Dollar supported by risk-off tone

OVERNIGHT

Risk-off sentiment largely prevailed during the Asian trading session, although stocks in China rose in anticipation of government policy announcements potentially this week. US equity markets closed lower on renewed concerns about its financial sector, but futures are higher following positive after-hours tech earnings reports. In Australia, Q1 CPI inflation fell to 7.0% from 7.8% in Q4 which may support Australian interest rates remaining on hold.

THE DAY AHEAD

The CBI distributive trades survey for April is the only notable UK release today. Last month’s report pointed to a pickup in optimism among retailers regarding expected sales. Today’s update will provide an early indication of the strength of retail activity at the start of Q2. In a separate report by the GfK released last week, consumer confidence increased again in April to a 14-month high, but there is room for further improvement as it remains at a historical weak level.

There are no major Eurozone releases ahead today. Earlier this morning, Germany reported an improvement in consumer confidence for a seventh month in a row, to -25.7. The French consumer confidence index increased to 83. Sweden’s central bank, the Riksbank, is expected to raise interest rates by 50bp to 3.5% as policymakers aim to dampen inflationary pressures.

US durable goods orders and the goods trade balance for March will be watched ahead of tomorrow’s first estimate of Q1 GDP. We expect headline durable goods orders to bounce back by 1.0%, but weaker core capital goods orders point to relatively subdued business investment. The goods deficit may narrow slightly to around $90bn from $92bn in February. Overall, the US economy is currently expected to have expanded by 2.0% (q/q annualised), driven by strong consumer spending at the start of the quarter, but momentum going into Q2 appears to have moderated.

MARKETS

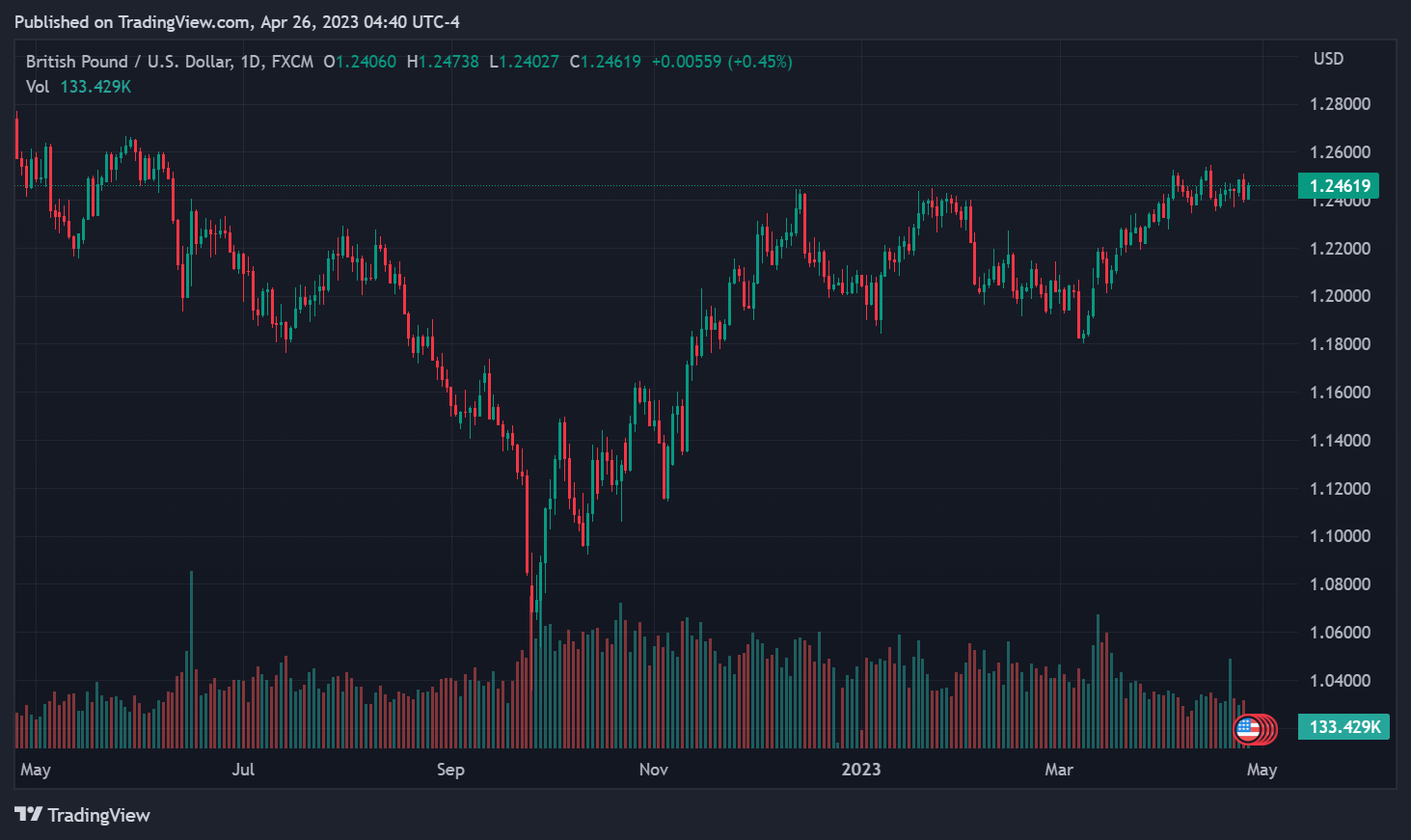

US Treasury yields declined yesterday on renewed concerns about the country’s financial sector. The benchmark 10-year Treasury yield fell below 3.40% but stabilised overnight. UK 10 year gilt yields closed down 9bp at 3.695%. The US dollar was supported by safe-haven considerations as the pound dipped to $1.24 before edging higher during Asia trading.