- Domov

- Komunita

- Obchodné systémy

- Forex Growth Bot

Advertisement

Forex Growth Bot

| Zisk : | +2644.71% |

| Čerpanie | 94.46% |

| Pipy: | 8075.5 |

| Obchodníci | 2881 |

| Vyhrané: |

|

| Prehrané: |

|

| Typ: | Reálny |

| Páka: | 1:200 |

| Obchodovanie: | Automaticky |

Edit Your Comment

Forex Growth Bot Diskusia

Členom od Oct 13, 2010

21 príspevkov

May 08, 2013 at 02:06

Členom od Oct 13, 2010

21 príspevkov

better wait until next month. euro will not trending until ... 😇

Členom od Mar 28, 2011

84 príspevkov

May 08, 2013 at 05:02

Členom od Mar 28, 2011

84 príspevkov

elizo posted:

There is a thing called cost of opportunity and risk-free rate of return. Markets defend themselves to be exploited massively by not allowing consistent returns above a reasonable level, not too far away from that rate. Go and check Barclay Hedge CTA Index for notions about where are those levels. And no, to stay on this business for a long time you cannot expect yearly compounded returns above 20% consistently.

For those lazy boys: https://www.barclayhedge.com/research/indices/cta/sub/cta.html

Boy that was nice info to find out.

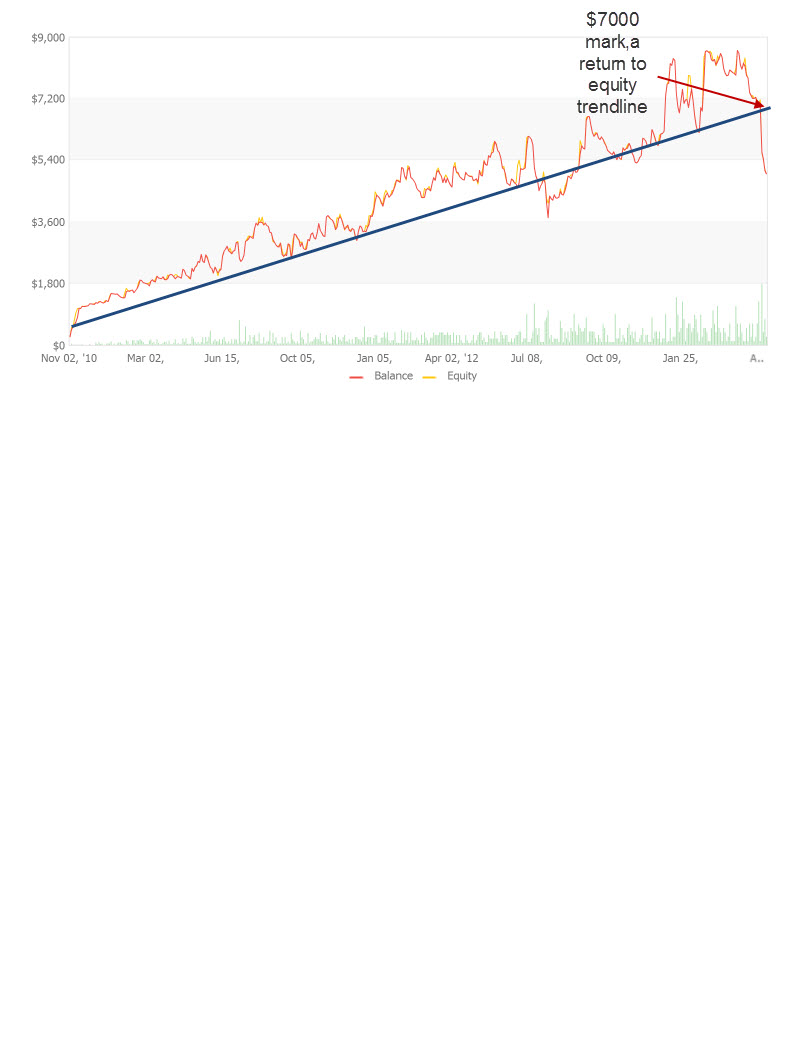

That curve reminds me of something I've been following (paper only) for some time.

https://www.estlanderpartners.fi/sijoitustuotteemme/varainhoitotuotteemme_alpha_trend

Consistent returns about 11% pa. for 20 years.

What do you care if you have few loosing *years*!

In the long run you are really profitable but i just takes a little patience and hopefully it was your parents that started investing when they were young to have the profits flowing in 😀

Its really easy to forget that you can be lucky only for a short time and you can't avoid laws of probability.

Členom od Mar 20, 2010

52 príspevkov

May 08, 2013 at 05:54

Členom od Mar 20, 2010

52 príspevkov

This 42% draw down we've had thus far is the biggest in the forward life of the account, and I believe it represents too much heat for too many its loyal followers. EA adherents usually bail on EAs that exceed the 25% draw down mark, and while many have no doubt stuck with this EA because of its historical record, the 40% DD figure is a new level of pain that has probably forced a sizable percentage of its loyal base to disable it.

Členom od Jan 26, 2013

72 príspevkov

May 08, 2013 at 06:30

Členom od Jan 26, 2013

72 príspevkov

I'll tell you one thing...I'm in it for the LOOONG Haul...but I'm now considering decreasing my lot size that's for sure...

Členom od Oct 05, 2012

38 príspevkov

May 08, 2013 at 06:30

Členom od Oct 05, 2012

38 príspevkov

if you are in doubt; wait for the equity curve to recover before you get in.

Členom od Mar 01, 2010

6 príspevkov

May 08, 2013 at 08:27

Členom od Mar 01, 2010

6 príspevkov

petays posted:

Boy that was nice info to find out.

That curve reminds me of something I've been following (paper only) for some time.

https://www.estlanderpartners.fi/sijoitustuotteemme/varainhoitotuotteemme_alpha_trend

Consistent returns about 11% pa. for 20 years.

What do you care if you have few loosing *years*!

In the long run you are really profitable but i just takes a little patience and hopefully it was your parents that started investing when they were young to have the profits flowing in 😀

Its really easy to forget that you can be lucky only for a short time and you can't avoid laws of probability.

Correct. I'll tell you something: to me, this bot is valid. Signals are as good or bad as any EV+ strategy. Profit Factor is still around 1.15. What is wrong is to follow the same money management approach. This risk management is clearly wrong, and it will show that in the long term.

I would apply a fixed ratio money management programme. Of course, results wouldn't be so special, but still would be good. You have to bear in mind that this program has generated +6671 pips since its inception. This year is suffering clearly the worst streak ever, and it's still only -92.90 pips down!! So imagine being extra humble and just risking a fixed lot size all the time...

Členom od Sep 30, 2011

68 príspevkov

May 08, 2013 at 11:21

Členom od Sep 30, 2011

68 príspevkov

there is no need to improve MM here, it is better to use RV

Členom od Jan 21, 2013

7 príspevkov

May 08, 2013 at 11:21

Členom od Jan 21, 2013

7 príspevkov

elizo posted:

Correct. I'll tell you something: to me, this bot is valid. Signals are as good or bad as any EV+ strategy. Profit Factor is still around 1.15. What is wrong is to follow the same money management approach. This risk management is clearly wrong, and it will show that in the long term.

I would apply a fixed ratio money management programme. Of course, results wouldn't be so special, but still would be good. You have to bear in mind that this program has generated +6671 pips since its inception. This year is suffering clearly the worst streak ever, and it's still only -92.90 pips down!! So imagine being extra humble and just risking a fixed lot size all the time...

Bingo! Now we are talking about the same:

(EV+ strategy) + Capitalization + Right_Pip_Value + Time + Patience - Forums = Trading for a living

Členom od Jan 21, 2013

7 príspevkov

May 08, 2013 at 11:22

Členom od Jan 21, 2013

7 príspevkov

cgasucks posted:

I'll tell you one thing...I'm in it for the LOOONG Haul...but I'm now considering decreasing my lot size that's for sure...

So, you are in it for the LOOONG haul. That´s pretty good.

But then, I don´t understand why you are trading with an intraday bot. Unless you were a big shareholder of your broker.

Členom od Jan 10, 2013

5 príspevkov

May 08, 2013 at 14:00

Členom od Jan 10, 2013

5 príspevkov

It's not looking good for all of us, those that are using fgb and I decided to deactivate it for now cause that is just too much. 😕

Členom od Oct 28, 2009

1413 príspevkov

May 08, 2013 at 14:10

Členom od Oct 28, 2009

1413 príspevkov

Just ensure you don't turn it back on after you see a winning streak, as that's the fastest way to lose money ;)

Best regards Steve

Best regards Steve

Členom od Mar 28, 2011

84 príspevkov

May 08, 2013 at 14:30

Členom od Mar 28, 2011

84 príspevkov

stevetrade posted:

Just ensure you don't turn it back on after you see a winning streak, as that's the fastest way to lose money ;)

I agree with that.

There was almost 40% DD previously so it was not a suprise that it happened again.

It just doesn't seem threatening on the chart but I believe it was as shocking then as it is now.

I have made same mistake with my riskier Zulu traders too many times because their statistics are too short and suddenly they took twice as big loosing streak as before just after I have started following them hoping for good gains.

I have noticed this pattern the hard way 😭

If you jump in you have be prepared for the ride for a long time to see the profits.

Členom od Mar 20, 2010

52 príspevkov

May 09, 2013 at 00:23

Členom od Mar 20, 2010

52 príspevkov

Členom od Feb 12, 2011

10 príspevkov

May 09, 2013 at 03:12

Členom od Feb 12, 2011

10 príspevkov

Considering this bot is using MM it should be a curve, not a line.

Členom od Oct 05, 2012

38 príspevkov

May 09, 2013 at 05:33

Členom od Oct 05, 2012

38 príspevkov

losing 40% means you have to make 80% to recover the 40% loss. we are here for the long haul; it will take at least few months to get to breakeven.

Členom od Mar 01, 2013

25 príspevkov

May 09, 2013 at 09:19

Členom od Mar 01, 2013

25 príspevkov

scalptastic posted:

losing 40% means you have to make 80% to recover the 40% loss. we are here for the long haul; it will take at least few months to get to breakeven.

only if you change the lot size by the decreasing equity curve, otherwise not.

Členom od Apr 13, 2013

8 príspevkov

May 09, 2013 at 11:26

Členom od Apr 13, 2013

8 príspevkov

My wife always was skeptical about of making money in Forex. She used to say, "if Forex is so profitable activity, why there is not full of millonaire people living of that? or " if a developer make a profitable robot why selling it instead of making money using it in the market? Now I have found the response to both questions..

forex_trader_114150

Členom od Feb 28, 2013

12 príspevkov

May 09, 2013 at 11:51

Členom od Feb 28, 2013

12 príspevkov

scalptastic posted:

losing 40% means you have to make 80% to recover the 40% loss. we are here for the long haul; it will take at least few months to get to breakeven.

I'm afraid recovery is very unlikely for clients that started within the last year. At the rate of decline, 80% recovery would be a miracle in 6-12 months.

Členom od Jan 22, 2012

9 príspevkov

May 09, 2013 at 13:48

Členom od Jan 22, 2012

9 príspevkov

40% loss requires 67% to recover.

Two full size trades in the right direction and we would be more than half way there.

Členom od Mar 01, 2013

25 príspevkov

May 09, 2013 at 13:48

Členom od Mar 01, 2013

25 príspevkov

now, the critical moment is here

*Komerčné použitie a spam nebudú tolerované a môžu viesť k zrušeniu účtu.

Tip: Uverejnením adresy URL obrázku /služby YouTube sa automaticky vloží do vášho príspevku!

Tip: Zadajte znak @, aby ste automaticky vyplnili meno používateľa, ktorý sa zúčastňuje tejto diskusie.