EBC Markets Briefing | Oil prices hesitate on mixed signals

Oil prices fell on Friday, setting up for a second weekly decline, as mixed economic signals weighed on investor sentiment. A stronger greenback added to the downward pressures.

US crude inventories fell by 4.9 million barrels last week, data from the EIA showed, compared with a decline of 30,000 barrels forecast by analysts in a Reuters poll. That underlined expected hot demand in summer.

Meanwhile the OPEC+ is unlikely to recommend changing the group's output policy, including a plan to start unwinding one layer of oil output cuts from October, three sources said.

Chinese leaders signalled on Thursday that Beijing would stay the course with economic policy, though few concrete details were disclosed. Investors were calling for more stimulus to address the existing challenges.

Crude oil imports were 11.05 million bpd in the first half of the year, down 2.9% over the same period in 2023. The overall picture is dire with no evidence of accelerating demand.

With some traders still upbeat on the outlook for the rest of the year, a flurry of bullish oil options traded on Tuesday. Those included contracts that would profit from a rally to $100 and beyond for WTI and Brent.

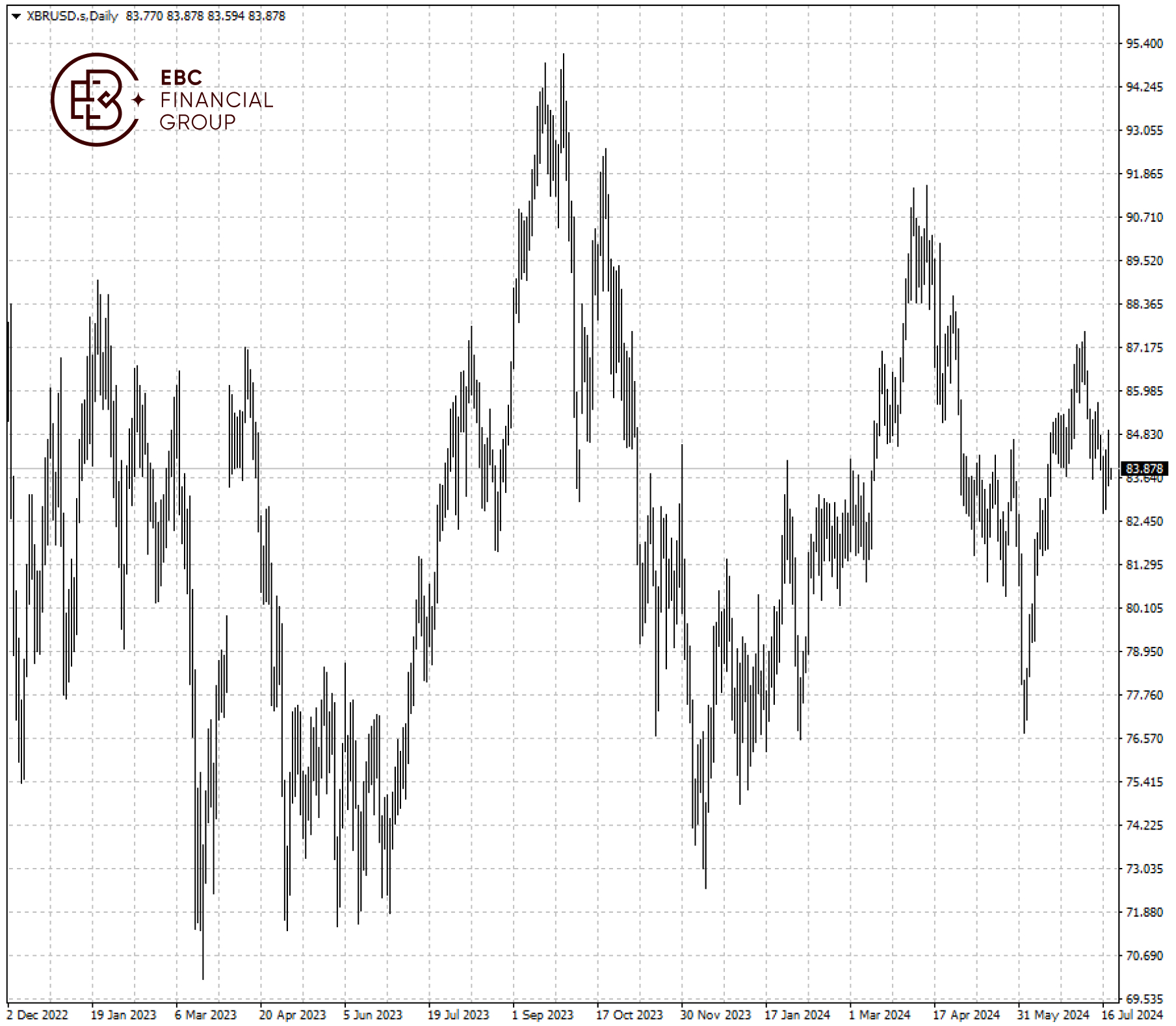

Brent crude was hovering around the low it hit in 10 July. We see it as neutral now after solid support was found around $82.70.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.