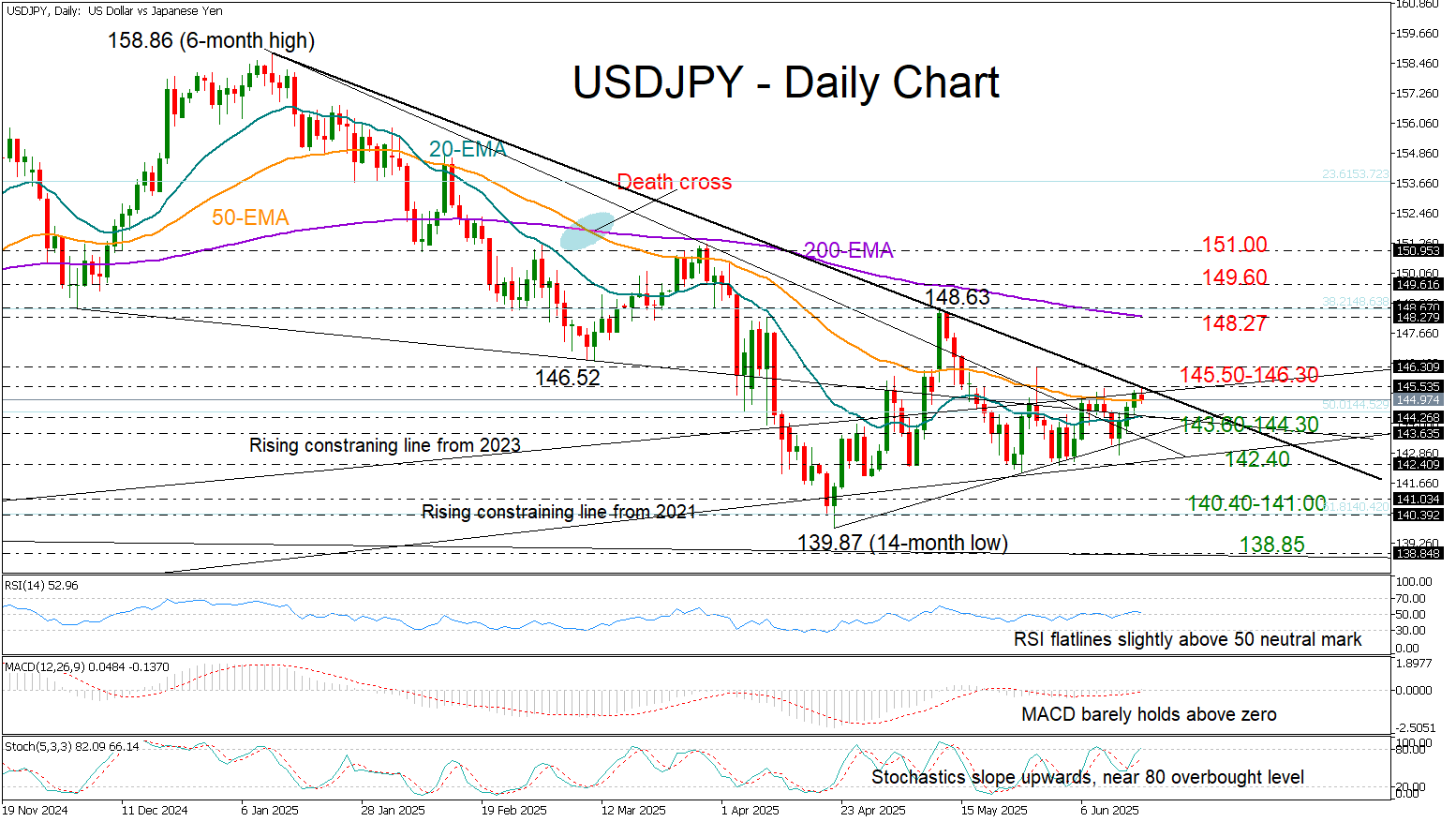

USDJPY held its ground above the 143.00 level last week and rebounded to test a key resistance trendline connecting the January and May 2025 highs, seen near 145.50.

Momentum may remain subdued as investors await the FOMC policy announcement scheduled for 18:00 GMT. While rate cuts are not expected, policymakers face a complicated economic environment. With the Israel-Iran conflict injecting further uncertainty into the inflation outlook, policy easing could be a tough task for the central bank.

Technically, the outlook is cautiously optimistic. The RSI is hovering slightly above its neutral 50 mark, while the MACD remains marginally positive above both its signal and zero lines - signs of tentative bullish momentum.

If buyers manage to push the price decisively above the 145.50 barrier and break through the 146.30 resistance, a stronger recovery could unfold, with the 200-day exponential moving average (EMA) at 148.27 acting as the next target. A successful move beyond that could face initial resistance around 149.60, before aiming for the 151.00 zone.

On the downside, if selling pressure intensifies, the 143.60–144.50 area could provide initial support. A break below that may open the door toward the 142.40 floor. If that floor fails to hold, losses could extend into the 140.40–141.00 zone, with the next significant support seen around 138.00, where the ascending trendline from January 2024 lies.

In summary, while USDJPY has shown signs of stabilization and recovery, a sustained move above the 145.50–146.00 resistance zone is still needed to confirm a bullish breakout and generate stronger upside momentum.

.jpg)