Weak Chinese inflation is bad for the markets

While slowing inflation in the US and Europe is being greeted with relief by financial markets, weak figures from China are causing concern.

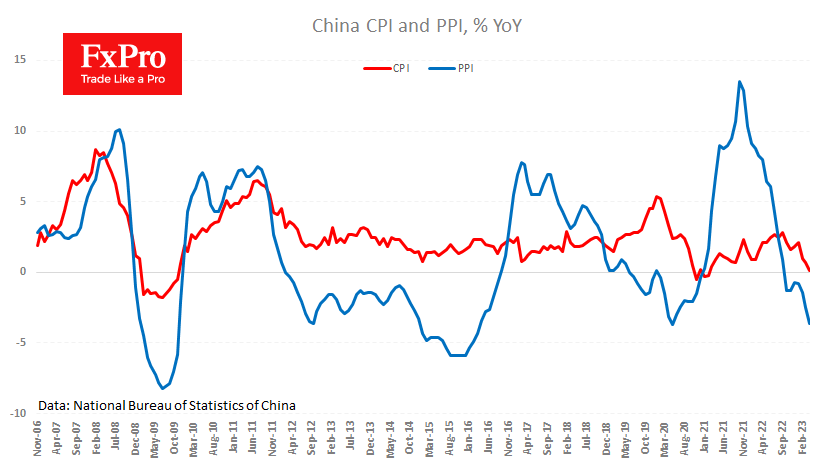

China's consumer inflation slowed to just 0.1% y/y in April, down from 0.7% the previous month and the expected 0.3%. This is the lowest rate since February 2021, when the lockdown impacted prices. However, the situation is more alarming in this case as producer prices continue their downward trend.

Last month's Producer Price Index was 3.6% lower than a year earlier. The fall in the PPI warns that pressure on consumer prices will continue in the coming months. But investors and traders see it more as a signal of weakening industrial activity in the "global factory", which is seen as a warning of a global slowdown.

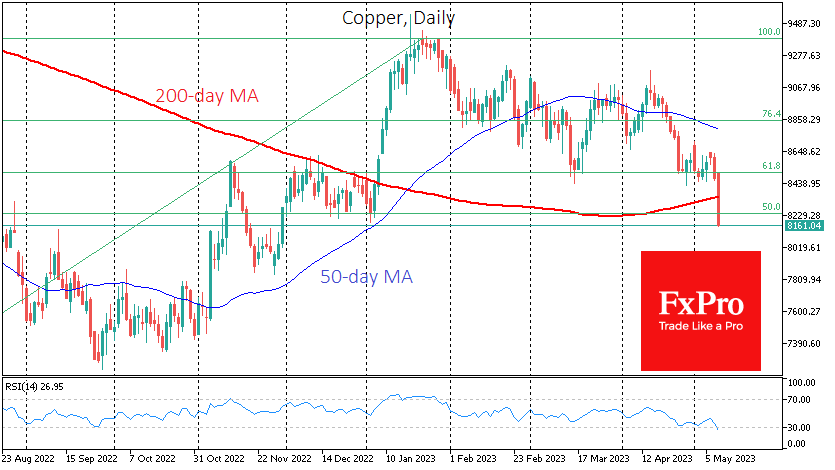

Copper is down over 4% today on the news, having fallen to lows not seen since November last year, and has been in a downtrend since January this year, falling below its 200-day average. This decline has gone beyond the traditional correction after a rally. This is bad news for the stock market, which acts as a leading indicator for the economy.

Weak inflation is also bad news for the renminbi, which has fallen to 6.95 per dollar, close to testing its 200-day average and the psychologically important 7.0 level.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)