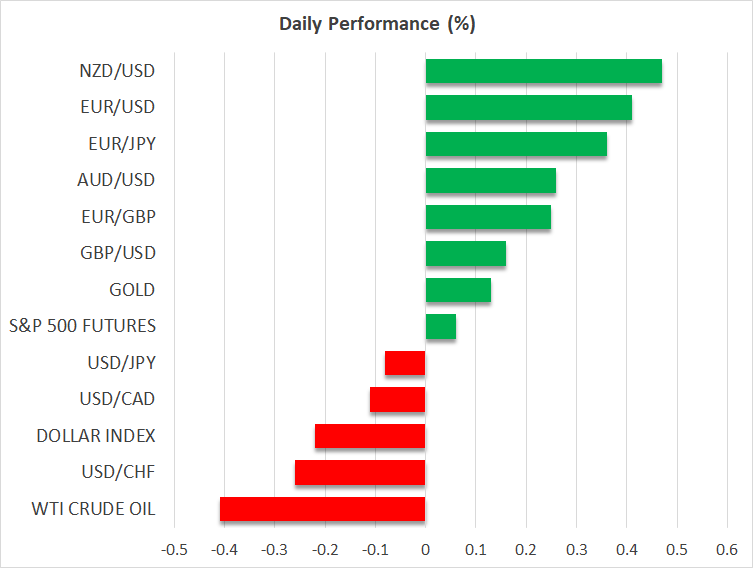

Improved risk appetite ahead of Trump’s ceremony

Trump’s second term begins

The countdown to the first key event of the year is almost over. President Trump will officially take office today, with nearly 100 executive orders ready to be signed. Despite repeated commentary about tariffs, these orders are expected to mostly focus on immigration and energy.

However, a negative surprise cannot be ruled out, with tariffs or other trade restrictions being imposed on Canada, Mexico, Panama or Denmark, or very hawkish rhetoric following the Inauguration Day procedures. Such an announcement could quickly reverse the current improved risk sentiment seen in equities.

The Trump-Xi phone call has raised expectations for a less eventful start to the US president’s second term. Therefore, Asian stocks are in the green today, building on the positive performance recorded by US equity indices last week. Actually, it was the strongest week for US indices since early November, with the more traditional Dow Jones 30 index setting the pace again.

Dollar rally losing steam

The dollar could use the boost as it started the week slightly on the back foot. With today being a US bank holiday, the data calendar is rather light this week in the US. Friday’s preliminary PMI surveys could potentially create some market volatility.

Additionally, the official Fed blackout period has started, as the next Fed meeting is just nine days away. Following the recent set of mixed US data, the market is pricing in 38bps of monetary policy easing in 2025, with the first 25bps rate cut fully priced in by July. However, the market remains in angst over what the new President may bring to the table going forward.

Speaking of volatility, the crypto market remains on fire. Following a period of consolidation, bitcoin is trading a tad below the $109k level, trying to cover lost ground compared to other key cryptocurrencies like XRP and solana. The buzz, though, over the weekend was created by the Trump meme coin recording extraordinary price jumps.

BoJ is meeting on Friday

The biggest economic event of the week is probably Friday’s BoJ meeting. There are strong expectations about the announcement of a rate move, with the probability of a 25bps rate hike rising to 81%. Dollar/yen has somewhat benefited from the buildup of expectations, hovering around the 156 area and maintaining a good gap from 158, which tends to provoke verbal interventions from Japanese government officials.

The ball is in now in Governor Ueda’s court. Assuming US president Trump does not start a trade war in the coming days and Friday’s Japanese inflation report does not show a considerable downside surprise, the BoJ will probably announce the much-discussed rate hike.

Gold gains, oil suffers

Gold and oil are on divergent paths, with the former trading comfortably above the $2,700 level and the latter recording its third consecutive red candle. Gold has been on an upward glide since late December, as most investors have ignored the strong dollar rally in recent weeks, choosing instead to keep their positions open ahead of Trump’s second term.

Oil has recorded an impressive rally from the mid-$60s area, climbing above a key long-term trendline and reaching a new 5-month high of $80.59. Profit-taking is likely underway, with a strong likelihood for an even stronger correction if Trumps makes significant announcements about energy supply today.

.jpg)