Gold takes a breather after another milestone

Gold opened Wednesday’s session with a downside gap, extending its retreat from the record high of 3,499.

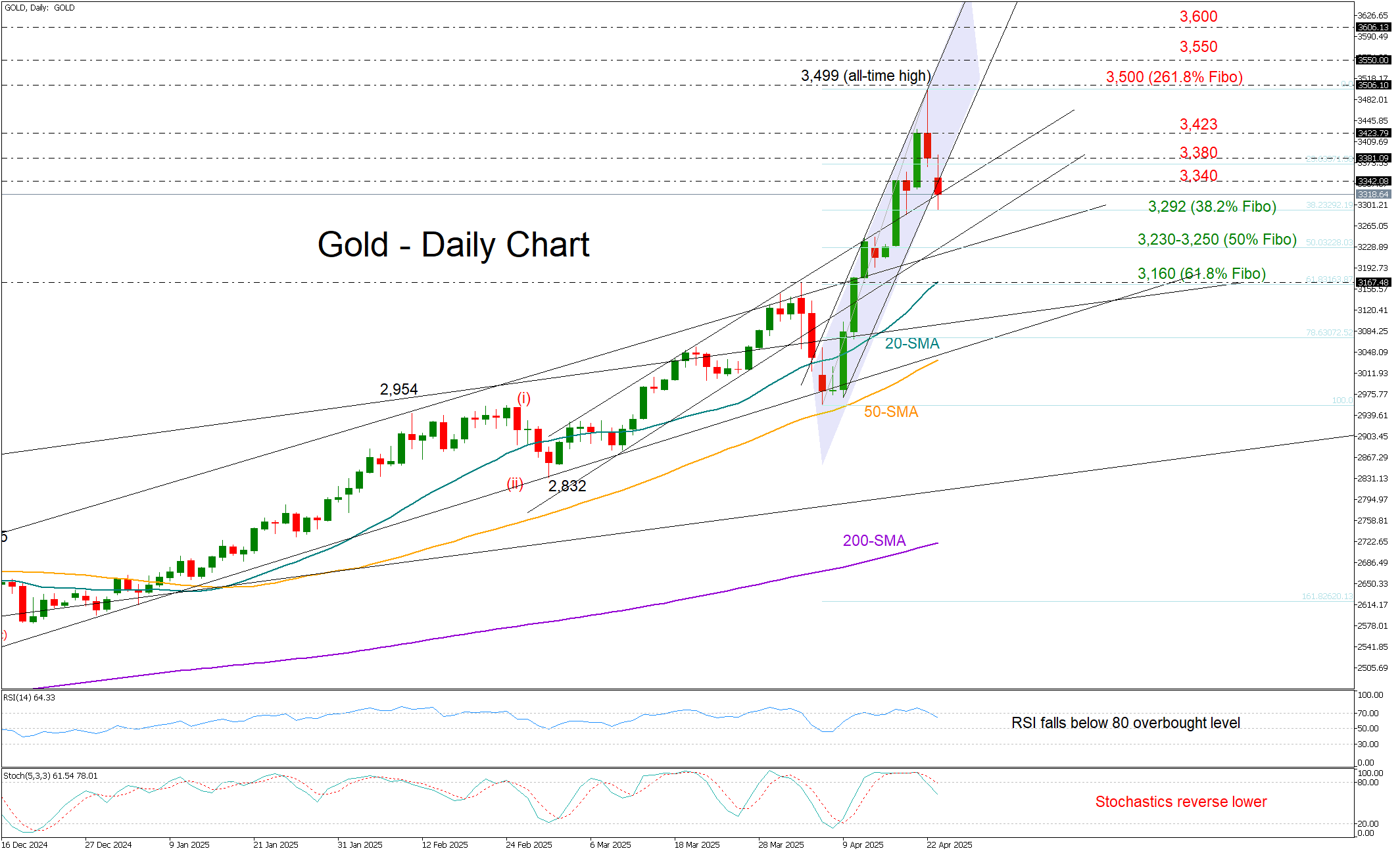

The formation of a bearish shooting star on the weekly chart increases the probability of a downside reversal. This view is reinforced by overbought signals coming from both the RSI and the stochastic oscillator on the daily timeframe.

However, a confirmation of the bearish bias would likely come with a drop below the 3,340 support area, and more importantly, a break beneath the 38.2% Fibonacci retracement level of the recent rally at 3,292 – a level that provided a footing under the price earlier today. If the bears take control below this zone, the next key support could come around the trendline area of 3,230-3,250, where the 50% Fibonacci mark resides. Further weakness could potentially lead the price toward the 61.8% Fibonacci mark at 3,160 and the 20-day simple moving average (SMA). A drop below that could expose the price to the 3,100 region.

On the flip side, if the precious metal pivots above 3,340, it may initially retest resistance around the 3,380 zone ahead of the 3,423 barrier. A sustained break above the 3,500 psychological level could reignite bullish momentum, setting the stage for a rally toward 3,550 and potentially 3,600. A continuation higher may even put the 3,800 region in focus.

All in all, gold’s recent pullback could extend in the short term, but sellers may wait for a decisive break below 3,292 before stepping in more aggressively.

.jpg)