- Início

- Comunidade

- Sistemas de Negociação

- Forex Growth Bot

Advertisement

Forex Growth Bot

| Ganho : | +2644.71% |

| Limite de prejuízo | 94.46% |

| Pips: | 8075.5 |

| Negociações | 2881 |

| Ganho: |

|

| Perdido: |

|

| Tipo: | Real |

| Vantagem: | 1:200 |

| Negociação: | Automatizado |

Edit Your Comment

Forex Growth Bot Discussão

May 08, 2013 at 05:02

Membro Desde Mar 28, 2011

84 posts

elizo posted:

There is a thing called cost of opportunity and risk-free rate of return. Markets defend themselves to be exploited massively by not allowing consistent returns above a reasonable level, not too far away from that rate. Go and check Barclay Hedge CTA Index for notions about where are those levels. And no, to stay on this business for a long time you cannot expect yearly compounded returns above 20% consistently.

For those lazy boys: https://www.barclayhedge.com/research/indices/cta/sub/cta.html

Boy that was nice info to find out.

That curve reminds me of something I've been following (paper only) for some time.

https://www.estlanderpartners.fi/sijoitustuotteemme/varainhoitotuotteemme_alpha_trend

Consistent returns about 11% pa. for 20 years.

What do you care if you have few loosing *years*!

In the long run you are really profitable but i just takes a little patience and hopefully it was your parents that started investing when they were young to have the profits flowing in 😀

Its really easy to forget that you can be lucky only for a short time and you can't avoid laws of probability.

May 08, 2013 at 05:54

Membro Desde Mar 20, 2010

52 posts

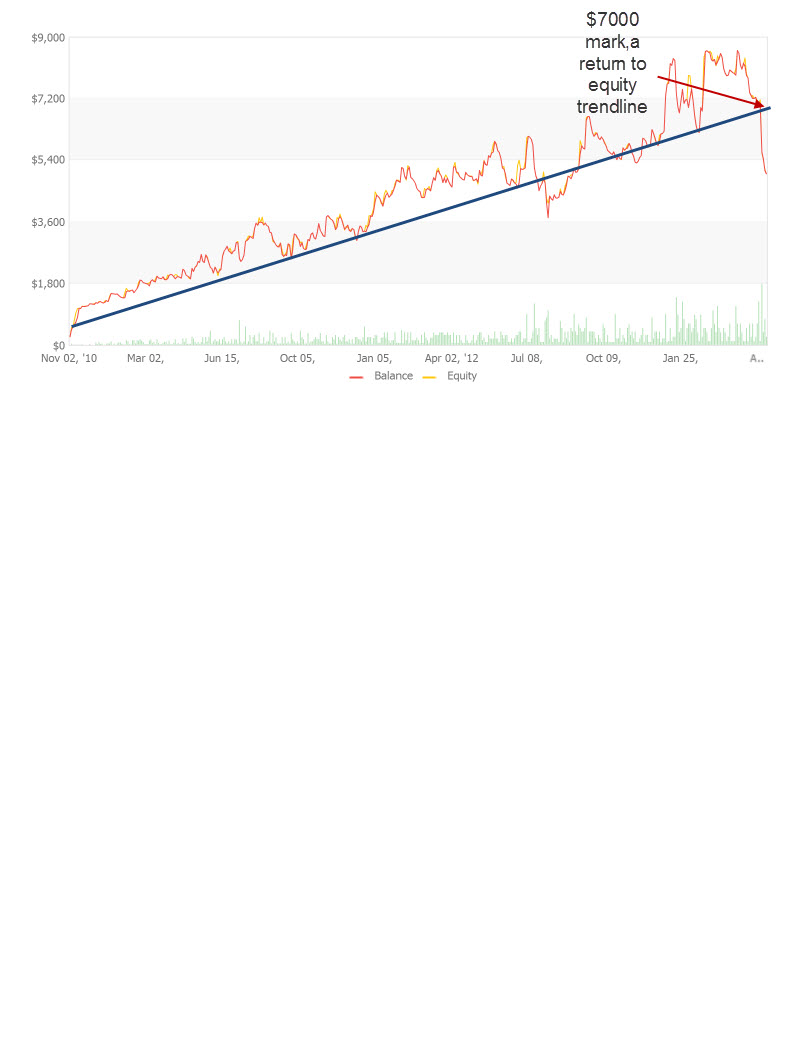

This 42% draw down we've had thus far is the biggest in the forward life of the account, and I believe it represents too much heat for too many its loyal followers. EA adherents usually bail on EAs that exceed the 25% draw down mark, and while many have no doubt stuck with this EA because of its historical record, the 40% DD figure is a new level of pain that has probably forced a sizable percentage of its loyal base to disable it.

Membro Desde Oct 05, 2012

38 posts

May 08, 2013 at 08:27

Membro Desde Mar 01, 2010

6 posts

petays posted:

Boy that was nice info to find out.

That curve reminds me of something I've been following (paper only) for some time.

https://www.estlanderpartners.fi/sijoitustuotteemme/varainhoitotuotteemme_alpha_trend

Consistent returns about 11% pa. for 20 years.

What do you care if you have few loosing *years*!

In the long run you are really profitable but i just takes a little patience and hopefully it was your parents that started investing when they were young to have the profits flowing in 😀

Its really easy to forget that you can be lucky only for a short time and you can't avoid laws of probability.

Correct. I'll tell you something: to me, this bot is valid. Signals are as good or bad as any EV+ strategy. Profit Factor is still around 1.15. What is wrong is to follow the same money management approach. This risk management is clearly wrong, and it will show that in the long term.

I would apply a fixed ratio money management programme. Of course, results wouldn't be so special, but still would be good. You have to bear in mind that this program has generated +6671 pips since its inception. This year is suffering clearly the worst streak ever, and it's still only -92.90 pips down!! So imagine being extra humble and just risking a fixed lot size all the time...

Membro Desde Jan 21, 2013

7 posts

May 08, 2013 at 11:21

Membro Desde Jan 21, 2013

7 posts

elizo posted:

Correct. I'll tell you something: to me, this bot is valid. Signals are as good or bad as any EV+ strategy. Profit Factor is still around 1.15. What is wrong is to follow the same money management approach. This risk management is clearly wrong, and it will show that in the long term.

I would apply a fixed ratio money management programme. Of course, results wouldn't be so special, but still would be good. You have to bear in mind that this program has generated +6671 pips since its inception. This year is suffering clearly the worst streak ever, and it's still only -92.90 pips down!! So imagine being extra humble and just risking a fixed lot size all the time...

Bingo! Now we are talking about the same:

(EV+ strategy) + Capitalization + Right_Pip_Value + Time + Patience - Forums = Trading for a living

Membro Desde Jan 21, 2013

7 posts

May 08, 2013 at 11:22

Membro Desde Jan 21, 2013

7 posts

cgasucks posted:

I'll tell you one thing...I'm in it for the LOOONG Haul...but I'm now considering decreasing my lot size that's for sure...

So, you are in it for the LOOONG haul. That´s pretty good.

But then, I don´t understand why you are trading with an intraday bot. Unless you were a big shareholder of your broker.

Membro Desde Oct 28, 2009

1413 posts

May 08, 2013 at 14:10

Membro Desde Oct 28, 2009

1413 posts

Just ensure you don't turn it back on after you see a winning streak, as that's the fastest way to lose money ;)

Best regards Steve

Best regards Steve

May 08, 2013 at 14:30

Membro Desde Mar 28, 2011

84 posts

stevetrade posted:

Just ensure you don't turn it back on after you see a winning streak, as that's the fastest way to lose money ;)

I agree with that.

There was almost 40% DD previously so it was not a suprise that it happened again.

It just doesn't seem threatening on the chart but I believe it was as shocking then as it is now.

I have made same mistake with my riskier Zulu traders too many times because their statistics are too short and suddenly they took twice as big loosing streak as before just after I have started following them hoping for good gains.

I have noticed this pattern the hard way 😭

If you jump in you have be prepared for the ride for a long time to see the profits.

May 09, 2013 at 00:23

Membro Desde Mar 20, 2010

52 posts

Membro Desde Oct 05, 2012

38 posts

Membro Desde Mar 01, 2013

25 posts

May 09, 2013 at 09:19

Membro Desde Mar 01, 2013

25 posts

scalptastic posted:

losing 40% means you have to make 80% to recover the 40% loss. we are here for the long haul; it will take at least few months to get to breakeven.

only if you change the lot size by the decreasing equity curve, otherwise not.

Membro Desde Apr 13, 2013

8 posts

May 09, 2013 at 11:26

Membro Desde Apr 13, 2013

8 posts

My wife always was skeptical about of making money in Forex. She used to say, "if Forex is so profitable activity, why there is not full of millonaire people living of that? or " if a developer make a profitable robot why selling it instead of making money using it in the market? Now I have found the response to both questions..

forex_trader_114150

Membro Desde Feb 28, 2013

12 posts

May 09, 2013 at 11:51

Membro Desde Feb 28, 2013

12 posts

scalptastic posted:

losing 40% means you have to make 80% to recover the 40% loss. we are here for the long haul; it will take at least few months to get to breakeven.

I'm afraid recovery is very unlikely for clients that started within the last year. At the rate of decline, 80% recovery would be a miracle in 6-12 months.

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.