USDJPY stalls as Fed and BoJ decisions keep traders on edge

The Japanese yen strengthened against the US dollar after the Bank of Japan (BoJ) held its benchmark interest rate steady at 0.5%,the highest level since 2008, in line with market expectations. The 7-2 vote outcome underscores lingering uncertainty surrounding Japan’s political landscape and the potential impact of US trade tariffs.

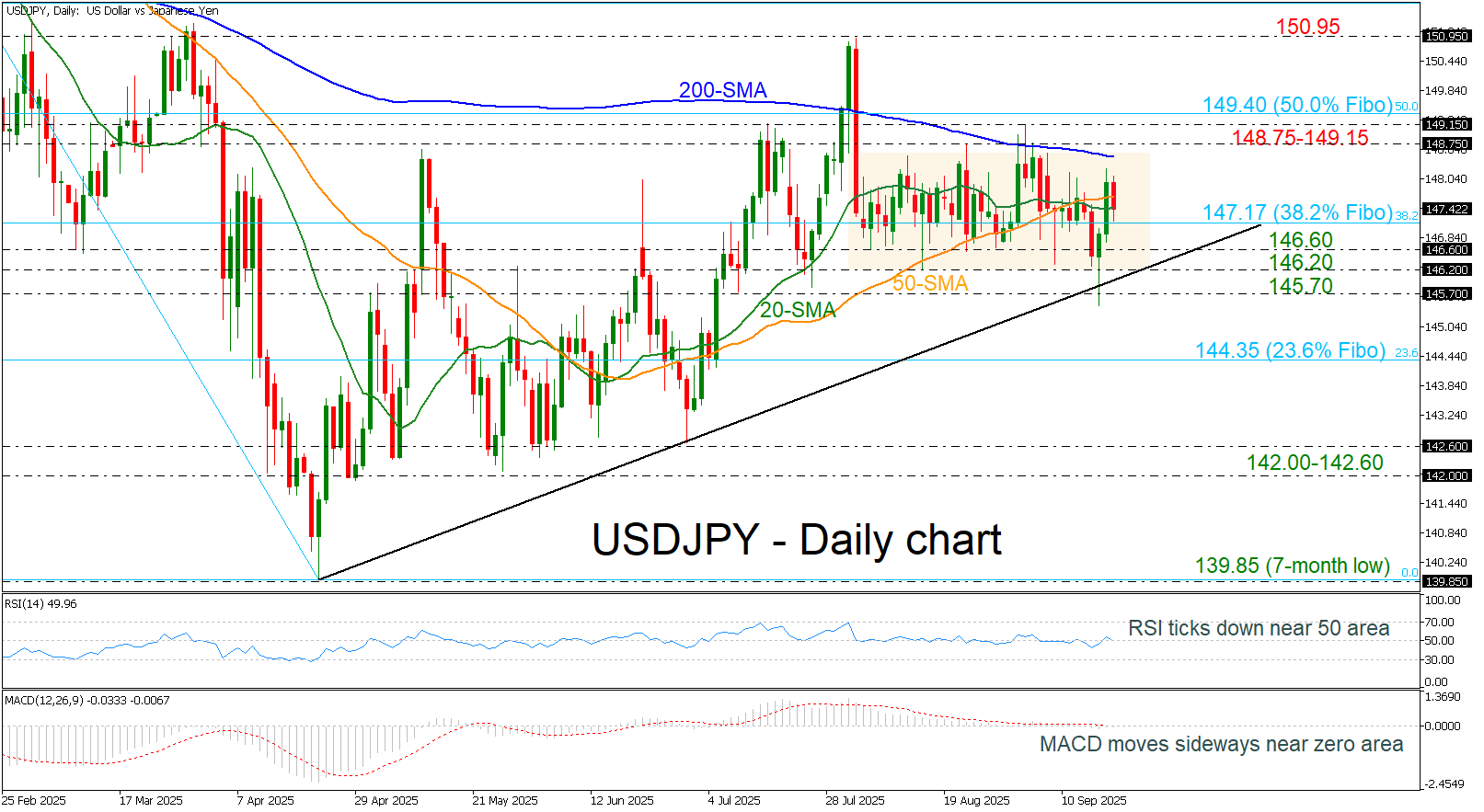

Since early August, USDJPY has been consolidating within a narrow range of 146.20–148.75, with the medium-term uptrend line remaining intact. Following Wednesday’s rebound off this trendline, triggered by the Federal Reserve’s policy decision, the pair is now approaching key technical resistance levels. The 200-day simple moving average (SMA), positioned just below the 148.75 ceiling, may act as a significant barrier. Further resistance lies at 149.15 and the 50.0% Fibonacci retracement level of the 158.86–139.85 decline, located at 149.40.

On the downside, a break below the 38.2% Fibonacci level at 147.17 could shift focus toward immediate support levels at 146.60 and 146.20. A deeper move may test the recent low near 145.70 and the underlying uptrend line.

From a technical perspective, momentum indicators suggest a lack of clear direction. The RSI is trending downward near the neutral 50 mark, while the MACD remains flat around the zero line, reflecting the pair’s ongoing consolidation.

All in all, USDJPY remains within a trading range following this week’s interest rate decisions by the Fed and the BoJ. A clear directional bias may only be confirmed with a decisive close above 148.75 or below 146.20.

.jpg)