Fed hawks lower expectations for Powell’s Jackson Hole speech

Fed rate cut bets take a hit ahead of Powell speech

Fed Chair Jerome Powell isn’t due to make his keynote address at Jackson Hole until 14:00 GMT but investors are already scaling back their expectations of a rate cut in September following some very cautious remarks from Fed officials. Speaking on Thursday, a slew of regional Fed presidents indicated that their stance on monetary policy had not changed much since the soft July jobs report, casting doubt on the need for immediate rate cuts.

Kansas City Fed President, Jeff Schmid, who is the host of the Jackson Hole event, which takes place annually in the state of Wyoming, reiterated the message from Wednesday’s minutes that the inflation risks are “marginally higher” than the risks to the labour market. Cleveland Fed chief, Beth Hammack, who is not a voting FOMC member this year, said she wouldn’t vote for a rate cut if there was a meeting tomorrow, while the Atlanta Fed’s Raphael Bostic – also not a voting member – stuck to his projection of just one rate cut this year.

Austin Goolsbee, the head of the Chicago Fed, sounded somewhat more dovish, suggesting that September is a “live meeting”.

August PMIs add to reduced dovish expectations

Investors sharply pared back their expectations of Fed easing in September, with the odds of a 25-basis-point cut dropping to around 70% from 84% before the comments. The surprisingly hawkish rhetoric might not have had such an impact, however, if it wasn’t complemented by an upbeat set of PMI readings.

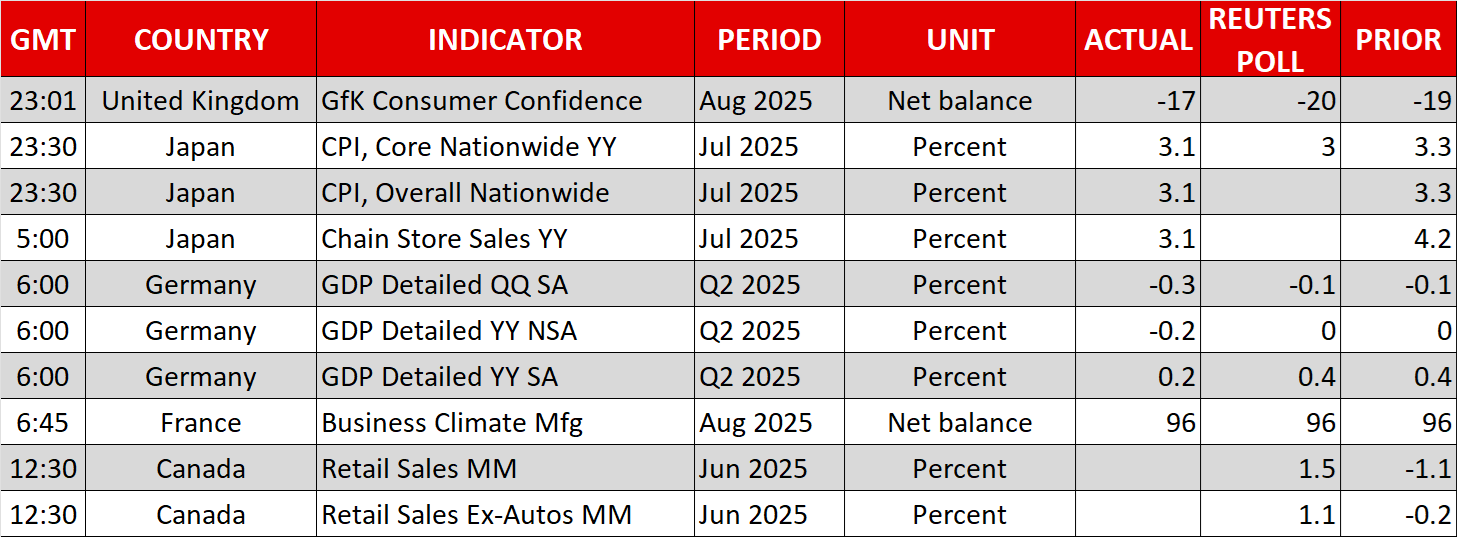

The S&P Global flash PMIs for August came in much stronger than expected, with both manufacturing and services activities growing robustly in the first half of the month, easing fears of deteriorating conditions from President Trump’s chaotic tariff policy.

Moreover, the employment and price indices for both sectors rose in August, supporting the majority view within the Fed that it’s too soon to ignore the inflation risks from higher tariffs without further evidence that the labour market is in serious trouble. Nevertheless, the Fed will be paying a very close eye on the upcoming employment data, as jobless claims for the week ending August 16 ticked up slightly.

It’s possible that the next jobs report ahead of the September FOMC will be more crucial than Powell’s speech at Jackson Hole. But with markets now positioned to not expect a major dovish pivot today, there is a risk that Powell ends up surprising markets by strongly hinting at a September cut.

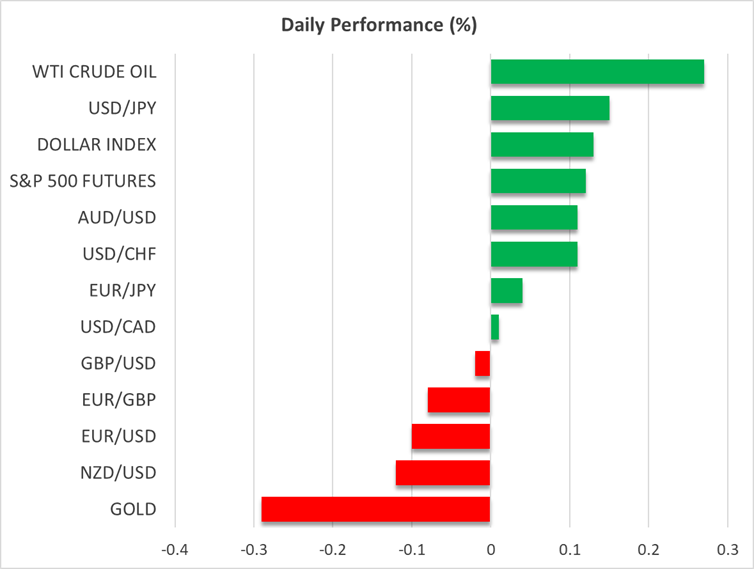

The US dollar is advancing higher against a basket of currencies today, on track for weekly gains of almost 1%.

Wall Street flounders amid AI woes

However, Wall Street hasn’t been having such a great time lately. The S&P 500 finished Thursday in the red – its fifth consecutive loss, and although the Nasdaq 100 managed to record one positive session this week, it’s running weekly losses of 2.4%.

Aside from the lowering of expectations of how dovish Powell will sound at Jackson Hole, there’s been a separate setback for US stocks from the AI front.

A report earlier in the week that revived concerns about AI spending by corporate America has led to tech stocks retracing more than 50% of their August rally. Adding to the downbeat sentiment are the White House’s plans to obtain stakes in companies that are receiving government grants under the CHIPS Act, and reports that weak demand from China for Nvidia’s specially designed H20 AI chip is forcing the chipmaker to suspend production.

Nvidia’s shares are down 3% this week.

In contrast, stocks in China have been rallying, in part due to domestic chip producers capitalizing on Nvidia’s pain, while London’s FTSE 100 has also been outperforming.

Euro and yen shrug off headlines, oil eyes weekly gains

On a more positive note, there’s been good news for European carmakers as the EU and US finalize the details of their preliminary trade deal. The US has agreed to exempt the EU from sectoral tariffs such as those on automobiles and steel in exchange for preferential access to European markets for some American goods.

The trade update didn’t make much of an impression on the euro, however, which is trading marginally lower against the greenback today. There was also little reaction in the yen from slightly hotter-than-expected Japanese CPI data for July.

In commodities, oil has stood out this week, with Brent futures in particular enjoying a more than 2.5% boost. Fading hopes that Russia will engage constructively in talks to agree on security guarantees for Ukraine as a step towards peace have raised concerns that the US might reconsider imposing fresh sanctions on Russian oil exports.

.jpg)