Daily Global Market Update

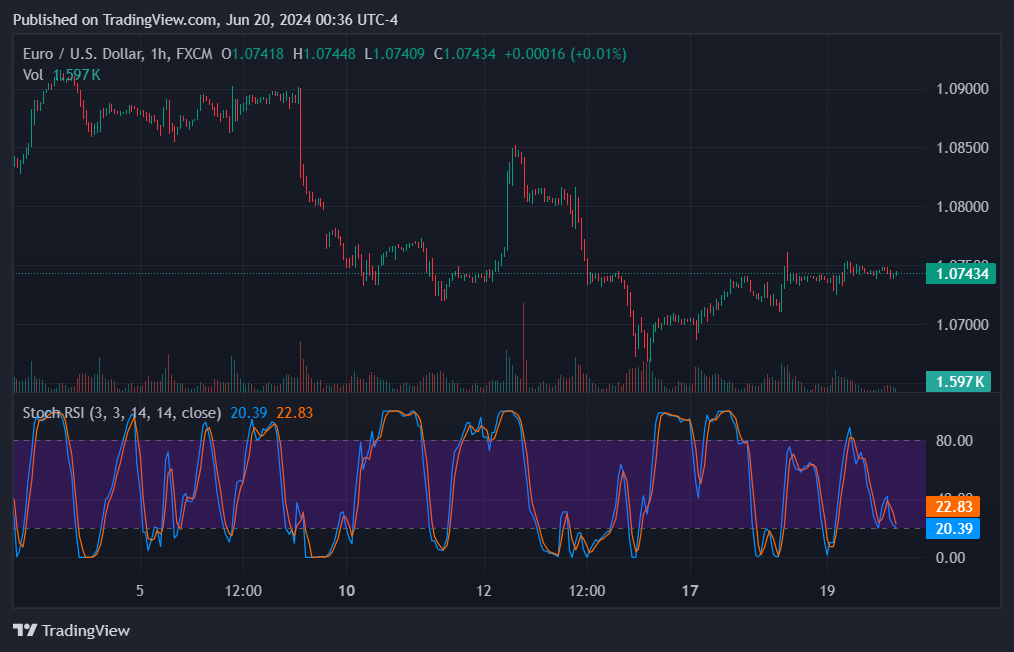

Euro/Dollar Steady in Recent Session

The Euro/Dollar price remained largely unchanged in the last session. The Stochastic RSI is giving a positive signal.

Dollar/Yen Overbought in Last Session

The Dollar/Yen price remained largely unchanged in the last session. According to the Stochastic RSI, we are in an overbought market.

Gold/Dollar Shows Positive Movement

The Gold/Dollar price remained largely unchanged in the last session. The CCI is giving a positive signal.

Tesla's Recent Drop

Tesla shares dropped by 0.8% in the last session. According to the Stochastic RSI, we are in an overbought market.

Global Financial Headlines

Dollar struggled for direction while the Euro remained close to its recent lows on concerns that a new government in France could weaken fiscal discipline, increasing the debt risk premium across the Euro area. Canada's main stock index fell to a near four-month low as industrial and financial shares led broad-based declines in a seasonally weak period for the commodity-linked market. British inflation returned to its 2% target for the first time in nearly three years in May, but strong underlying price pressures all but rule out a pre-election interest rate cut.

Upcoming Economic Highlights

Here's a brief rundown of today's anticipated economic releases:

• US Housing Starts - 12:30 GMT

• US Initial Jobless Claims - 12:30 GMT

• Germany's Producer Price Index - 06:00 GMT

• Eurozone's Consumer Confidence - 14:00 GMT

• Japan's National Consumer Price Index - 23:30 GMT

• UK's GfK Consumer Confidence - 23:01 GMT